Can stated future export levels at the Vostok Oil project be achieved in a time of political adversity?

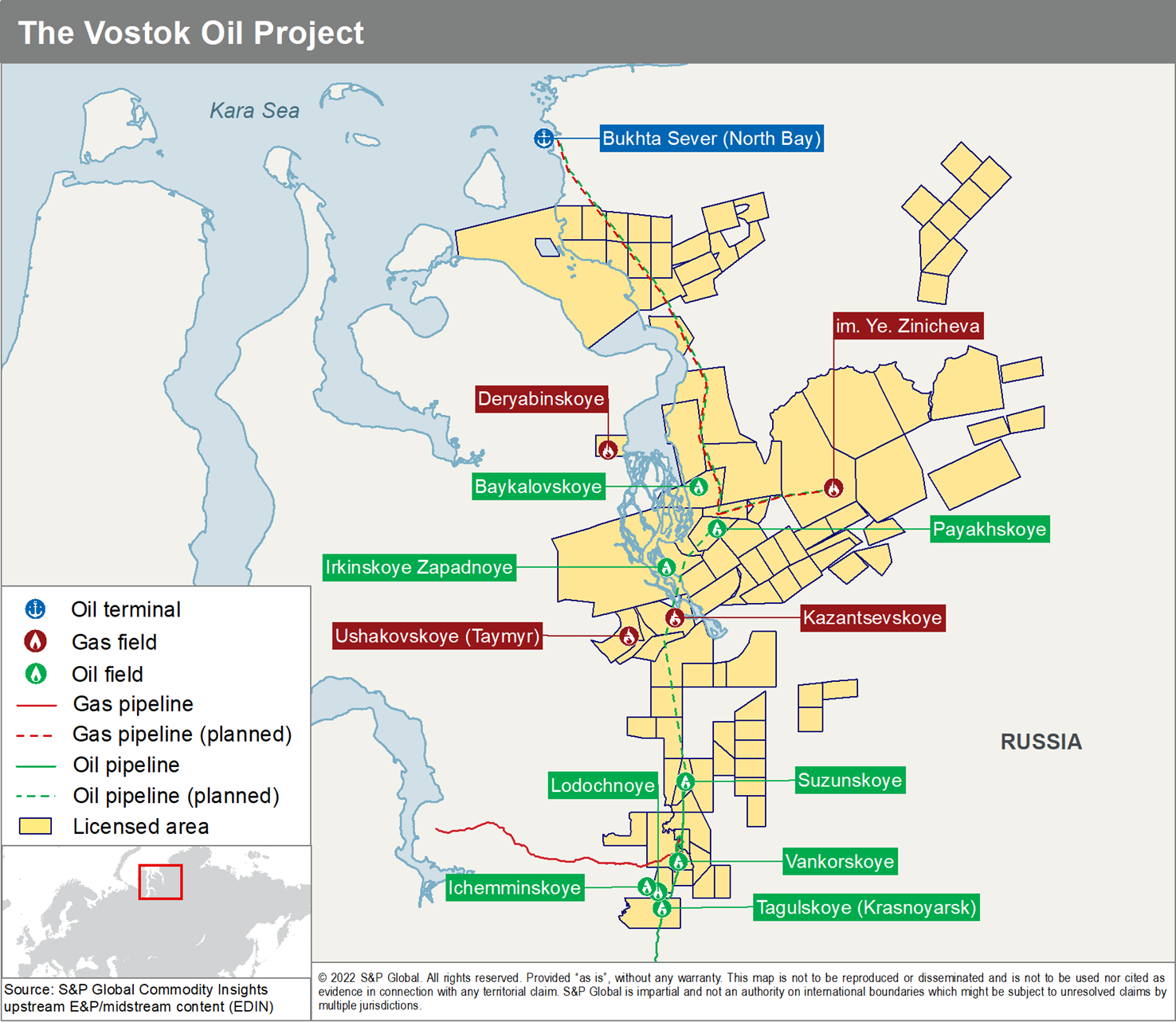

The Vostok Oil development is a vast project located in the Arctic portion of Krasnoyarsk, around the Yenisei Bay that extends to Russia's Taymyr peninsula (Figure 1). The project is stated to export around 30 million tonnes per year by 2024 and gradually increase to around 100 million tonnes (~730 million barrels per year (MMbbl/y)) by 2030. However, analysis of the current resource, political uncertainty and market demand may prove this difficult to achieve.

