Brownfield and mature field revitalization in Brazil's Campos Basin

Brazil's Campos Basin has produced more hydrocarbons than the rest of the country's basins combined, having reached over 15.4 billion barrels of oil equivalent (boe) of cumulative production through the end of 2022. However, after peaking at almost 1.8 million barrels per day (bbl/d) in 2011, Campos Basin oil production has been falling, and reached 680,000 bbl/d in 2022. Ongoing brownfield and revitalization projects promise to reverse this trend and return the basin to a growth trajectory in the near term.

Several key brownfield and revitalization projects coming onstream and in advanced stages of execution such as: Marlim/Voador, Parque das Baleias, Roncador, Albacora Leste, Peregrino and more, promise to reverse negative production trends and put the Campos Basin back on a growth trajectory. <span/>According to an S&P Global Commodity Insights analysis[1], there are four key aspects to address that could contribute to value creation in this mature play: low processing utilization rates, aging facilities, new players in the basin, and underinvestment.

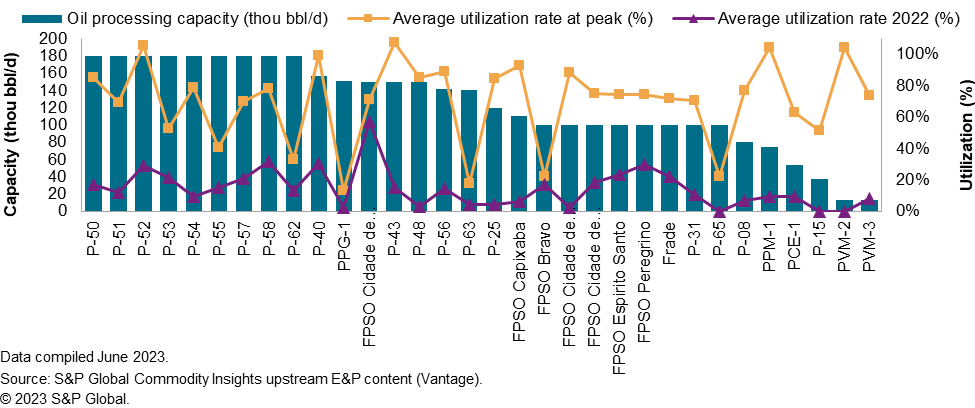

As of 2022, average utilization rates in the Campos Basin have fallen below 20% of the total installed oil production capacity, having peaked at about 55% in 2002. At the same time, average years in operation of current installed facilities in the Campos Basin are around 23 years, with an expected average useful life of 28 years. As facilities age and approach the end of their useful lives, maintenance costs and downtime tend to increase, the combination of these factors results in rising operating costs per barrel and negatively impacts profit margins.

Replacing aging facilities for several brownfields and mature fields in the Campos Basin helps to offset rising Opex/boe costs. Such is the case of the Marlim/Voador Complex, where 8 production facilities (P-18, P-19, P-20, P-26, P-27, P-33, P-35, P-37) are being replaced by two Floating Production Storage and Offloading (FPSO) vessels (Anita Garibaldi and Anna Nery). According to S&P Global Commodity Insights analysis, this strategy would help reduce Marlim/Voador's Opex/boe by around 70% by 2025.

Figure 1: Oil processing capacity and utilization rate by platform

An additional aspect that has enabled some Brownfield development and mature field revitalization in the Campos Basin is the presence of new players in the area. In 2017-18, Petrobras launched its divestment program, which facilitated the entrance of new companies and attracted fresh capital investment for the revitalization of mature fields. As of July 2023, more than 10 companies own interests in the area, but Petrobras still holds about 68% of estimated remaining entitlement oil equivalent volumes. The incorporation of new capital in the basin has proven to be successful and it's just starting to blossom, given that oil production from 2022 to June 2023, is starting to display the beginning of the long-awaited reversal of production decline. Continued investments in brownfield assets and mature field revitalization could bring the basin to a growth trajectory of above 800,000 bbl/d in the near term.

The discovery of the Santos Basin pre-salt fields in the mid-2000s led to a massive reallocation of financial and operational resources to prioritize development of the new play. This has directly impacted further development and has delayed investment in mature field revitalization projects in the Campos Basin. According to S&P Global Commodity Insights analysis, one of the main effects of underinvestment in the Campos Basin is on value creation. Assets with significant remaining recoverable oil resources that are currently not undergoing or have not implemented revitalization activities, would have negative Net Present Values (NPV) due to declining production rates, low utilization of installed capacity, rising Opex per barrel and proximity of decommissioning obligations. In contrast, assets with ongoing brownfield/revitalization projects are estimated to generate positive value from base and incremental production.

With several key projects coming onstream in the next several years, the Campos Basin seems poised to reverse a decades-long trend of oil production decline. According to S&P Commodity Insights analysis, expected investment in modeled brownfield and revitalization projects could unlock over 5 billion barrels of recoverable oil resources to 2050. To achieve this outcome would imply substantial improvements in oil recovery factors in the most high-potential producing fields in the basin.

Note

Detailed S&P Commodity Insights analysis is available for Vantage subscription clients.

Solutions

To ask questions, see a demo and learn more about QUE$TOR™ please contact ci.support@spglobal.com

For more information regarding well, field & basin summaries, please refer to EDIN

For more information regarding asset evaluation, portfolio view, and production forecasts, please refer to Vantage

[1] Brownfield development and mature field revitalization in Brazil's Campos Basin: Projects poised to reverse a decade of production declines

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.