Chevron proposed $58 billion acquisition of Anadarko would create Permian powerhouse

Our team shares a two-part analysis on the proposed acquisition of Anadarko Petroleum by Chevron, including a view of upstream competition and the onshore US assets.

Key implications for a Chevron acquisition of Anadarko

"The bottom line—It's about scale. Overall, the acquisition is premised on creating further scale within Chevron's focus areas, and the addition of Anadarko would provide Chevron with a portfolio that complements the company's existing strategy," says Chris DeLucia, CFA, associate director, companies and transactions research, IHS Markit.

- Chevron's proposed $58 billion (equity value plus liabilities)

acquisition of Anadarko would be the largest upstream-focused

corporate transaction since Shell's acquisition of BG in 2015 and

would be the fourth-largest on record. Based on the current offer

metrics and preliminary IHS Markit estimates, the transaction would

be slightly accretive to Chevron's appraised net worth.

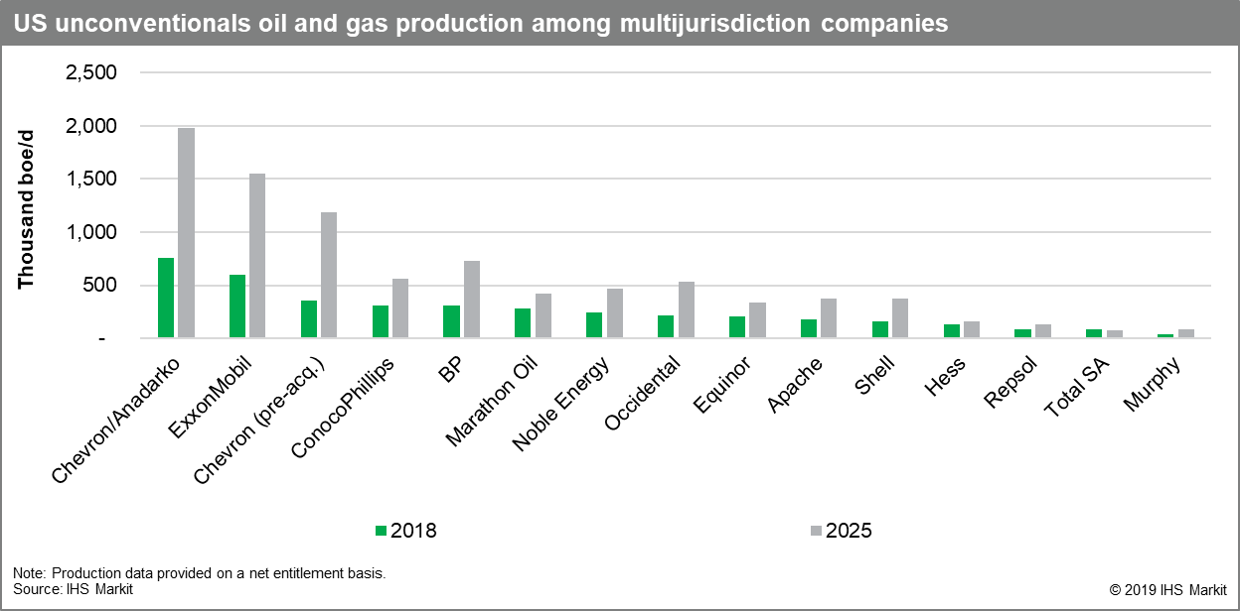

- The strategic rationale for the transaction is aimed at providing additional scale for Chevron within U.S. unconventionals, global deepwater and LNG. In the U.S. Lower 48, Anadarko's Permian Basin portfolio would supplement Chevron's existing footprint in the Permian's Delaware Basin, while adding a new position in the Denver-Julesburg Basin. Based on IHS Markit's current projections for both companies, net U.S. unconventionals output from the pro-forma company could reach 2 million barrels-of-oil-equivalent (BOE)/day by 2025.

