Carbon capture, utilization and storage (CCUS) is the technology with the highest mitigation potential to decarbonize the cement industry

Cement is a key component of concrete, the world's second most consumed material, and it is widely used in modern infrastructure. Cement production is also one of the largest single CO2 emitting industries, making it subject to increasing environmental pressure as more net-zero pledges are announced.

About half of the CO2 emissions in cement production are due to the inevitable chemical process of calcination while the remaining comes from the energy-intensive heat needed for the process. A recent report by Clean Energy Technology at IHS Markit benchmarked multiple decarbonization pathways currently available for the cement industry. Results show that, from all available options, CCUS is by far the solution with the highest mitigation potential since this technology significantly and directly reduces CO2 from the calcination process.

However, adding CCUS to cement production currently more than doubles the cost of cement; hence, a wide range of capture technologies, with different degrees of technology readiness, are being tested globally with the objective to reduce capture cost. Currently, multiple CO2 capture technologies are planned to start operations in large-scale projects, including the relatively developed post-combustion amine scrubbing, oxy-fuel combustion, and other emerging CCUS options, such as cryogenic, solid sorbent, membranes. Despite the cost reduction the new technologies could bring, policy support will still be required to incentivize these projects. Thus, there is no surprise to see that regions with defined policy support like Europe are leading the pipeline of CCUS projects in the cement industry globally.

Europe emerges as a leader for first CCUS projects in the cement industry

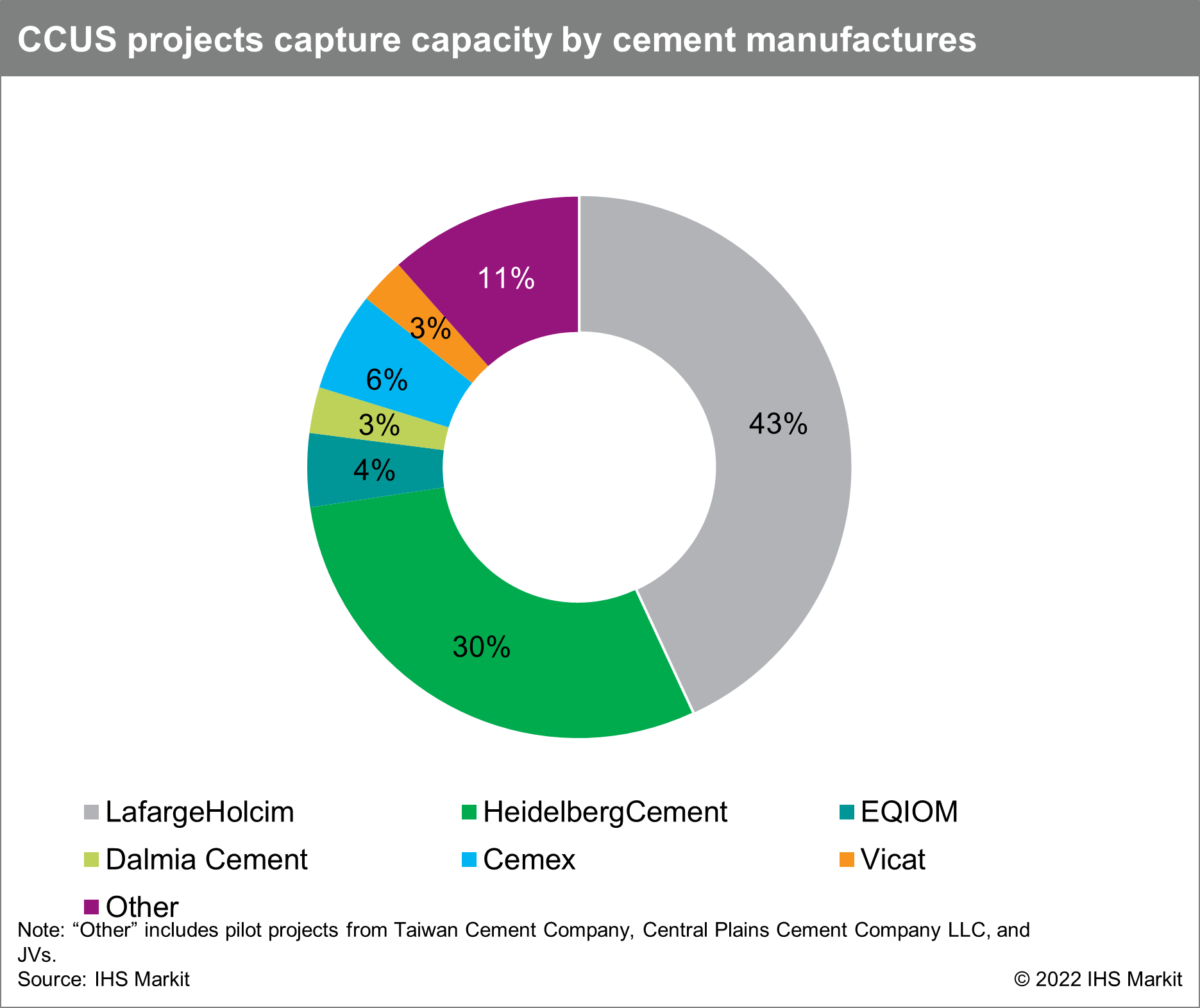

The CCUS pipeline of projects for the cement industry is mainly a story of European cement manufacturers. Europe not only accounts for 56% of the CCUS projects in the cement industry, but also two European players - LafargeHolcim and Heidelberg cement - are leading 73% of the CCUS projects for the industry globally.

These companies are leading efforts to decarbonize the industry, anticipating the critical role that CCUS can play in the industry, and the potential costs associated with untackled emissions that could lie ahead if they don't decarbonize their operations. In fact, the European emissions trading system (EU-ETS) will start the phase-out of free allowances in 2026 through 2030, which will represent a significant cost for cement manufacturers going forward. However, if decarbonization solutions are in place, producers could significantly reduce the emission cost of their operation.

An analysis from IHS Markit shows that the investment in capture technologies such as oxy-fuel combustion, calcium looping and amine scrubbing in Europe could offset the emission costs from EU-ETS beyond 2035, which could be a significant incentive for cement manufacturers to implement decarbonization technologies such as CCUS in their operations.

There is no doubt that policy support is needed to decarbonize the cement industry, and although Europe seems to be moving in the right direction, the region only accounts for 4% of the global cement production. If we want to see a significant change, mainland China - the main cement producer globally with more than 50% of the global cement production- will have to put the right policy in place to accelerate the decarbonization of the Chinese cement industry.

To learn more on this topic, request free access to our Global Clean Energy Technology service on the Climate and Sustainability Hub here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.