Carbon capture in power generation cost: An Asia Pacific case study

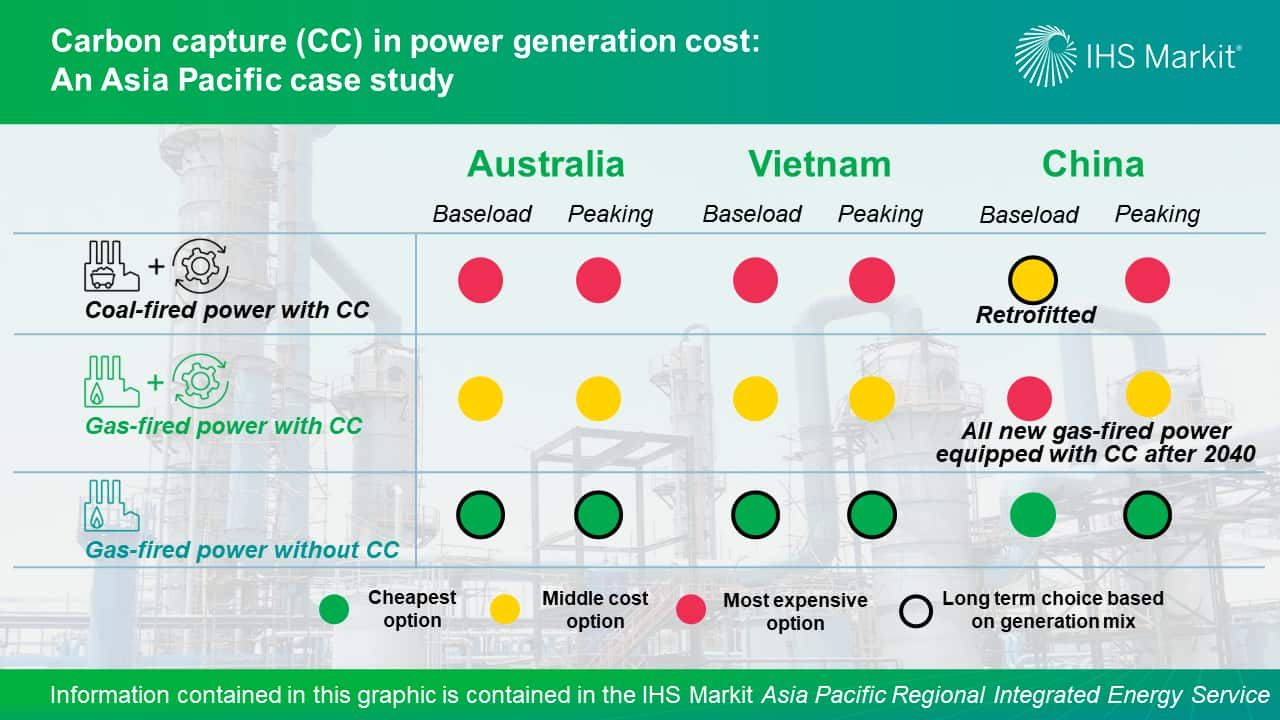

Power generation in Asia Pacific is a key area for exploring the potential use of carbon capture and storage (CCS). In 2020, power generation accounted for 36% of global carbon emissions, and Asia Pacific represented a 47% (and growing) share of global power demand. We identify three markets—Australia, Vietnam, and China—as case studies to showcase the diversity in economic development, power market structure, decarbonization goals, resource availability, and affordability across the region. Without carbon capture (CC), carbon emissions from a CCGT unit are approximately half that from a coal unit, while CC equipment can capture 90% of a plant's carbon emissions. Incremental CC capex does not vary among different markets at the current stage. However, CC premium as a percentage of total generation cost diverges widely owing to the high level of variation of components in the non-CC levelized cost of electricity (LCOE), impacting coal-gas competition differently across the region.

Incremental CC capex on a coal-fired power plant is about twice the incremental capex for a gas unit owing to the larger amount of carbon that needs to be captured. In Australia and Vietnam, the significant incremental cost of CC on coal-fired power compared with on gas units will make coal-fired power more expensive than gas-fired power running as baseload, midmerit, and peaker. As a result, CC will not reverse the coal phaseout in these markets. The role of thermal power with and without CC in the future capacity mix will depend on renewables' and energy storage's penetration levels to meet power demand and the action plans to achieve carbon commitment in each market.

China stands out compared with the rest of the world as having extremely low coal-fired power capex, making coal-fired power generation cost much lower than gas-fired power in all capacity factor levels without CC. Although installing CC will more than double the generation cost from coal-fired power without CC in China, gas-fired power with CC is still more expensive than coal power with CC running as base load and midmerit. On the other hand, given growing power demand and the large amount of coal-fired power in the existing fleet and already under construction, gas-fired power without CC could be a practical option in the medium term, while retrofitting coal plants with CC equipment could help the sector decarbonize in the long term.

Transportation and storage costs are significant elements that need to be taken into account but do not change the conclusion that with CCS gas power is cheaper than coal power in Australia and Vietnam. In China, the high end of carbon transportation and storage can alter the coal versus gas competitiveness in generation cost. Nonetheless, the key conclusion for China also remains unchanged—gas without CCS will be a medium-term decarbonization option, while new coal-fired power, with or without CCS, will lose favor owing to the global decarbonization ambitions and the supply chain disruption that will follow.

Across the region, CCS can be a crucial tool for decarbonizing the last mile in power generation, although diversification from fossil fuels will remain the biggest contribution to carbon emissions reduction from power generation. Non-fossil fuel power capacity will be the largest contributor in reducing carbon emissions from power generation in all three case study markets.

Learn more about our Asia Pacific energy research and insight.

Jenny Yang is a Senior Director covering Greater China's gas and LNG analysis.

Allen Wang is a Director covering Southeast Asia's power and renewable analysis.

Joo Yeow Lee is an Associate Director covering Southeast Asia's power and renewable analysis.

Posted on 8 December 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.