- Deal will establish Chevron as a Permian powerhouse. For Chevron, the addition of Anadarko's U.S. onshore portfolio would supplement its existing position in the Permian Basin, which is increasingly becoming the company's primary focus area. Chevron's current Permian acreage is adjacent to some of Anadarko's in southwest Lea County and north-central Loving County. On a gross-production basis, the combined company would be the second largest Permian producer, a size and scale that should offer cost and operational synergies, which is increasingly important in the hyper-competitive Permian Basin.

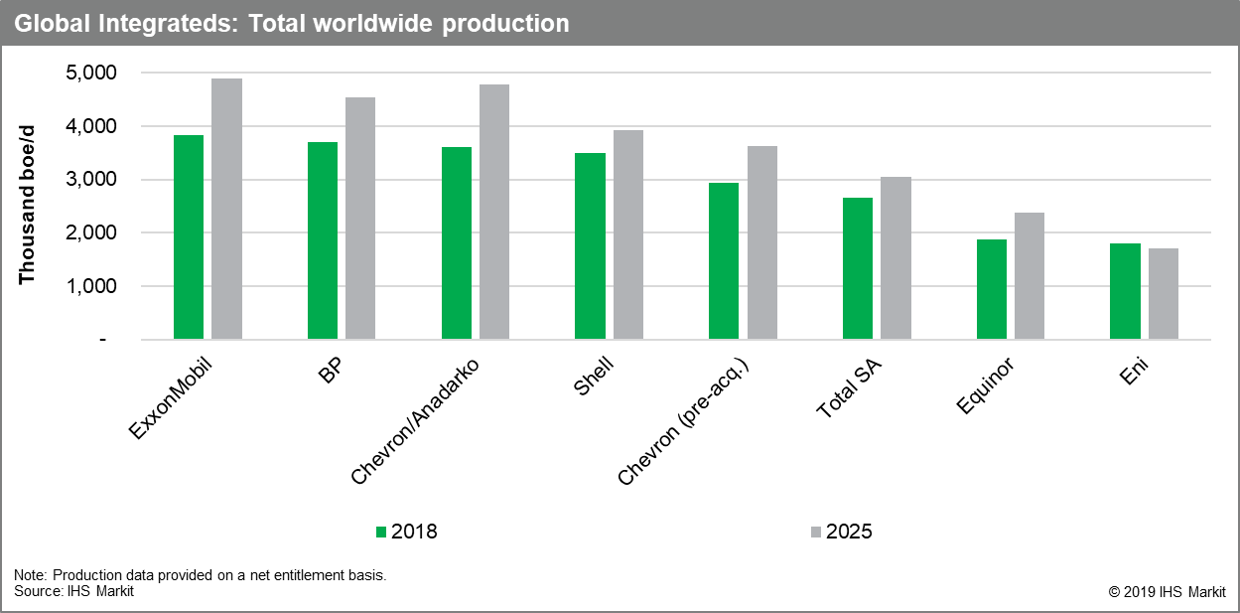

- Deal makes Chevron a Global Integrated leader. For Chevron, the addition moves the pro-forma entity toward the top of the Global Integrated peer group on the basis of production volumes. Current IHS Markit forecasts point to net output of 4.8 million BOE/day for the combined company by 2025, trailing only ExxonMobil's 4.9 million BOE/day at that time, but ahead of BP's estimated 4.5 million BOE/day. In 2018, Chevron ranked fourth among the Global Integrated companies in terms of net-entitlement volumes; the pro-forma company would have ranked third. (However, this growth outlook is subject to upcoming asset sales, with Chevron targeting $15 billion—$20 billion in divestitures through 2022, should the transaction close.

Figure 1: Global integrateds: Total worldwide production

- Chevron could become a leader in U.S. unconventionals by 2025.

Driven by Chevron's target of 900,000 BOE/day of net output from

the Permian Basin by 2023, IHS Markit estimates that combined U.S.

unconventionals output from the two companies could reach 2 million

BOE/day by 2025, making the company the largest producer in the

U.S. unconventionals space among the multi-jurisdiction group of

companies, well ahead of ExxonMobil's 1.5 million BOE/day by that

time.

