China’s 2021/22 winter supply preparation: Improved but still at risk of a supply shortage in a colder-than-average winter

Chinese gas demand exceeded expectations to grow 14.9% in the first half of 2021, ahead of the 7.6% growth in 2020. LNG imports were the biggest contributor—almost half of the incremental supply year on year—to meet demand growth so far this year. With the quickly aproaching heating season, which typically begins in mid-November, the question is, will China rely heavily on the spot market to meet gas demand this winter?

From a demand perspective, growth moderation is expected in the coming months. The high demand growth in the first half of the year was the result of winter conditions, a strong economic growth rebound, the continued coal-to-gas campaign, and robust power demand growth at the time of limited power generation from hydro and coal. The latter three factors are showing signs of decelerating gas demand. Support for gas demand may come from a short-term clean air push for "blue sky" during the Beijing 2022 Winter Olympics in February, although the effect will be limited to the neighborhood region and could partially be offset by safety measures.

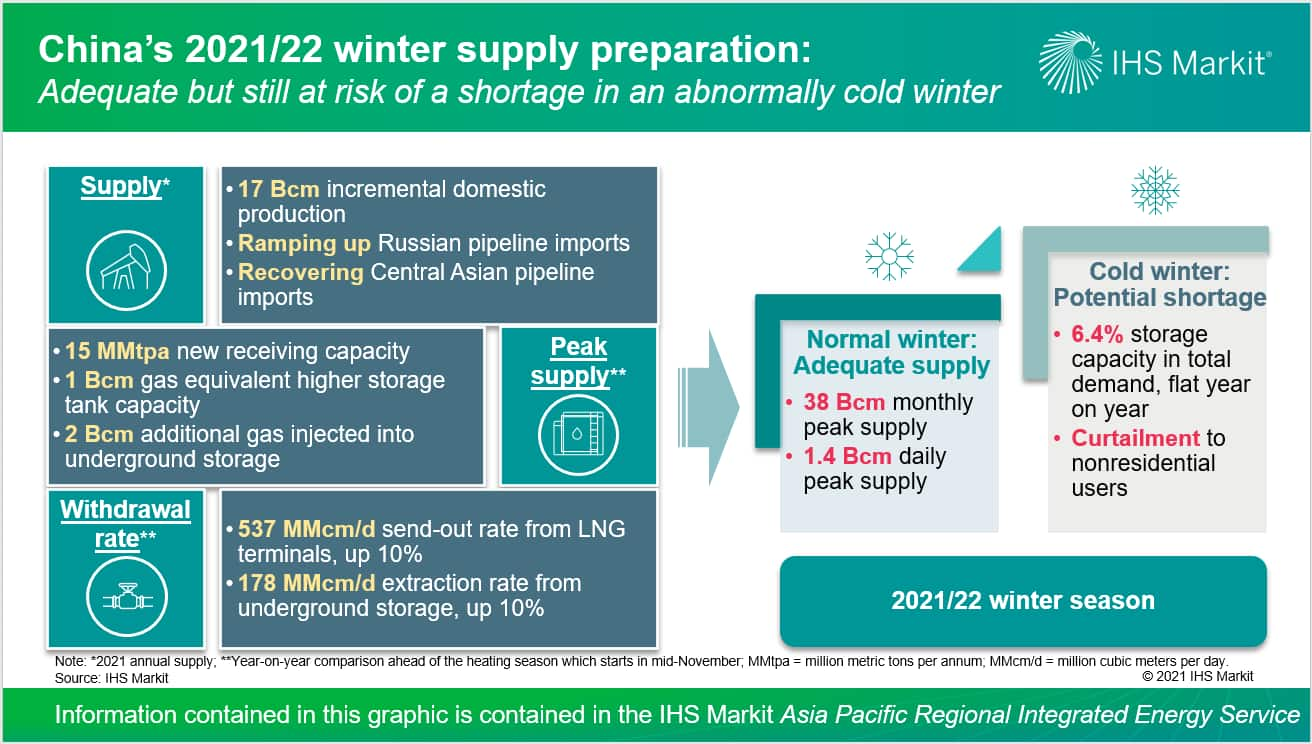

Total supply in general and flexible supply in particular will improve this winter compared with the last winter season. Supply increase will mainly come from domestic gas production and Power of Siberia gas imports. In terms of flexible supply, storage capacity, gas available from storage, and the withdrawal rate will also improve year on year. Compared with the beginning of the last heating season, storage capacity at LNG-receiving terminals and underground storage working capacity will rise 17% and 12%, respectively. Gas injection plans indicate that gas available for withdrawal ahead of the 2021/22 winter will be 1-2 Bcm higher. In addition, the daily send-out capacity from LNG terminals and daily extraction rate from underground storage will rise 10%, reaching 537 million cubic meters per day and 178 million cubic meters per day, respectively.

Adding together the rising upstream production capacity, the ramping up of Power of Siberia gas imports, and the withdrawal rate from underground storage facilities and LNG receiving terminals, peak supply can cover 38 Bcm per month and 1.4 Bcm per day, which are our peak demand assumptions in normal weather conditions.

However, the share of storage capacity in total demand will be flat year on year at 6.4%, making tight supply a distinct possibility in a colder-than-average winter. Without any supply-side factors, a "1-in-5 year" colder winter will likely add about 2 Bcm to the monthly demand, equivalent to 1.4 million metric tons (MMt) of LNG. In a "1 in 20 years" cold winter, the additional demand from the base case will be 2.4 MMt of LNG. However, the currently high spot LNG prices are certainly a challenge for Chinese importers to make a profit. In addition, new policies on supply security post-midstream reform also reduce suppliers' willingness to import LNG at a loss. As a result, supply curtailment will continue to be the tool of last resort in a tight supply winter.

Learn more about our Asia Pacific energy research with a climate and sustainability focus.

Jenny Yang is a Senior Director covering Greater China's gas and LNG analysis.

Xiao Lu is an Associate Director covering Greater China's gas and LNG analysis.

Megan Jenkins is a Senior Analyst covering Greater China's gas and LNG analysis.

Posted on 29 September 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.