Cleantech component prices decline but do not immediately translate into lower renewable system CAPEX

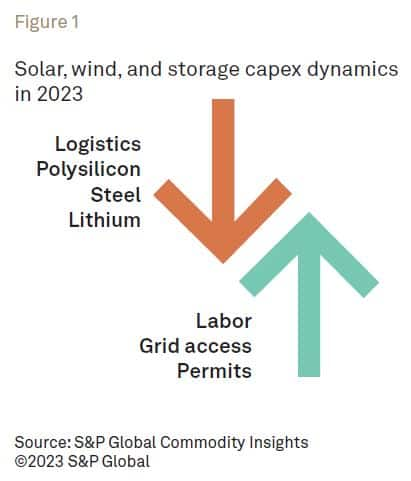

After two years of tight supply chain dynamics, raw material and shipping costs decline in 2023, which has a direct impact on solar, wind, and energy storage component prices. Global shipping costs are even back at pre-pandemic levels. These lower prices will, however, not translate immediately into overall lower capex for renewable power systems.

Land access and grid connections now prove to be the biggest bottleneck for the industry. This has the unintended consequence of driving up development costs as investors look to deploy capital quickly into markets where supply of available grid connections is insufficient and as investors are willing to pay for expediency in the form of large premiums for construction-ready projects. Equally, another major challenge for renewable power capex is the rising costs of construction labor. A shortage of skilled workers risks pushing these cost increases above inflation levels in the most active markets. Additionally, any improvements in capex risk being counterbalanced by the rising costs of capital. On top of these overall cost influencing factors, each technology has its own dynamics that will impact capex throughout the year.

Solar photovoltaics (PV)

In 2023, PV module prices return to the downward curve they were following prior to the pandemic, at a faster pace than anticipated. In the first weeks of 2023, polysilicon supply has already eased, and prices dropped sharply. This will trickle through to module prices, even if some of the drop will be offset by manufacturers seeking to recover margins.

Further down in the value chain, installers and distributors will also raise their margins where possible. Rooftop solar systems are therefore unlikely to become much cheaper for the end user, given the high demand. The utility-scale segment will reap the main benefit of lower module prices, and we project the demand for large PV systems to intensify globally, even more so in cost sensitive emerging markets.

Wind

Average selling prices of ordered turbines have risen continuously since the second half of 2021 as Western original equipment manufacturers (OEMs) gradually started passing supply chain cost inflation to customers to recover margins. With the installation of turbines typically lagging the order date by up to two years, capital costs of projects in western markets could start increasing from 2022 onward, through 2024.

Capital costs are expected to flatten and start decreasing thereafter, driven by an expected correction in turbine prices from 2023 onward. Factors, including a sharp reduction in freight and key raw material costs like steel and a growing threat from lower-cost Chinese OEMs, will contribute to this.

Energy storage

In 2023, energy storage prices decline modestly as lithium becomes more available. Already in the second half of 2022, prices for energy storage stabilized, following the 20-30% increase that had taken place over the previous 12 months. High demand keeps capex from falling significantly.

Fundamental drivers like rising energy costs and aggressive policy drivers make 2023 a record year for energy storage installations. To meet the demand expansions, competition heats up to secure supply of batteries across the energy storage supply chain. Companies across the space are increasingly able to enter long-term agreements, at larger scale than ever before. But these don't come without compromise. In many cases, supply has been agreed from factories that are yet to be built, and to out-compete automotive offtakers, prices are elevated.

To read more on trends expected to dominate clean energy technologies this year, download our whitepaper: 10 Cleantech Trends in 2023. If you are interested in finding out more information about the service that produced the research, visit our marketig page here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.