Commercial analysis of the Rencong-1X high impact well

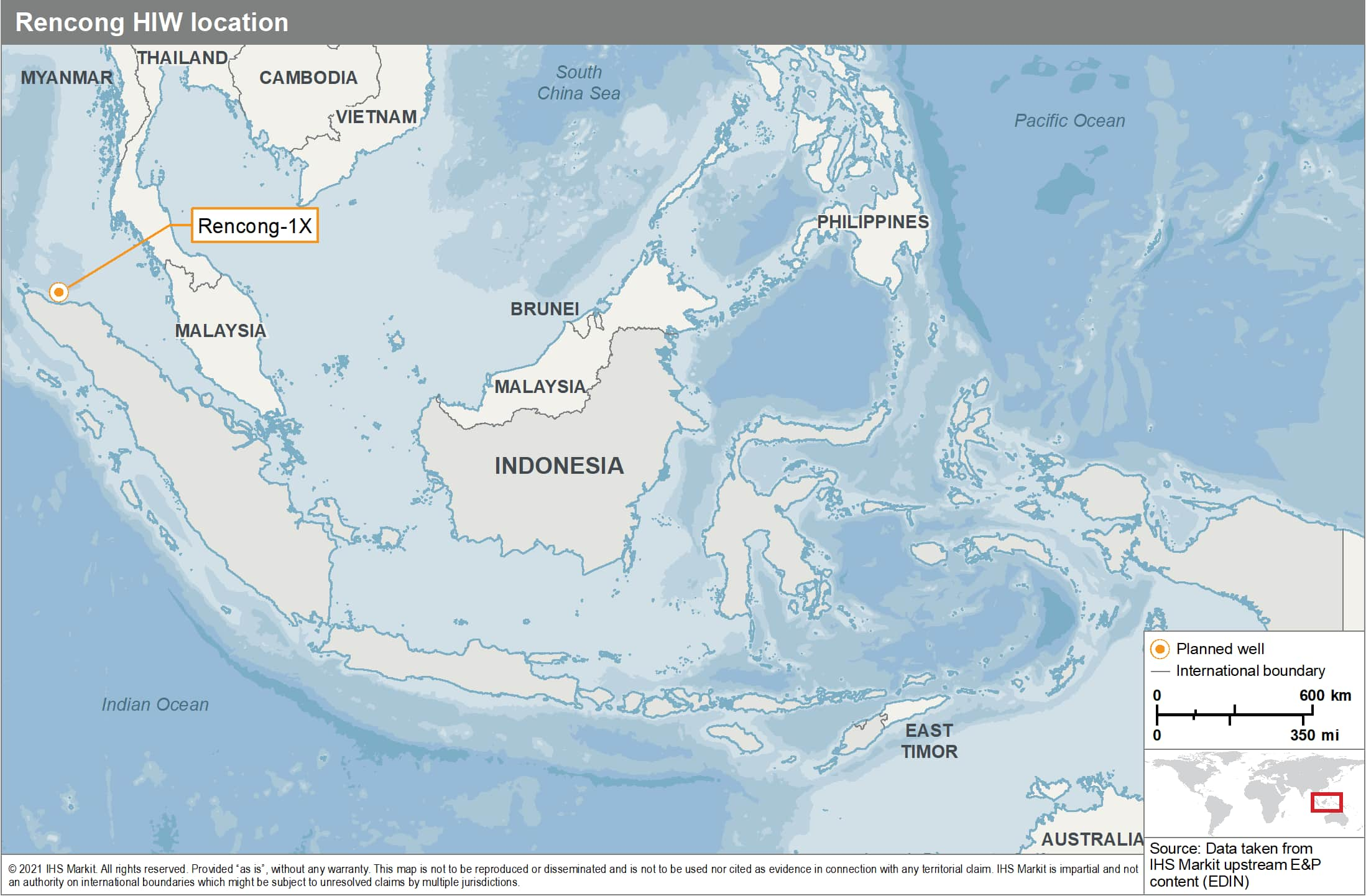

The Rencong-1X High Impact Well (HIW) is located in the Andaman III Contract Area, in the deepwater portion of the North Sumatra Basin, offshore Indonesia. Operated by Repsol, this exploration well is scheduled to be drilled in 2021 and targets prospective gas resources of 4 Tcf.