For Anadarko, in the U.S. onshore, which accounted for 65 percent of its output at year-end 2018, the company's portfolio is currently centered on its core DJ Basin (272,000 BOE/day in the fourth quarter 2018) and Permian Basin (127,000 BOE/day) positions. These two core positions are supplemented by production from the Greater Natural Buttes of Utah and Powder River Basin in Wyoming. IHS Markit is currently forecasting production growth from both the DJ Basin and Permian Basin positions, with Anadarko's net U.S. unconventional output expected to reach 800,000 BOE/day by the middle of the next decade.

Figure 2: US unconventionals oil and gas production among multijurisdiction companies

- Don't forget the growth. Aside from scale, this deal would deliver growth. On a pro-forma basis, the combined Chevron/Anadarko would also be the highest growth portfolio among the peer group, with IHS Markit forecasting growth at a 4.1% Compound Annual Growth Rate (CAGR) between 2018 and 2025, for the combined company (ahead of second-ranked ExxonMobil's 3.6% CAGR during that time).

- Anadarko's portfolio would also supplement Chevron's deepwater U.S. Gulf of Mexico footprint. Anadarko's position in the play is largely centered on its operated hubs in the Miocene/Miocene sub-salt, which provide an array of short-cycle tieback opportunities and sustained free cash-flow potential. Notably, this position complements Chevron's growth opportunities in the Gulf of Mexico, which are centered on its Lower Tertiary and Jurassic-Norphlet positions.

- Anadarko's portfolio would also provide a growth opportunity within LNG. The Mozambique LNG project is nearing a final investment decision, and progress on this development would provide Chevron with a new growth option in its LNG portfolio following the recent wave of operated Australian LNG developments that have come onstream in the last few years.

"For some time, we've been predicting consolidation in the North American E&P sector as companies seek to increase efficiencies, strengthen their balance sheets and create new avenues for growth. Relatively low valuations and an improved oil-price environment could create the catalyst for additional M&A. We anticipate more M&A (merger & acquisition) deals will follow, as the chess game continues with the majors flexing their muscles and leveraging their cashflows," says DeLucia.