Figure 1: Location of the Vostok Oil Project and the Vankor Cluster. The Licensed area's represent licenses that could use the Bukhta Sever port infrastructure for export.

On June 6th 2022, the European Union announced an embargo on

Russian crude imports from December 5th 2022 and petroleum products

from February 5th 2023. As a result, forecasts from the Energy

Information Agency (EIA) in June 2022 expect a fall in Russian

crude production by 2 million barrels of oil per day (MMbbls/d), or

around 18% in the first quarter of 2023. In addition, a price cap

on Russian seaborne crude was announced by the G7, the EU and

Australia at the beginning of December at 60 USD/bbl. This is an

attempt to curb Moscow's revenue streams and ultimately its funding

of the conflict in Ukraine. All seaborne Russian crude will be

affected by the price cap, with western countries not providing

shipping insurance to cargoes priced over the 60 USD/bbl threshold.

This is likely to affect a significant number of projects in

Russia, especially in the west of the country.

Vostok Oil being Russia's new mega oil project is currently in the

appraisal / development stage with all crude destined for export

markets via tankers. China and India, who are Russia's largest

crude export markets, are not likely sign up to the price cap in

risk of compromising their energy security and damaging political

relations with Moscow. The price cap could mean that additional

volumes of crude could reach these markets at a further discounted

rate, squeezing out more expensive Middle Eastern and North

American imports. Nevertheless, the quality of Vankor oil coupled

with the threat of additional cuts by Russia, the announcement from

OPEC+ to cut production by 2 MMbbl/d and implementation of the 60

USD/bbl cap could help prop up Russia's export prices to its far

eastern markets.

