Chemical recycling of plastics waste – A new business opportunity in the Arabian Gulf

Over the last three decades, the Arabian Gulf has emerged as a

major global supplier of commodity plastics based on a platform of

advantaged feedstock, world-scale production, and state of the art

technology. In contrast, the region remains a small consumer in

global terms at around 6% of demand. Even so, if Turkey is included

in the Middle East region for analysis purposes, then there is a

regional market of circa 17 million metric tons. This implies a

need for managing waste plastics from manufacturing and the

post-consumer supply chain through mechanical and chemical

recycling, seeking to minimize waste heading for landfill and

incineration.

Chemical or feedstock recycling is being considered as a game

changer that can transform recycling. With chemical recycling,

innovative technologies - such as pyrolysis, gasification, chemical

depolymerization, catalytic cracking and reforming, and

hydrogenation - convert plastic waste into chemicals. These

technologies produce feedstocks such as monomers, oligomers, and

higher hydrocarbons that can in turn be used to make virgin

polymers. In many regions of the world,

especially in European Union, legislation is setting aggressive

targets, driving recycling efforts. The technical limitations in

mechanical recycling to meet those goals, leads to the view that

chemical recycling should play a role in future recycling

strategies. This should be an opportunity for chemical recycling in

the GCC and wider Middle East region for chemical recycling.

In many regions of the world,

especially in European Union, legislation is setting aggressive

targets, driving recycling efforts. The technical limitations in

mechanical recycling to meet those goals, leads to the view that

chemical recycling should play a role in future recycling

strategies. This should be an opportunity for chemical recycling in

the GCC and wider Middle East region for chemical recycling.