The well is located in a lightly explored and prospective area of the basin that continues to generate interest and is being keenly watched by regional players and global integrated oil companies (IOCs). The well has the potential to be a play opener and, if successful, could result in a number of further prospects being drilled in this region's deepwater areas.

In addition, this well will be critical for Indonesia, as the State has set ambitious domestic production targets to achieve by 2030. These targets cannot be met purely through the development of discovered undeveloped resources.

This blog post provides a summary of the full analysis that we have performed, which is available to subscribers of our GEPS and Plays & Basins services.

Well details

The planned Rencong-1X well is located 40-45 km from shore in waters about 1,100 m deep. The current timeline calls for the well to be drilled in the second half of 2021. The well has been delayed a number of times after an initial plan to drill the well in the second half of 2019. The well was first delayed due to issues securing a suitable rig, then the COVID-19 pandemic caused further delays.

Figure 1: Rencong HIW Location

There is limited existing oil and gas infrastructure in Aceh province, with the main facilities of relevance being related to the Arun gas field development and some subsequent smaller projects. There are two main options to commercialise the gas from a potential discovery at Rencong. The first would be to sell the gas into the domestic market through the existing pipeline infrastructure. The second would be to sell the gas as LNG, this would require that the Arun terminal be converted back to an LNG liquefaction and export terminal.

For our analysis, we have only considered the domestic gas option as the LNG export option would likely require additional gas reserves from future discoveries in the area.

Modelling methodology

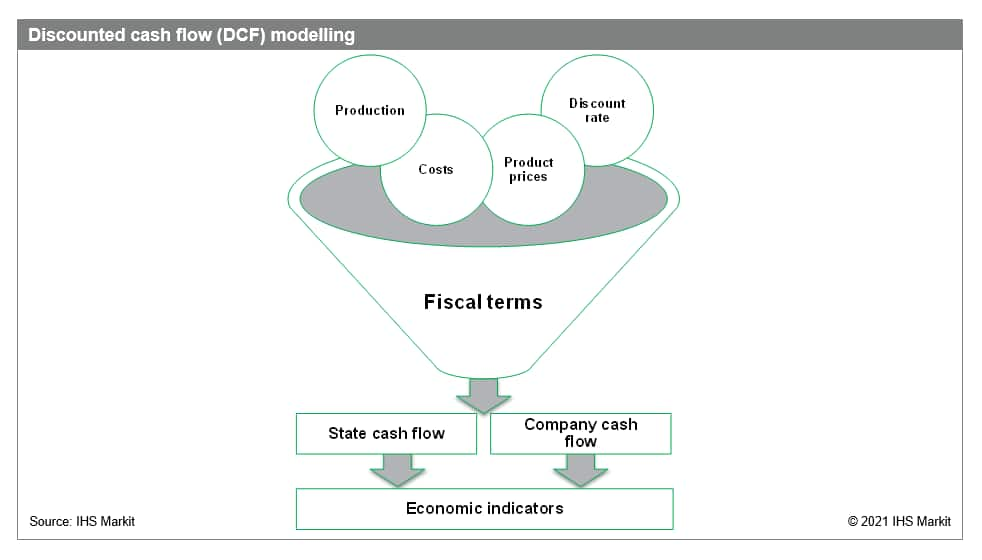

We have used discounted cash-flow (DCF) models as the basis of our valuations for a potential discovery at Rencong-1X.

DCF models use the projected future cash flows of project to determine the value of an investment, with a discount rate used to calculate the present value of these future cash flows. In the oil and gas industry, the fiscal terms that govern the contract provide the framework for calculating how the future cash flows are divided between the investor/company and the state.

Figure 2: Discounted cash flow (DCF) modelling

At IHS Markit, we have built up a global library of DCF-based valuations for discovered oil and gas resources and have a global team of analysts continually updating and improving these models. The models are published through our Vantage tool, allowing you to view our asset valuations and reports or perform bespoke analysis and analytics.

