China’s new renewable consumption targets: An enabler to fulfill 2030 climate commitment

On 10 February 2021, National Energy Administration (NEA) released drafted renewable power consumption targets during 2021-30, following China's 2030 new Nationally Determined Commitments (NDCs) announced in December 2020.

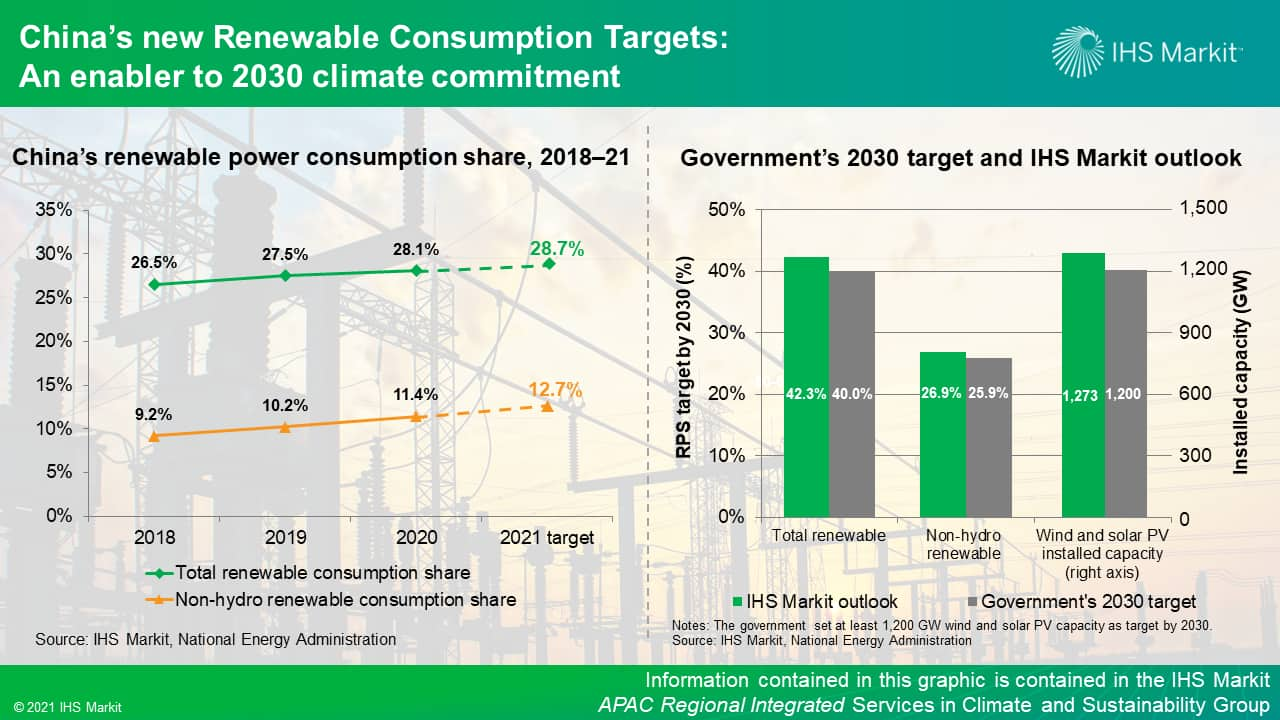

- Renewable power (including hydro power) consumption share in total power supply will reach 28.7% and 40% by 2021 and 2030, respectively.

- Non-hydro renewable power (mainly wind, solar PV and biomass) consumption share in total power supply will reach 12.7% and 25.9% by 2021 and 2030, respectively.

- Renewable power consumption share targets will increase from 2021 levels, which vary across provinces, to a uniform 40% by 2030 at a constant rate for each province.

The government launched the Renewable Portfolio Standard (RPS) mechanism in early 2018, setting mandatory renewable and non-hydro renewable consumption targets, or RPS targets, at provincial level.

2021 RPS targets are well achievable

China has maintained a good record in achieving provincial RPS targets during 2018-2020. On the one hand, the target setting represents merely incremental growth each year. On the other hand, rapid renewable power penetration enabled the target achievement for most provinces through local renewable consumption. In 2019, 70% of the provinces met the renewable consumption targets and 80% met the non-hydro renewable consumption targets, based on local consumption. For provinces that initially missed the targets with local renewable consumption, the gaps were limited and then largely filled by the renewable consumption volume trading.

By end-2020, wind, solar PV and biomass installed capacity reached 281 GW, 253 GW and 29.5 GW, growing by 25.3%, 19.0% and 22.6%, respectively. Wind and solar PV new additions reached 71 GW and 48 GW in 2020, despite the negative impact of COVID-19. In 2021, IHS Markit expects total renewables and non-hydro additions to be above 110 GW and 90 GW, respectively. The incremental pace in RPS target setting is also maintained in 2021. Therefore, we expect that the provinces will continue to achieve RPS targets in 2021 without encountering insurmountable challenges.

2030 RPS targets are also within reach

The 2030 RPS targets indicates that the renewable and non-hydro renewable consumption share will grow at 1.3% and 1.5% per year. Compared with the pace in 2021 share growth at 0.6% and 1.3% for renewable and non-hydro renewable consumption, 2030 targets represent fairly modest tightening.

In the latest IHS Markit outlook (issued before 2060 carbon neutrality pledge was announced), China will add above 90 GW of wind and solar PV capacity each year during the next decade. Installed capacity of wind and solar will exceeds 1,200 GW by 2030, well aligned with China's 2030 NDC, which is also the basis for the 2030 RPS target setting.

Increasing penetration of wind and solar PV will be accompanied by peaking coal-fired power generation at 2026-27, as well as the growth of hydro, nuclear and battery capacity. By 2030, IHS Markit expects the renewable and non-hydro renewable power consumption to take shares of 42.3% and 26.9%, respectively, compared with RPS targets of 40% and 25.9%.

RPS mechanism is the pivotal renewable policy in grid parity era

China's renewable policy has gone through a number of phases starting with a decade of direct subsidy to renewable auction from 2019, then grid parity from 2021. Shifting away from subsidy mechanism that focuses on capacity buildout, China relies on RPS to mandate renewable consumption, which is pivotal for China's energy transition strategy and climate commitment.

RPS mechanism will entail the optimization of renewable capacity additions and penetration process. The entities who are obliged to meet the RPS targets—including local governments, power generators, grid companies and power users—will have to work closely to fulfill the local targets. Along the collaboration process, we expect to see simplified project approval procedures, improved access to low-interest financing, more diversified tax benefits, and accelerated grid connection.

Moreover, RPS mechanism will facilitate the market-oriented power sector reform. In addition to direct trading of renewable consumption volume, Green Certificate (GC) purchasing is also recognized as an alternative solution for target fulfillment. The RPS-plus-GC mechanism will give rise to sustained demand for GC market and materially improve the liquidity.

For more information in power, renewables, and clean energy technology research in Asia Pacific, visit our service pages for our Asia Pacific Regional Integrated Energy and Global Power and Renewables Service.

Bing Han, senior research analyst at IHS Markit, works on Greater China power and renewables research and is a member of Asia's research and consulting team.

Lara Dong, senior director on the Climate and Sustainability team at IHS Markit, leads Greater China power and renewables research and is a member of Asia's research and consulting team.

Posted 23 February 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.