Bangladesh’s central and southern regions will shape the future gas story, but pipeline access remains a bottleneck

Bangladesh's central and southern regions will shape the future gas story, but pipeline access remains a bottleneck

Bangladesh's natural gas demand is mostly localized, with around 68% of the overall demand concentrated around the central, northern, and eastern parts of the country. These regions are located around legacy gas fields, which has contributed to the establishment of the different demand centers ranging from the power sector to industrial and residential consumers. In addition, a robust transmission and distribution gas network was created for these demand centers.

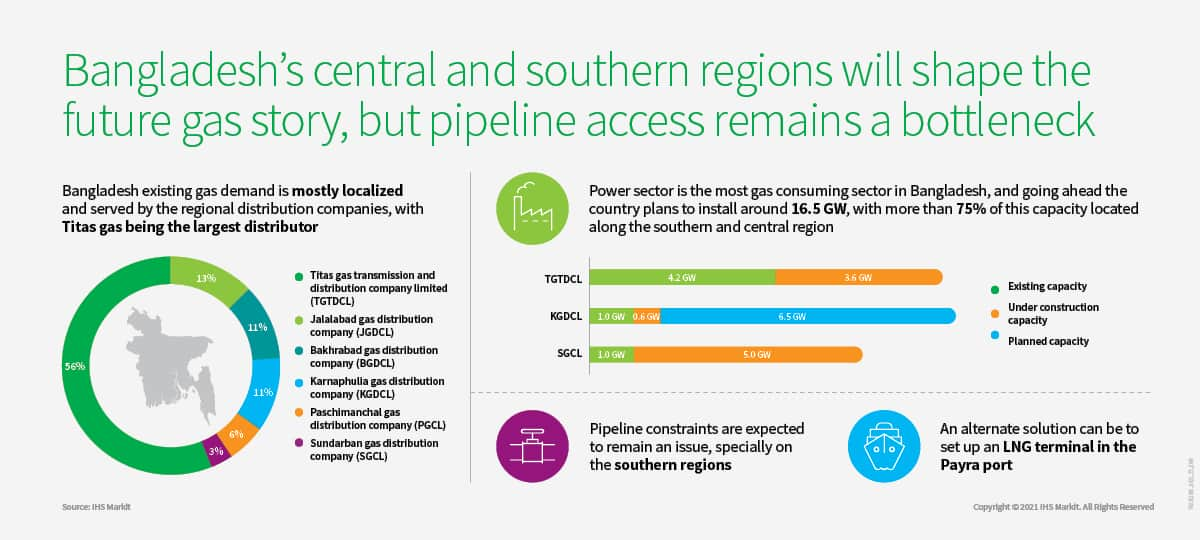

To facilitate regional demand, Bangladesh has established six distribution companies, which are responsible for laying the distribution network and supply gas in their respective franchise areas. Among these, Titas Gas Transmission and Distribution Company Limited (TGTDCL) is the largest distribution company, catering to around 56% of the total gas demand, followed by Jalalabad Gas Transmission and Distribution System Limited (JGDSL) with a 12.7% share and Bakhrabad Gas Distribution Company Limited (BGDCL). The other distribution companies Karnaphulia Gas Distribution Company Limited (KGDCL), Paschimanchal Gas Company Limited (PGCL), and Sundarban Gas Company Limited (SGCL) are smaller in size despite their large geographical areas.

The power sector is expected to be the key driver for gas demand in the medium term

Bangladesh currently has around 22 GW of installed grid-based power plant capacity, with gas-based power plants contributing to around 11.8 GW (54%). In terms of future power sector development, around 10 GW of capacity is under the construction phase and around 6.5 GW under the planning stage. Out of this, more than 85% of the total capacity is in the southern and central regions of the country. Consequently, IHS Markit expects the Southern and Central regions to shape the country's future gas story.

Pipeline limitations might be a constraint in realizing this new demand

Bangladesh gas pipeline connectivity is limited around the southern parts of the country, especially in the south-western regions where more than 50% of the under-construction capacity is located. Although the transmission operator, Gas Transmission Company Limited (GTCL), has set elaborate plans to expand the grid network, no physical progress has happened to date. Fast-track development of the interconnector and truck pipelines is required to realize this incremental gas demand. An alternative solution is to pursue a regasification terminal in Payra port or importing piped gas through India.

However, infrastructure progress and legal approvals from the Bangladesh government have been slow, which may hinder these proposed developments. Should infrastructure fail to be developed on time, there is a risk that the gas-fired power plants that are being built will be stranded.

Learn more about the South Asia gas and LNG market developments in the Asia-Pacific service.

IHS Markit webiner on 22 September 2021 04:00 PM SGT Online event

Topic and registration link: Which regions in Bangladesh will shape the country's future gas demand story?

Bangladesh gas demand is localized and is being catered to by the different regional distribution companies. In this presentation, we will delve into the regional demand catered by the different gas distribution companies and also look at the installation of new gas-fired plants and associated pipelines to understand the future gas demand centers and infrastructure requirements.

Speakers:

Pratim Bhattacharjee, Senior Research Analyst, Climate & Sustainability

Zhi Xin Chong, Director, Climate & Sustainability

Webinar Details:

Duration: 1 hour; Language: English

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.