China’s national ETS update: Free allowances tightened but overall cost increase still limited

On 15 March 2023, the Ministry of Ecology and Environment released the allowance allocation plan for thermal generators for the second compliance cycle of China's national emissions trading scheme (ETS). The plan provided the much-needed policy clarity on how free allowances will be determined, allocated, and settled in the second ETS compliance cycle, which covers thermal generators' emissions in both 2021 and 2022.

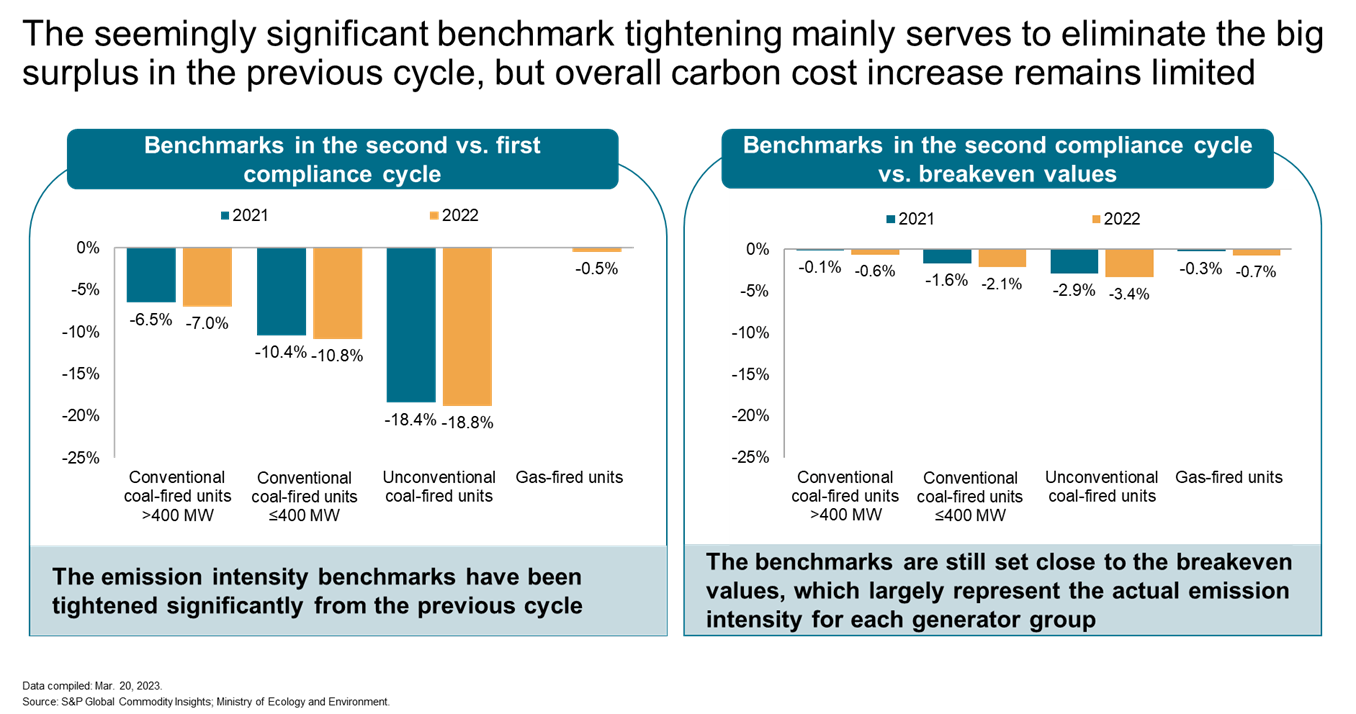

Thermal generators will continue to receive allowances free of charge. The allocation of free allowances will continue to be determined bottom-up based on emission intensity benchmarks, with no predetermined cap on absolute emissions. Compared to the first compliance cycle in 2019-2020, the benchmarks have been tightened by 6%-18% and 7%-19% for coal generators for their emissions in 2021 and 2022, respectively, and by 0.5% for gas generators for their emissions in 2022.

While the tightening may seem significant at first glance, it mainly serves to eliminate the large allowance surplus observed in the first compliance cycle but still leaves the ETS market largely balanced. This is because the new benchmarks are set only marginally lower than what the thermal fleet would otherwise need to fully cover its emissions in 2021, as indicated by the 2021 breakeven emission intensity levels, adding only a limited carbon cost at the system level.

Nevertheless, the tighter benchmarks will expose inefficient generators to a higher carbon cost penalty and provide them with greater incentives to improve efficiency. But in most cases, the cost increase should be relatively manageable, if not insignificant, thanks to the relatively loose benchmarks and several cost containment measures designed to further limit their final exposure. In addition to capping the maximum compliance obligations at 20% of their verified emissions, coal generators will also be allowed to borrow from their 2023 allowance budget to cover some of their current shortfalls. This essentially helps push some of the obligations into future cycles and gives coal generators more time to restore their strained cash flows. With coal prices already stabilizing at lower levels, Chinese policymakers hope that coal generators will be in a better financial position next year to absorb potentially larger increases in carbon costs.

China will continue to develop its ETS, both in terms of coverage and stringency, to keep pace with tightening climate policies at home and aboard. In addition to the power sector, China aims to extend the ETS to another seven energy-intensive industries, including aluminum, steel, cement, refining, petrochemicals, paper and pulp, and aviation, but has been delayed by COVID disruptions and short-term economic risks. However, the delay will not materially affect China's overall progress toward its carbon commitments, as China relies much more heavily on command-and-control measures to drive decarbonization activities, with the ETS playing a more complementary role.

Learn more about our Asia-Pacific energy research.

Xiaonan Feng, a senior research analyst in Greater China power and renewables research for the Gas, Power, and Climate Solutions team, primarily focuses on the Asia Pacific carbon market analysis, including carbon capture and storage outlook in the power sector, carbon trading, carbon emissions, carbon tax, and carbon- and climate change-related policies.

Posted on 10 April 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.