Biodiesel producers will use record volumes of soyoil in 2022

The global biodiesel output is forecast to rise sharply in 2022. One of the key questions is how this new demand will be covered on the feedstock side, and how these changes impact commodity markets.

To be more specific: the market not only has to deal with questions around economics but also with food security issues and changes in well-established trade flows. E.g. which role will virgin vegetable oils (VVO) play next year? What about non-crop feedstock, which have become a key pillar of the global input portfolio - can one expect other dynamics here than those in VVO?

The projected increase in world biodiesel production next year stems from two factors:

- The expected recovery in road diesel demand in 2021 and 2022, after the drop last year, when the COVID-19 pandemic hit the market. The bulk of the biodiesel used worldwide is in road applications (off-road: up to three million tonnes per annum or 6% of the global total).

- Renewable energy and decarbonization targets rise across the globe on various reasons.

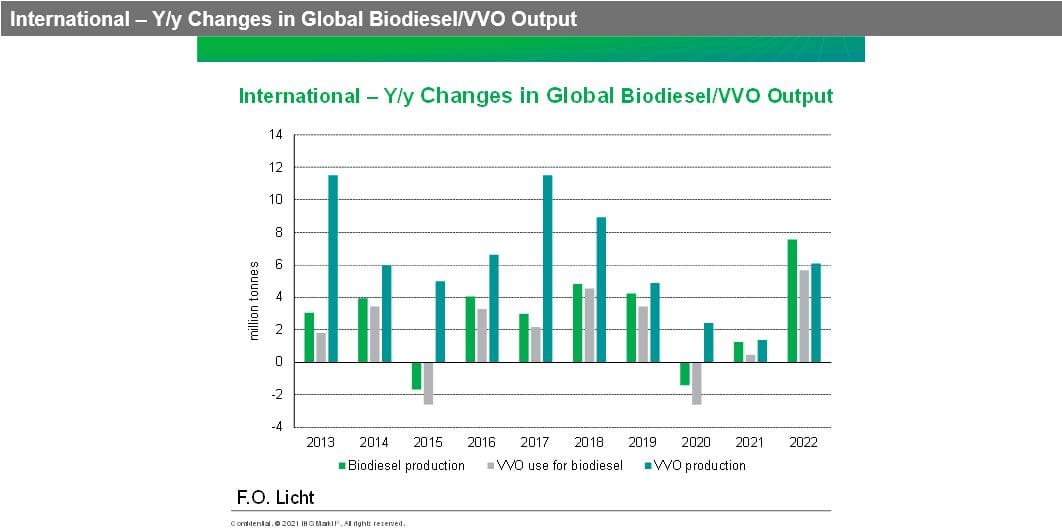

In 2022, biodiesel production is seen rising by more than 15% to roughly 53 million tonnes, 7 million more than forecast for 2021, against a much weaker plus this year and a drop in trouble-hit 2020.

The term biodiesel here refers to fatty acid methyl esters (FAME) and renewable diesel (RD) produced in stand-alone or co-processing units.

VVO output set to rebound - but will there be enough?

Global productionof the major plant oils in 2021/22 may rise y/y by almost 10 million tonnes to roughly 215 million tonnes, after a slight drop in 2020/21, market projections show. This sounds impressive at first, but the additional output has to cover food and fuel needs.

One must not forget that demand for palm oil in India and China Mainland is set to remain high (at 8-9 million tonnes annually and roughly 7 million, respectively) in 2021/22. The same applies to soybeans, where China Mainland's import requirement is estimated at more than 100 million tonnes.

The outlook for the global productionof crude palm oil (CPO) in the current cycle points to an increase to slightly below 80 million tonnes, with Indonesia contributing up to 2 million tonnes more and Malaysia 1 million.

The soyoil situation in the Americas is not straightforward. True, a y/y increase in US soybean output from the current harvest on the back of strong plantings is helpful. At the same time, the season started with a weak carryover while demand will expand. This means the US bean balance will recover only slightly. Projections for 2022/23 plantings are for an increase.

At the same time, available supplies in 2021/22 in Brazil (=from the harvest starting early 2022) may grow only slightly. The bean harvest may reach more than 140 million tonnes, but the outlook for exports remains strong.