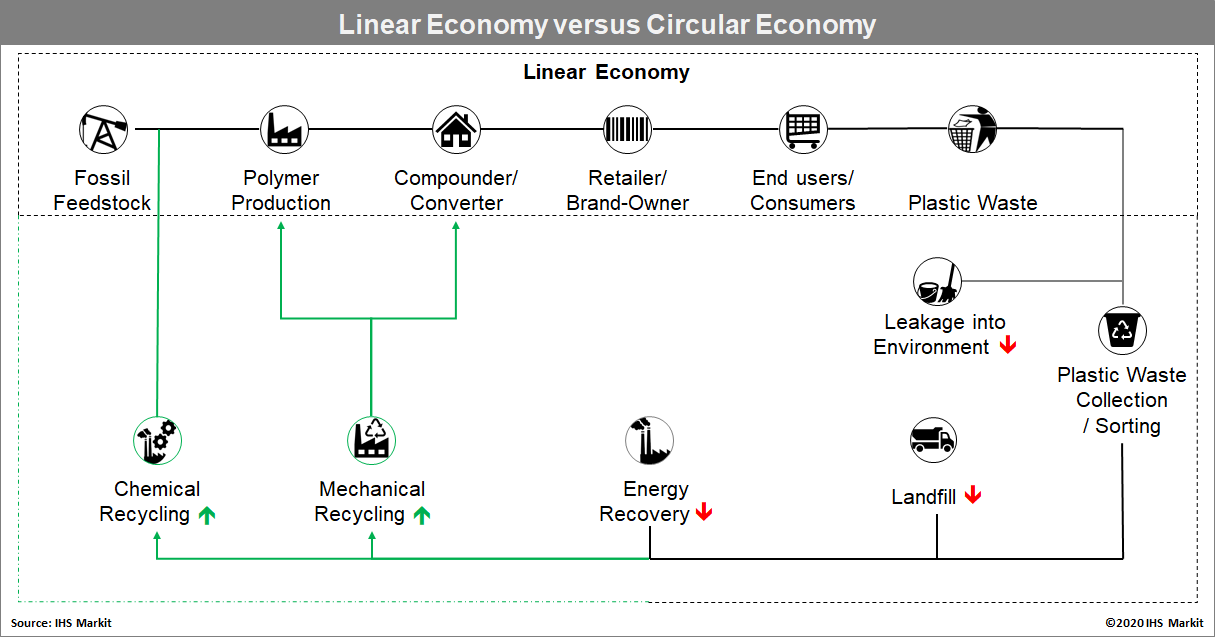

It is important to put the role of plastics recycling into the

wider movement for establishing a circular economy and displacing

linear economic thinking. The latter takes hydrocarbon and other

raw materials through various conversion processes to provide

solutions for end-users and consumers, e.g. food packaging, but

directing post-consumer waste to landfill and/or incineration. The

circular economy seeks to recover as much of the waste material and

return it to viable use as a polymer and/or feedstock back in the

petrochemical supply chain.

Recycling approaches

Cost and complexity are challenges to establishing a widespread

chemical recycling infrastructure, compared to mechanical

recycling. Opinions differ regarding carbon lifecycle assessment

(LCA) footprints cost and LCA optimization dependent on how

projects are structured, linking municipal waste collection with

sorting, recycling methods and integration with chemical conversion

operations.

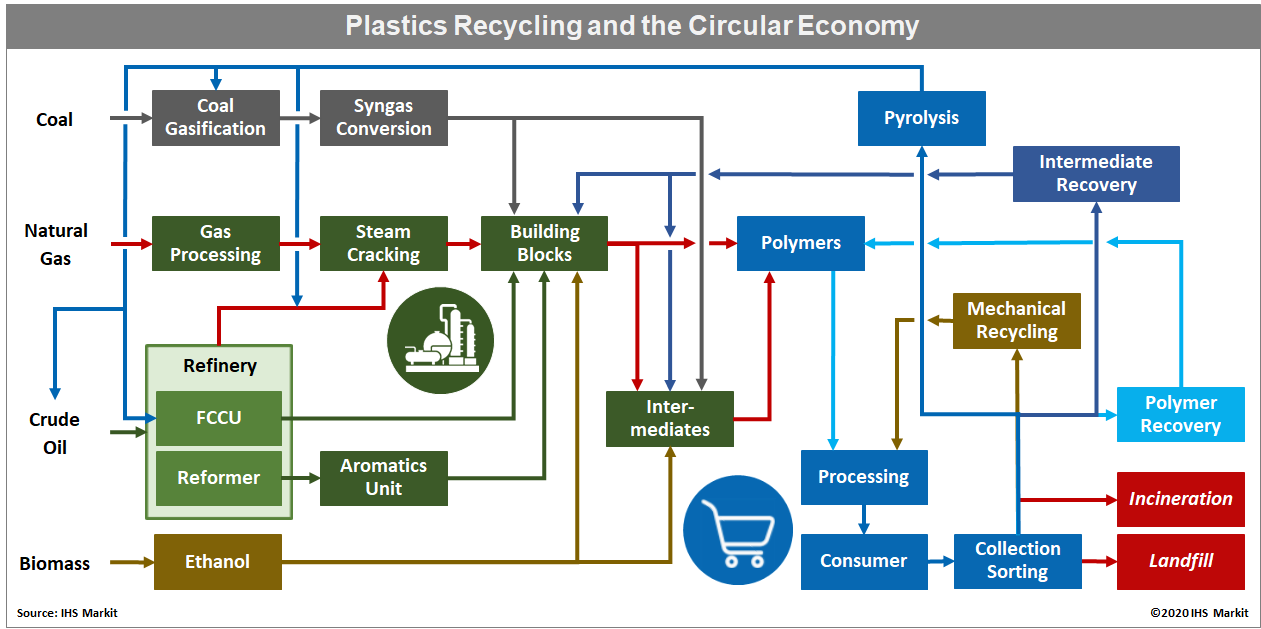

In recent consulting work, IHS Markit has seen common themes emerge

in plastics recycling, especially the circular economy, and how

"circularity" is achieved can vary significantly. Many people will

understand the basics of converting hydrocarbon feedstocks into

petrochemical building blocks that can include olefins and

aromatics or their derivatives, e.g. ethylene glycol. Most polymers

made today are processed with additives, fillers, and fibers to

meet specific end-use customer needs, ranging from barrier films to

keep food fresh to rigid components in automobiles.

