Company guidance for 2015 upstream spending by US E&Ps continues to fall

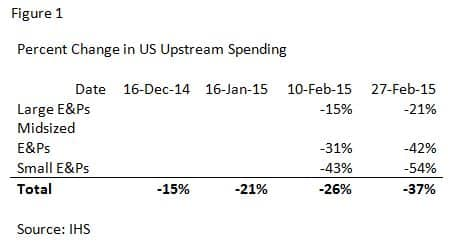

Capital spending plans from the 52 US E&P companies surveyed by IHS will, on average, decline by 37% for 2015. The 52 companies spent over $100 billion in 2014 on US upstream operations. This year's cuts equate to $38 billion in upstream spending reductions. At this point, with the vast majority of our company coverage list having reported 2015 guidance, a 35% to 40% reduction is a reasonable outlook. We note that the latest figure is substantially greater than the original 15% reduction we reported in mid-December 2014 and greater than the 26% average reduction from our early February spending update. Consequently, it would not be surprising if the spending continued to decline to a 40% reduction or more.

Many companies have now reduced 2015 spending guidance at least once, with some already reporting multiple reductions. As long as oil and gas prices still remain depressed, the potential for further spending cuts exists. In a normal year, companies would generally set the spending budget early in the year and not review it again until midyear. We think this year has already been an exception. Our feeling is that the 2015 guidance announcements have come out more slowly than in past years and, given the oil and gas price volatility over the budget planning time period, this made absolute sense. Given balance sheet concerns and continued price and cost volatility, we expect companies will be keeping a closer eye on capital budgets and balance sheets this year. This suggests that the final say on capital spending for this year has yet to be made.

Reduced spending resulting in anticipated service cost reductions

While no clear consensus has been reached on what oil prices will average this year, companies continue to report reduction in service costs. Currently companies that have discussed this trend typically mention service cost reductions already realized of 10% to 15% of the total well cost. Some operators have reported expecting service cost reductions as high as 25%. At this point, we believe that a 15% reduction in service costs this year is not an unreasonable expectation. Service cost reductions coupled with optimism about a more favorable oil price outlook for 2016 makes 2015 a year to endure.

Spending trend demonstrates value of Large E&P business model

The size effect that was noted in prior spending reports continues with cuts across the board in all peer groups. The breakdown of the most recent upstream spending guidance shows the large E&Ps spending around 20% less while the midsized competitors are reducing spending by twice that rate. The stronger balance sheets and generally higher rates of return on existing asset bases allow larger E&Ps to continue to spend at a higher relative rate. It wasn't long ago when the industry was questioning the value of the Large E&P business model, one characterized by a diversified asset base and slower growth rates for reserves and production. Industry observers may have found a renewed appreciation for this business model, which sacrifices some volume growth in favor of higher return on capital employed and a strong balance sheet. Given the relative balance sheet strength, it is the Large E&P peer group that has the opportunity to emerge from this part of the cycle stronger than before.

Andrew Byrne is Director, Energy Company & Transaction Research, IHS.

Posted 12 March 2015

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.