When undertaking our modelling for Vantage, we generally have a large amount of information, both from our proprietary databases and open data sources, on which to base the assumption for our models.

However, for Rencong, we are looking at an undrilled prospect, with little information on which to base our model. Therefore, we have used several assumptions for our model.

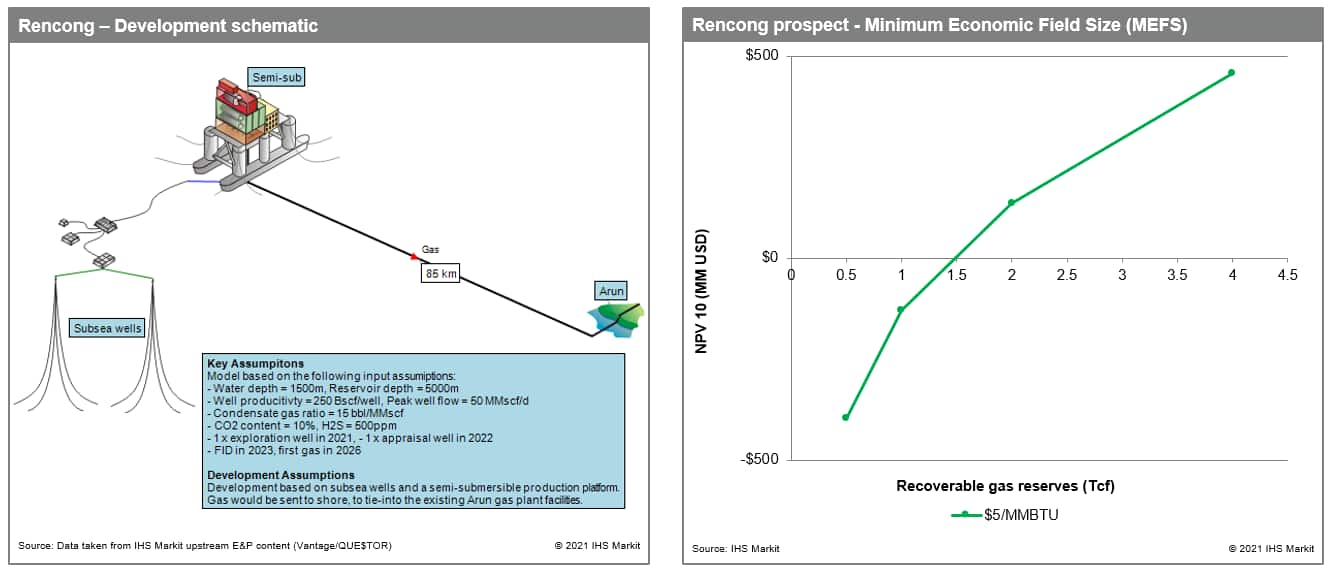

Rencong - Minimum economic field size

To allow us to calculate the minimum economic field size (MEFS) for a potential discovery, we have performed the DCF analysis for different reserve cases, these range from 0.5 Tcf to 4 Tcf of recoverable gas. The MEFS can then be defined as the reserve case that gives at net present value (NPV) of zero, for a given set of fiscal assumptions.

The below valuations are in nominal USD, with a 10% discount rate, and are provided as of 1 January 2021. For the product prices, we have assumed a real 2021 gas price of $5/MMBTU, with the oil price assumed to be $55/bbl, again real 2021.

Figure 3: Rencong - Development schematic And Minimum Economic Field Size

Under our modelling assumptions, the minimum economic field size for a discovery at Rencong-1X is about 1.5 Tcf.

The Rencong-1X well is being closely watched as it is a rare frontier exploration well in Indonesia. The potential of the Andaman area has long been discussed and a positive outcome at Rencong-1X could see a spur in activity in the Andaman area, as well as renewed interest and enthusiasm about investment in Indonesia. We are keeping our fingers crossed for a positive result.

Learn more about our asset valuation solution.

See the details of our upstream intelligence solutions including GEPs.

Learn about our coverage of global plays and basins.

Robert Chambers, Director at IHS Markit, is responsible for upstream asset evaluation and economic analysis in the Asia Pacific region.

Posted 24 February 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.