The Northern Area relating to Vostok Oil contains the Payakhskoye,

Irkinskoye Zapadnoye and Baykalovskoye fields. They will be the

backbone of future supply to the Vostok Oil terminal (Figure 2),

but it appears the fields will struggle to underpin production

rates to meet the desired 30 million (220 MMbbls/y) and 100 million

(730 MMbbls/y) tonnes per annum goals. Resources at the fields

remain under appraised and will likely be appraised through

development drilling adding additional risk to overall

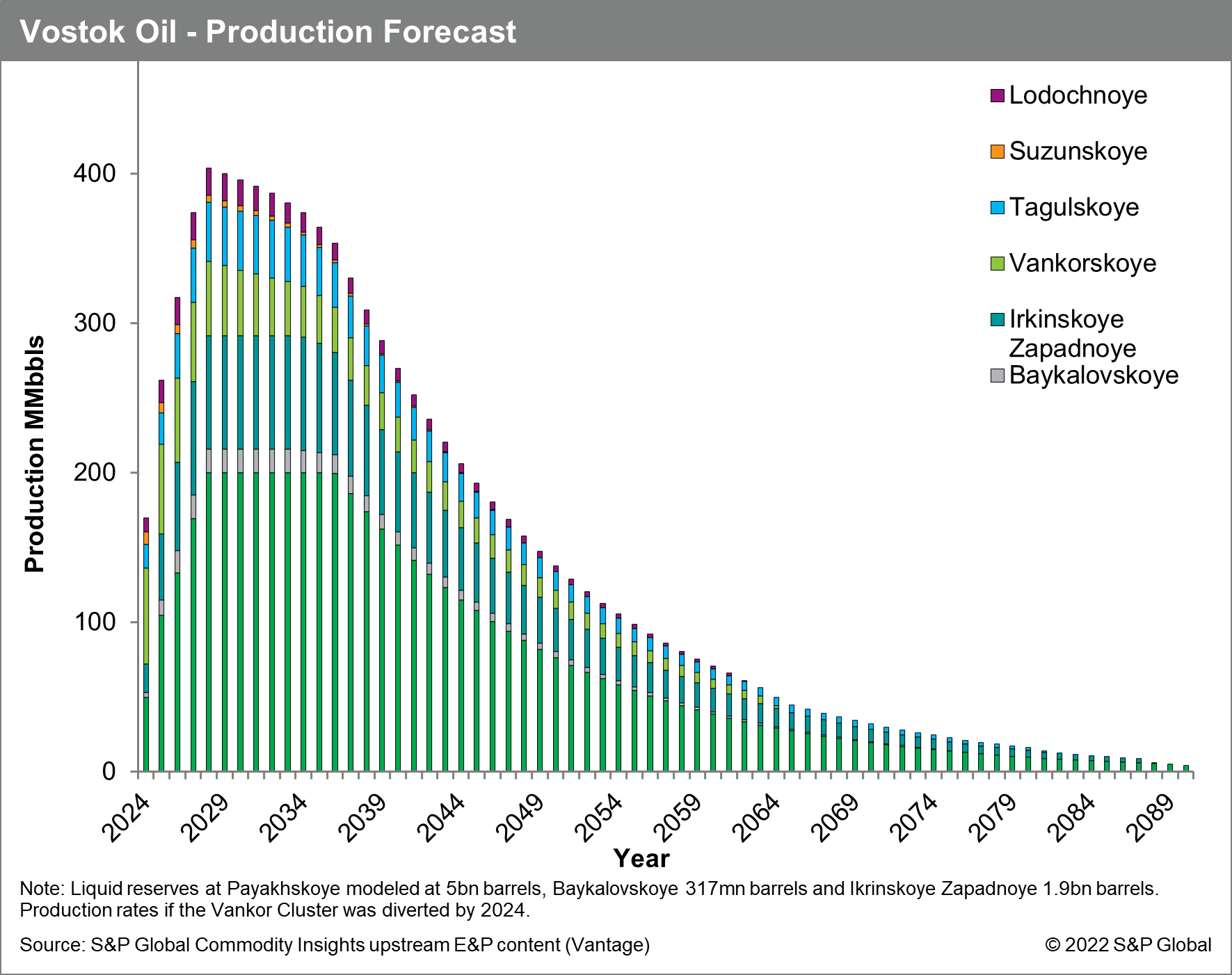

Figure 2: Forecast production figures for the major fields that could contribute to the Vostok Oil project. Note that Vankorskoye, Lodochnoye, Suzunskoye, and Tagulskoye will have to be diverted to the north rather than utilizing the exciting pipeline.

recoverable volumes and achieving these output targets. However,

positive appraisal drilling could increase the resource base at the

fields, potentially increasing production capacities and lowering

the breakeven price. Even the total diversion of large producing

fields such as Vankorskoye, Lodochnoye, Tagulskoye and Suzunskoye

will only take production to a maximum of 400 MMbbl/, around 55% of

the target capacity. Production at these some of these fields has

already begun to decline with Vankorskoye reaching peak production

in 2015. To offset this, Vostok Oil LLC will have to push an

aggressive exploration strategy in the next few years to

drastically increase the resource base coupled with a fast-track

development system to attain the production volumes targeted for

the project. Gazprom Neft has significant acreage around the

planned export terminal which currently would be the only viable

export route, though the acreage is unlikely to add any production

to the 2024 or 2030 target.