Bullish price signals come from rapeseed and canola. Rapeseed production in the EU-27 in 2021/22 recovered from the low 2019/20 and 2020/21 results but remained below the levels of around 20 million tonne seen earlier.

The outlook for urgently needed exportable supplies is disastrous:

- Dry weather conditions cut Canada's canola supplies sharpy, to below 13 million tonnes, drastically reducing crush and seed exports for the current cycle.

- Australia may export more canola in 2021/22 but these additional 0.5 million tonnes are not enough to change the bullish picture here.

- No relief comes Ukraine, following a drop in plantings there.

Winter rapeseed plantings for the coming cycle in the EU are set to rise, possibly by more than 5%, but remain below earlier seasons. EU farmers seem to prefer other crops such as wheat which may also have to do with regulation on plant protection.

Demand dynamics differ across the biodiesel feedstock portfolio

The projected plus of more than seven million tonnes in biodiesel output in 2022 will mainly be borne by VVO (+ five million), including a strong increase in soyoil. VVO-based biodiesel output is seen reaching around 37 million tonnes, which translates into around 41 million of VVO including refining losses and co-products.

Demand growth for VVO from the biodiesel sector will accelerate sharply next year. While palm oil will remain the main VVO used for biodiesel production, soyoil will see the strongest increase. Moreover, demand for rapeseed oil should see a sharp rebound after the drops in 2021 and 2020. Other VVOs such as sunflower oil or coconut oil or other crop-based products like distillers corn oil (DCO) will also see growth in demand. Jatropha oil plays no role here.

In relative terms, biodiesel from non-crop feedstock will continue to gain share. The non-crop feedstock section is a wide category and includes various types of secondary and tertiary biomass such as:

- Waste streams from the food supply chain such as used cooking oil (UCO) or animal fats/tallow,

- By-products of crude VVO refining and cooking oil production such as fatty acids, palm fatty acid distillates (PFAD), palm oil mill effluent (POME) oil, soapstock, acid oils, and stearine, as well as

- Fatty feedstock from industrial application such as tall oil.

All in all, more than 16 million tonnes or 31% of the 2022 biodiesel production may come from non-crop feedstock.

Feedstock use in terms of tonnage is hard to gauge as input/output ratios can differ widely. Non-crop inputs like UCO or animal fat usually have a much less advantageous conversion ratio than VVOs.

Another point impacting the dynamic of the feedstock demand for biodiesel are differences in the product yields in the FAME and RD production processes. A risen share of RD in global biodiesel production additionally boosts demand for fatty feedstock. The delta in plant oil or waste feedstock demand therefore also stems from the fact that the biodiesel yield in RD is significantly weaker than for FAME. In other words: a relatively smaller portion of the oil input ends up as RD than in FAME (FAME yield is about 90%, while that of RD is about 80%). In RD production, the "remainder" of the output consists of products such as green naphtha or substitutes for liquefied petroleum gas which are not being considered here but are relevant on the markets for energy and chemical products.

Shifts in the palm oil demand pattern

The global use of palm oil in biodiesel may exceed 16 million tonnes, based on a biodiesel production of slightly below 15 million. The year 2022 may bring a y/y increase of more than one million tonnes, with the bulk of that coming from Indonesia, and, to a lesser extent, from Malaysia and Thailand. These increases more than offset the expected decline in the EU.

The outlook for Indonesia is based on the current mandates (B-30 in road transport). I.e. the growth in road diesel demand determines the y/y change. An earlier announced plan for an increase to B-40 for which no binding time-frame exists would of course boost demand. The projected delta in Indonesia's 2022 biodiesel production is also in line with Jakarta's plans to get away from an economy focused on the export of raw materials.

The expected decline in EU palm oil biodiesel production (RD and FAME) to less than 1.5 million tonnes stems from efforts to phase out the use of the product as biofuel feedstock by 2030. Relevant legislation here is a Delegated Act under the EU Renewable Energy Directive II (RED II) which is challenged at the World Trade Organisation by Southeast Asian exporters. Worth noting is that EU member state legislation is partly stricter in this respect. There also are efforts to cut/phase-put the use of palm oil at company level from large biofuel suppliers (see e.g. announcements by Eni, Neste, etc.).

