Consolidation nation: US retail fuel sector becoming increasingly top-heavy

Earlier this year, global convenience store giant 7-Eleven completed its acquisition of Marathon Petroleum's network of "Speedway" branded retail fuel stations. Even after complying with a government mandate to divest nearly 300 of the newly acquired sites, 7-Eleven's retail fuel network is now by far the largest in the United States. The company currently owns around 8,650 retail fuel sites, far more than second place Alimentation Couche-Tard (5,920).

The Speedway acquisition thus represents a relatively dramatic consolidation of the US retail fuel sector, combining as it did the country's second and third largest networks. But it was by no means unique; consolidation has become an omnipresent feature of the US retail fuel sector for the past several years. Indeed, the Speedway network that 7-Eleven just acquired is itself the result of a 2018 combination of Marathon Petroleum and Andeavor (the third and seventh largest retail chains at that time). And that Andeavor network, meanwhile, was the result of the combination just one year prior between the country's 12th and 16th largest retail chains.

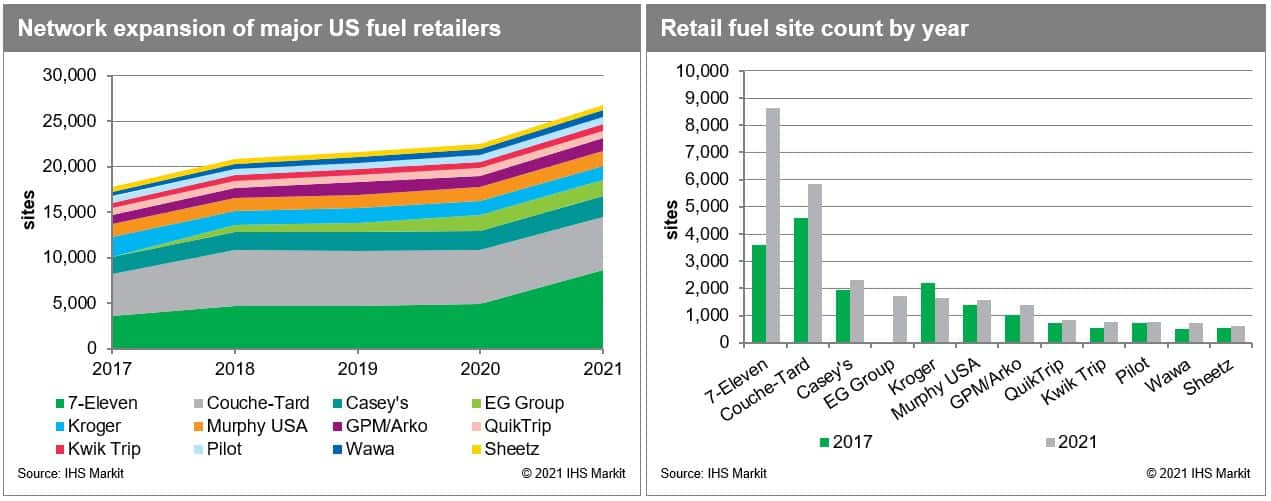

Thus, even as the overall US site count has declined by 4% since 2017, the number of service stations owned by the country's 12 largest retailers has increased by more than 50%. Much of this is fueled by 7-Eleven's meteoric rise, but four other retailers in that group have grown by at least 20% during this time, with another two expanding by more than 15%.

Less visible but equally significant is the accelerating pace of consolidation within the second and third tiers of the retail fuel sector. There are literally hundreds of retailers that own between 11 and 200 stations each—and hundreds more that own 10 or fewer locations. Such retail chains are almost always family-run businesses, which makes them highly vulnerable to acquisition if no one in the "next generation" is willing to take the reins when the older generation retires. Meanwhile, economies of scale—always useful in the notoriously low-margin retail sector—are only becoming more important as US fuel demand enters structural decline. As such, growth-oriented retailers with deep pockets have a plethora of opportunities.

Such companies include not only established operators like 7-Eleven or Couche-Tard, but also purpose-built retail acquisition vehicles—many of which are backed by the financial sector. For example, BW Gas & Convenience Holdings was formed in 2015 by global asset management company Brookwood Financial specifically to take advantage of the target-rich US fuel retail sector. It now ranks among the top 20 largest US retailers. Similarly, FR Refuel is a joint venture formed in 2019 between private equity giant First Reserve and a small South Carolina-based retailer. FR Refuel has already purchased seven different retail chains, each of which owned fewer than 50 sites.

Consolidation is all but certain to continue. There is no shortage of targets nor acquisition-minded retailers—particularly in the second and third tiers of the industry. The maturation of US fuel demand will also disproportionately pressure smaller chains and individual site operators, with the former category of retailers more vulnerable to acquisition and the latter category at greater risk of rationalization. In short, the big will continue to get bigger while the smallest must find a way to ride the Energy Transition wave—or be buried by it.

Visit us here for more Refining and Marketing insights.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.