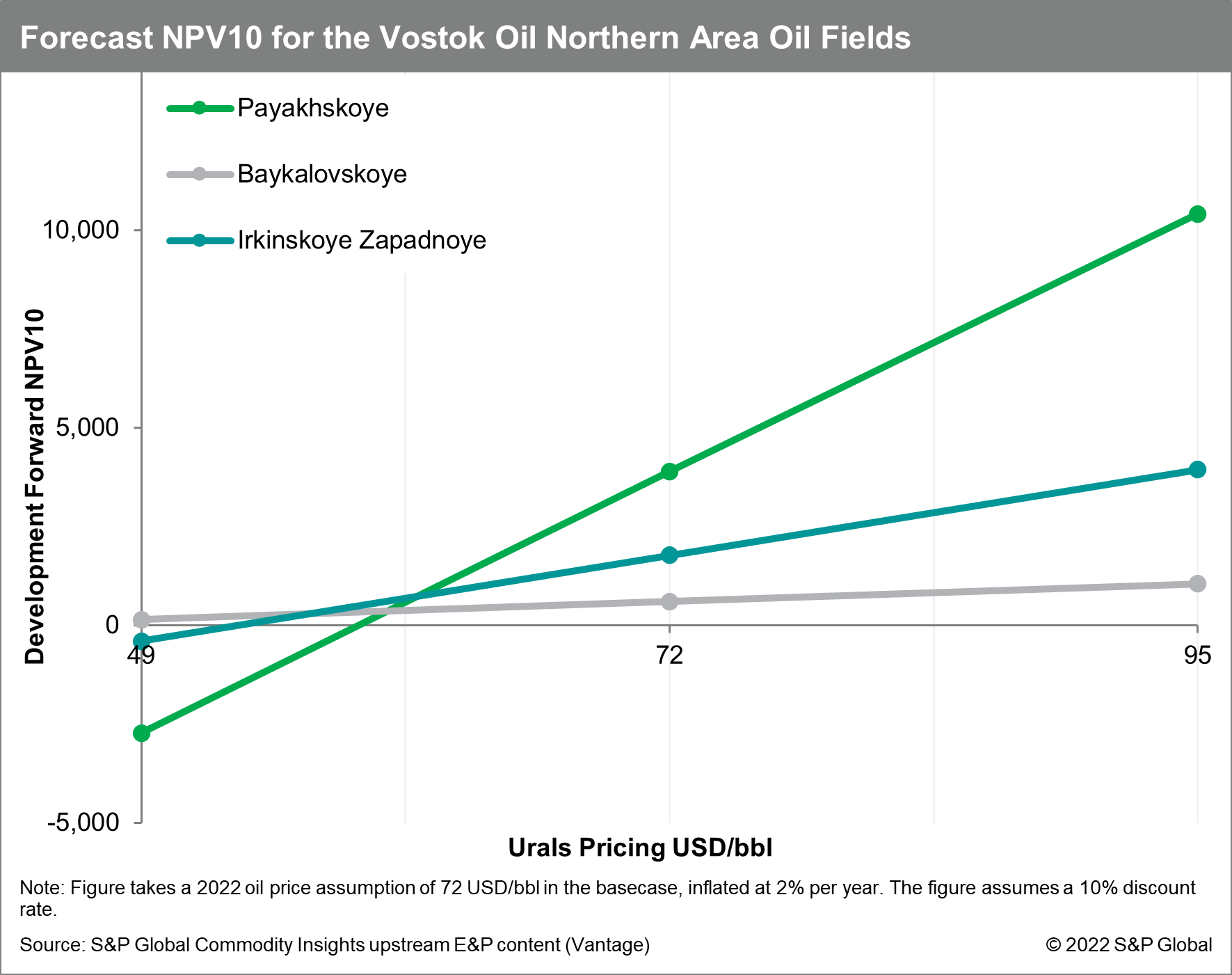

The economics of the three major fields prior to sanctions and

global market volatility seen over the last year presented viable

development opportunities with all breakeven prices being below 60

USD/bbl. Strong viable economics are present in the base case of 72

USD/bbl and 95 USD/bbl in the high case. However, in the low case

of 49 USD/bbl the projects quickly present negative NPV10 values

(Figure 3). At the current price cap at 60 USD/bbl, the fields

economics become marginal with small positive NPV10. Depending on

the operator's price outlook and additional incentives from the

state, the project is likely to still go ahead as planned.

Figure 3: NPV10 vs oil pricing for the three main fields that will supply the Vostok Oil Project in S&P Global Vantage. Breakeven prices for the fields are in the region of 50-60 USD/bbl, higher than the regional average but expected with significant new infrastructure required.

The new 60 USD/bbl price cap could provide short term problems for the project, especially with Rosneft stating that exports could start as early as 2024. All oil cargoes will be seaborne and could still be subject to a price cap, however the duration and the likelihood of the cap changing is dependent on future global economics and politics. If Vostok Oil LLC can discover additional liquids in the next 12 to 18 months, the project will benefit greatly, however additional volumes coupled with the current resource base and production from the Vankor Cluster is unlikely to attain the desired production rates in 2024 and 2030.

***

Want to access upstream-related expert content? Try the Upstream Demo Hub free membership to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.