This means that the global use of palm oil will more and more shift to the Southeast Asian biodiesel suppliers which are fulfill their local mandates and, occasionally, cover discretionary blending demand. At the same time, the relevance of renewable diesel in palm oil demand drops on a lack of sales opportunities on both the EU and the US markets.

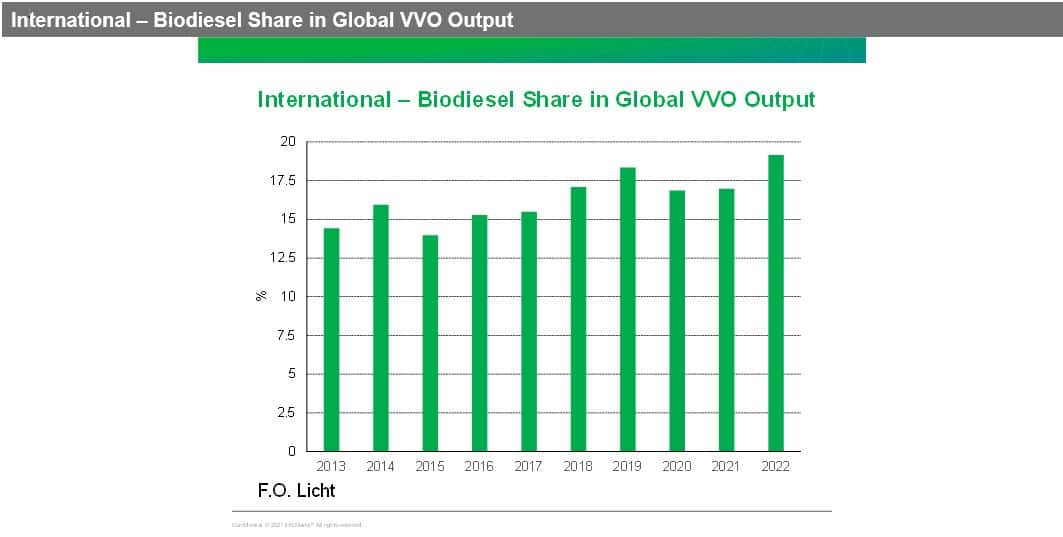

Summing up, we expect that 22% of the global palm oil production will end in the biodiesel segment, up slightly on 2019-2021 and against 13% ten years earlier.

Biodiesel producers in the Brazil, US boost soyoil demand

Biodiesel production from soyoil will jump to more than 13 million tonnes (=14 million tonnes of oil or 70 million tonnes of bean equivalents) in 2022, only slightly behind palm oil. This means a more than two million tonne y/y increase, following growth in Brazil and the US.

The biggest producer of soyoil-based biodiesel in 2022 will remain the US. Big Oil targets to reduce carbon emissions and reap gains from attractive markets for renewable fuels (e.g. the Low Carbon Fuel Standard (LCFS) in California). Several companies announced plans to invest in RD production capacity in recent years. So even when assuming a higher use of UCO/yellow grease, tallow or DCO next year, US biodiesel will eat into soyoil and bean exports.

Growth prospects for soyoil production in Brazil are limited amid a strong export outlook for beans. However, the federal government plans to partly liberalize the strictly regulated domestic biodiesel market. This eases the supply-side situation here and allows some growth. Uncertainty factors here are:

- The level of the mandate, following government interventions in recent months to prevent road fuel prices from rising. Our outlook is based on an average 12.5% vol. blend, up from 11% this year. However, it is far below the 15% targeted for 2023.

- The role of RD. State-controlled oil major Petrobras has conducted test runs with co-processing liquid biomass feedstock and targets sell into the mandate. An approval here would likely cut demand for expensive VVO feedstock such as soyoil.

All in all, we forecast that 25% of the global soyoil production will be consumed in the biodiesel segment, up from levels around 20% in 2019-2021 and 18% ten years earlier.

The developments in the US mean that more than two million tonnes will be used in RD, partly replacing demand from soyoil methyl ester (SME) producers, which is 18% of the expected total for biodiesel and up sharply from marginal levels currently.

Downside risks for SME production and use in the EU exist in near term in the context of deforestation concerns which could result in policy interventions.

Rapeseed oil demand to rise from the 2021 low?