A Closer Look at the US Onshore Lower 48 Assets

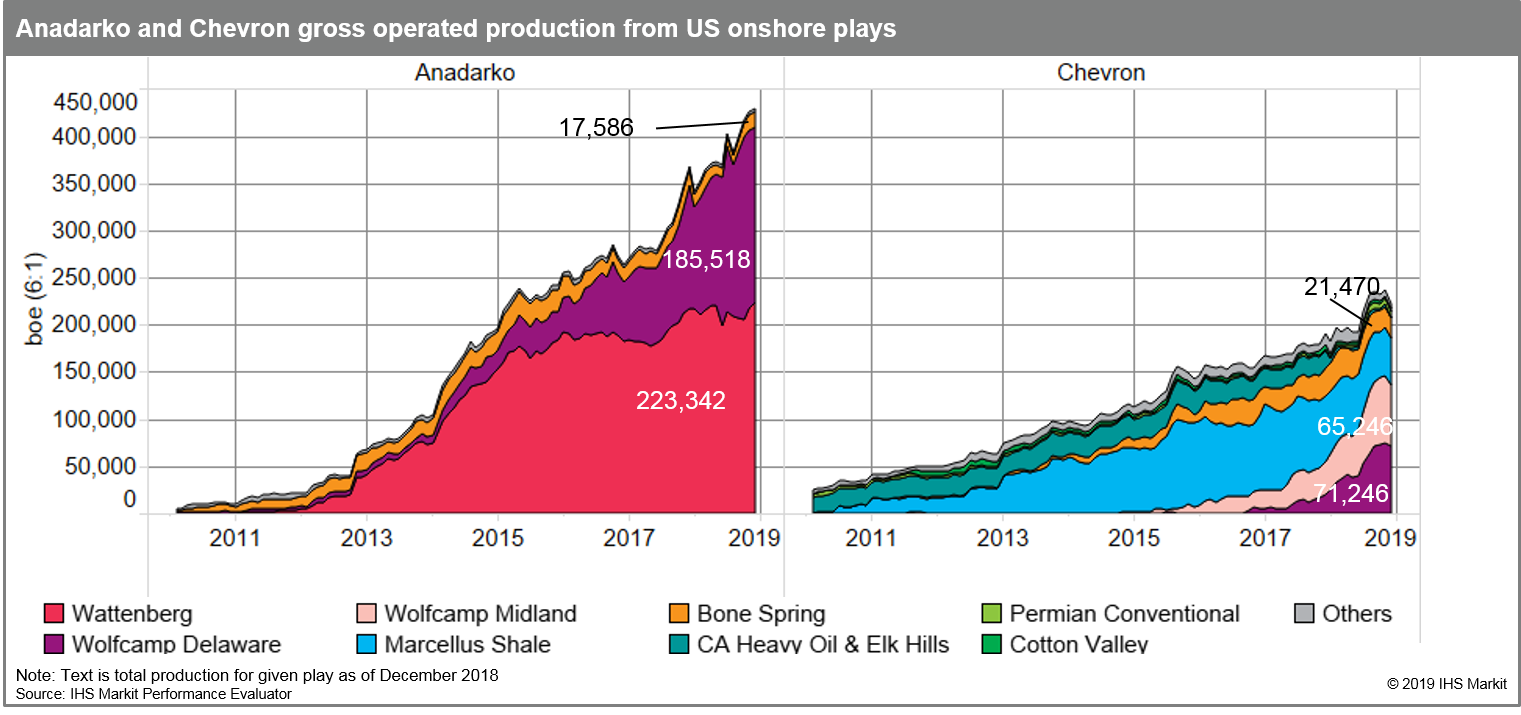

Chevron would nearly triple its U.S. onshore production through the acquisition of Anadarko. Anadarko's specialization during the past few years has been extreme. Chevron is buying two U.S. onshore assets in the Anadarko deal—the Permian Delaware Sub-basin and the Wattenberg/Powder River.

In the Permian:

- Running with the Wolves—Both Anadarko and Chevron are tied to the Permian, with the Wolfcamp Delaware comprising 47% and 52%, respectively, of the company's 2018 U.S. onshore wedge portfolio. Combined, the two companies account for just over 10% of the Wolfcamp Delaware wedge production, second only to the plays' current leader, EOG, which accounts for about 14% of the plays' wedge for 2018.

Figure 3: Anadarko and Chevron gross operated production from US onshore plays

- Anadarko wells in the Delaware Basin underperformed when viewed in terms of peak-month production. However, Anadarko has choked back wells and 12-month average rates are much more competitive with basin leaders. Chevron's Delaware Basin assets have performed in the middle of the pack historically, but have improved materially in recent quarters.

- Both companies are utilizing completions with above average intensities, leaving little room for improvement, in the near-term, from a change in the frack recipe.

- 50% of Anadarko's Permian position should yield wells falling into the 2nd and 3rd quintiles of historical Delaware Basin performance. Considerable running room remains at 12 wells per section—the asset is only 12% developed.

"In terms of well productivity in the Permian Delaware, Anadarko's relatively low peak-rate is offset by lower declines, resulting in impressive break-evens," explains Lauren Droege, senior research analyst, plays and basins, IHS Markit.

In the DJ Basin:

- The Wattenberg is a solid asset and Anadarko is one of two dominant players. (Chevron has no currently producing properties in the Rockies.) However:

- Wattenberg well results have not improved (for any company). The play continues to deliver roughly the same distribution of results, despite changes in proppant intensity.

- Senate Bill 181 in Colorado will have implications relative to the amount of room left in the play. While the Wattenberg is heavily drilled with verticals, recovery as low as 2% to 3% for vertical wells means that there a significant number of remaining horizontal locations.

- Wattenberg operators are in full development mode and Anadarko is averaging 365 ft. to 400 ft. of spacing between wells, with significant vertical offsets between neighboring wells. An estimate of 12 wells per section indicates that 65% of potential locations are currently producing.

"The lack of response to enhanced completions in the Wattenberg leads to flat productivity for the Anadarko wells, but average wells work at $60, as Anadarko's fee ownership greatly improves economics by eliminating royalties," says Imre Kugler, associate director, plays and basins, IHS Markit.

Learn more about our companies and transactions service or our plays and basins advisory service.

Posted 17 April 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.