Many municipalities collect and sort plastics waste, often

alongside paper, cardboard, and glass. Plastics must be sorted for

subsequent processing. Techniques such as near-infrared systems

that can "see" different plastics help with this. If manufacturers

can be convinced to rethink the design of common household items -

using a single polymer such as HDPE instead of a mix of

polyethylene, ethylene-vinyl acetate (EVA) copolymers, or

polyacetal - recycling could be simplified. This redesign process

is ongoing, especially when it comes to labelling. A simplistic view of the circular

economy and its relation to plastics recycling leads to different

re-entry points, depending on the polymer and recycling solution.

Sadly, today in several parts of the developed world, although

municipalities collect recycling, the plastics are often simply

incinerated.

A simplistic view of the circular

economy and its relation to plastics recycling leads to different

re-entry points, depending on the polymer and recycling solution.

Sadly, today in several parts of the developed world, although

municipalities collect recycling, the plastics are often simply

incinerated.

Once sorted, polymer articles can be cleaned and baled, ready for

downstream use. Many polymers can be mechanically recycled and

re-incorporated into select packaging solutions or made into fibers

for fabrics. In this way the plastics are re-used. As mechanical

recycling continues to grow and develop, one of the many concerns

is the range of applications that can use plastics recycled in this

way as quality and performance can deteriorate.

A key question for mechanical recycling is how many times articles

can be recycled and reprocessed in this way? In order to meet

legislation-mandated recycling targets, mechanical recycling alone

is insufficient.