High prices due to a tight rapeseed balance and issues on the input side (lack of catalysts) reduced EU-27 RME output in 2021.

A rebound is on the cards for 2022, but the pre-2020 levels may not be reached again. However, this requires an easier balance for rapeseed in the EU plus a sufficient supply of canola imports ex Canada and Australia.

Rapeseed oil use in RD/co-processing exists, at least in Europe, anecdotal evidence suggests, but the volumes here are still small when compared with the bloc's RME production. However, this may change once the phase-out of palm oil gains steam. Rapeseed use in RD could become a serious problem for RME producers. This also applies to the short-term. Replacing rapeseed oil is hard in times when SME offers no real alternative, and palm oil is being phased out.

At the global level, these data translate into around 17 million tonnes of rapeseed/canola used in biodiesel in 2022, a three-year high, but significantly below the levels seen pre-2020.

Feedstocks outside the VVO category

The COVID-19 pandemic reduced the availability of some non-crop feedstock such as UCO in a couple of regions such as Europe or North America, following closures of parts of the supply chain (restaurants, hotels, cantinas etc.). Nevertheless, biodiesel output from non-crop feedstock continued to rise.The incentives in the US and the EU are very attractive for greenhouse gas efficient, non-crop products.

Actually, the lower UCO collection in Europe and North America was offset by increased efforts elsewhere such as in Asia (China Mainland etc.). A significant share of the UCO collection was once again directly converted into FAME and RD and not exported as feedstock to Europe or the US. We therefore estimate that UCO-based biodiesel production was virtually flat at 5.5-6.0 million tonnes each in 2019 and 2020, with a growth towards 6.5 million on the cards for this year and almost 8 million for next.

A growing market segment in the non-crop category will be biodiesel made from POME. Biodiesel output here could easily reach 0.5 million tonnes this year and next, mainly in Southeast Asia, China Mainland and the European Union.

RD producers are able to soak up a growing share of these non-crop feedstocks. We estimate that more than 45% of the 2022 biodiesel output from non-crop feedstock is RD. This compares with 40% in 2021 and "only" 35% in 2013. The dynamic can be attributed to the replacement of palm oil as input at some companies, and the fact that RD producers in several markets are able to outbid FAME suppliers when seeking the most-attractive feedstock.

The aforementioned share of 31% of non-crop product in global biodiesel output expected for 2022 compares with 23% 10 years earlier.

Tough times in the non-crop segment ahead

The direction is clear. Biodiesel suppliers worldwide seeking to sell into the attractive markets in North America and Europe target to reduce their carbon intensity and therefore need non-crop feedstock with a low emission profile. The Far East has become the place where local biofuel and overseas producers compete for UCO, POME, tallow, etc.

However, as feedstock supplies are limited, alternatives - also from the crop section - have to jump in. Palm oil and PFAD offer no real solution, as their acceptance is shrinking in North America and Europe. Rapeseed oil is too expensive, and sunflower oil is not available for fuel at the moment. The only product that can fill the gap is soyoil. This explains part of the 2022 dynamic.

However, Europe and North America are only part of the global biofuels story.

At the same time, economies like Indonesia and Brazil target to lower their fuel import bills and support their ag sectors.

So, the global biodiesel market is divided into regions where GHG performance is key, and others, where fossil fuels consumption has to be reduced.

This development is unlikely to change soon. So the main issues will be:

- How much non-crop feedstock is available for GHG driven markets, and how will the split between RD and FAME evolve.

- What will the boom for palm and soyoil mean for the fragile equilibrium between the food and the fuel market.

Going beyond 2022, demand for liquid GHG efficient feedstock may see another boost from several decarbonization programs, including the yet-to-be discussed post-Renewable Fuel Standard in the US; cap-and-trade systems like the LCFS at the state level; the transposition of the RED II in the EU; and the planned Clean Fuel Standard in Canada. At the same time, producers of sustainable aviation fuel (SAF) will continue enter the market, which is significantly ahead of the time when the planned SAF mandates in the US or the EU may kick in.

An expansion of the feedstock portfolio, e.g. with renewable fuels of non-biological origins or synthetic fuels, is possible and likely to happen, but not at competitive cost and in the short-term. This puts a lot of pressure on these markets.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.