Bareboat charters: An unexpected solution for the newbuild rigs glut

For decades, most international offshore contractors have built their fleets by taking on financing to acquire rigs or order them from scratch. If they do not have a suitable rig to meet a potential demand, the option to do so by bareboat chartering one - that is, to lease a 'bare' unit without crew or provisions, and to assume responsibility for someone else's asset - is seldom considered. Nor do these firms usually bareboat their rigs to others.

But as offshore financing dried up in the last few years, and

contractors struggle to survive while yards pile up with unwanted

newbuilds, one trend has become clear of late: more offshore rigs

are being put to work on the back of bareboat arrangements. These

days, the cart can come before the horse: some firms chase the work

first, by offering units they do not own; and only when they win

the tender, do they seal the deal and lease the rig to fulfil the

contract.

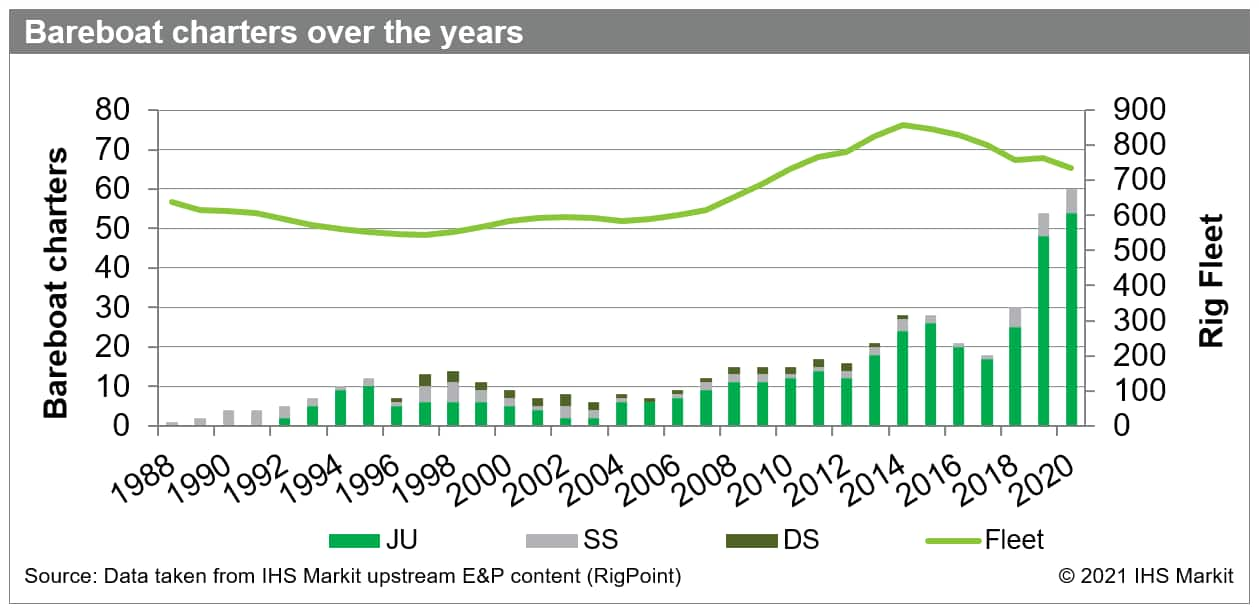

Figure 1: Bareboat charters over the years

The chart above shows the number of rigs on bareboat charter every

year over the last three decades. It includes units that may have

been bareboat for only part of a year, but most were on contract

for at least a year or longer. As the global drilling fleet grew

since 1988, the proportion of rigs on bareboat charters has also

increased progressively - from 0.2% of the fleet in 1988, to 2.5%

in 1998, 3.3% in 2014, and 8.1% in 2020.

It is clear from the chart that the majority of the units with

bareboat arrangements are jackups but this is not surprising as

floaters are more expensive than jackups, whether to build,

maintain, or charter. The terms for bareboat contracts, though, can

vary widely. Under some arrangements, the charterer or leasee has

to pay a fee only when the rig is working. Some have their units

chartered based on a monthly rate, while yet others are under

lumpsum agreements.

Sale-and-leaseback deals have also been a feature since the late

2000s. Under these agreements, rig owners would sell and then lease

back their rigs from the purchasers - allowing them to free up cash

while holding on to the assets they need for operation. In 2019,

Singapore yard Keppel FELS delivered newbuild jackups Cantarell III

and Cantarell IV to Grupo R, then bought the rigs from the Mexican

contractor before leasing them right back for 10 years. This way,

though the yard now effectively becomes a lender to a customer who

could no longer afford to own the jackups it ordered, it monetised

the assets and got the rigs working.

Historical data points show that bareboat fees are usually at least

10% of prevailing drilling day rates. With the rig market in the

doldrums, bareboat prices have also fallen as the market bottomed

out. Currently, fees for jackups range between USD 10,000 and USD

30,000 per day. Factors like job scope, rig age, state of the unit

and other specifications can also affect the price.

Location is another determinant. Early on, the few rigs on bareboat

charters worked mostly in Europe or in the Gulf of Mexico. This has

changed over the years. In 2020, the top three areas to feature

bareboat rigs are Asia-Pacific with 24 units, the Middle East with

19 units, and Mexico with 11. At present, Asia-Pacific is the

region with the largest bareboat fleet and the bulk of these units

are located in China - in 2020, 17 of the 24 units in Asia were

based there.

Building a fleet with bareboat rigs

An interesting facet of the recent increase in bareboat numbers is

how newbuilds are driving it. In 2017, just three of the 18 units

bareboat worldwide were mobilised straight from a yard. In 2018, it

was two. By 2019, this jumped to 24, or well over a third of the 54

units on bareboat charter that year. In 2020, although just seven

of the 60 bareboat units worldwide were newbuilds, 35 of them were

built within the last four years.

However, it is no coincidence that newbuild bareboat numbers rose

so dramatically in 2019 - that was the year SinoOcean was set up.

Since the last offshore downturn in 2014, China - the rig-building

powerhouse of the last decade - was quickly becoming a graveyard

for undelivered rigs. The state-owned entity was conceived to

manage offshore assets abandoned by their original buyers, working

behind the scenes to seek solutions for orphaned rigs. So far,

China's leading offshore rig contractor COSL is the one that has

taken on the bulk of Chinese newbuilds via bareboat arrangement. Of

the 58 offshore rigs it operates worldwide, at least 22 jackups and

semis are managed under bareboat contracts.

There is no doubt bareboat charters are a means for the industry to

cope with existing market conditions. It is a certainly a cheaper

option than ownership for contractors and other enterprising

middlemen to secure rigs. Not to mention the unexpected bonus of

bareboat charters having helped to ease the oversupply situation by

winnowing the number of undelivered rigs from over 120 units in

2018 to 60 today.

Yun Yun Teo is a data transformation principal for upstream energy at IHS Markit.

Posted 30 April 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.