Chemical recycling can take different forms. Some technologies like

the Vinylloop® process were developed to process PVC in a way that

recovered a polymer for reprocessing. The technology had some

challenges, e.g., entrained plasticizer, but the principle could be

revisited and potentially improved providing polymers for

reprocessing, possibly into pipe, etc. Other technologies applied

to polyesters and polystyrene can in effect "unzip" the polymer

chains to recover monomers and intermediates that can, in turn, be

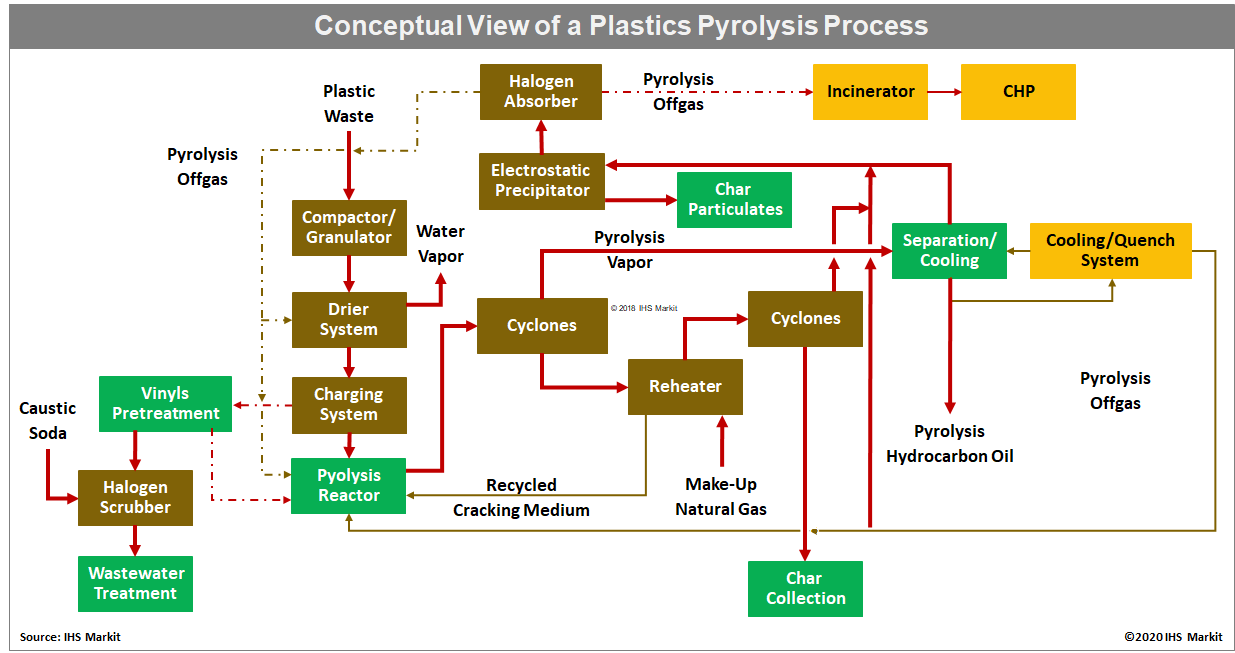

purified for use in polymer production. The processing of polyolefins and

certain mixed plastic waste can include technologies like pyrolysis

that generates a hydrocarbon oil. Different combinations of

polymers, pyrolysis technologies and post-treatment can yield

feedstocks that can feed a steam cracker, a refinery FFC unit, or

even be treated as some form of "syncrude" for the refinery. In

China, for example, pyrolysis products could be cofed into

gasification units and at present IHS Markit is analyzing in detail

direct polymer gasification/co-gasification with coal.

The processing of polyolefins and

certain mixed plastic waste can include technologies like pyrolysis

that generates a hydrocarbon oil. Different combinations of

polymers, pyrolysis technologies and post-treatment can yield

feedstocks that can feed a steam cracker, a refinery FFC unit, or

even be treated as some form of "syncrude" for the refinery. In

China, for example, pyrolysis products could be cofed into

gasification units and at present IHS Markit is analyzing in detail

direct polymer gasification/co-gasification with coal.

Pyrolysis - a simplified view

A simplified view of the pyrolysis (also referred to as

"thermolysis") process indicates the general principle of the

anaerobic heating of plastic waste, e.g., mixed polyolefins, at

medium temperature at circa 450ºC to 650ºC, with various approaches

to water removal, removal of chlorinated polymers, solids

separation, etc. Designs varies from maximum hydrocarbon liquid

make, which IHS Markit refers to as "pyro-naphtha", through to

maximum gas productions for reforming.

For companies and municipalities in the GCC and the wider Middle

East there are many opportunities to exploit different technology

solutions for recycling plastics. Many processes are developmental

at demonstrations scale. Some processes are already for license,

particularly in the pyrolysis family. These are generally small

scale today in the tens of thousands of metric tons per year range.

Scale economies are challenging, but work is ongoing to improve

scalability.

In addition, technology for the chemical recycling of plastics

continues to evolve. Companies like Synova, for example, are

developing technologies to convert waste plastics into olefins or

aromatics. There is a worldwide effort to develop scalable

processes to meet the plastics waste management challenges of the

future.

The post-consumer supply chain

Although, legislation can place levies on stakeholders, plastics

producers and processors, there needs to be a way in which all

parties in the circular economy chain can thrive, not one party

fairing at the cost of another.

A simple view of the value chain that links the municipality with

plastics production suggests scope for partnerships between private

industry and public bodies. Each has very different business models

and funding approaches. There are therefore opportunities for

public-private partnerships, but the cultures are different. Some

challenging bridges need building, in a way that the "value" is

shared.

If government-established recycling targets are to be achieved, the

links between consumers, municipalities, and petrochemical

production must be improved. After all, public opinion is moved by

media images of a threatened planet and ecosystem. Only through the

collaboration of people, municipalities, and industry - supported

by improved technology along the recycled plastics supply chain -

can we begin to find a cost-effective solution closing the gaps in

the circular economy and reduce polymer-based pollution. Such

opportunities exist in the GCC and wider Middle East region.