Corporate renewable procurement announcements reach 30 GW in the first half of 2023

Key Points:

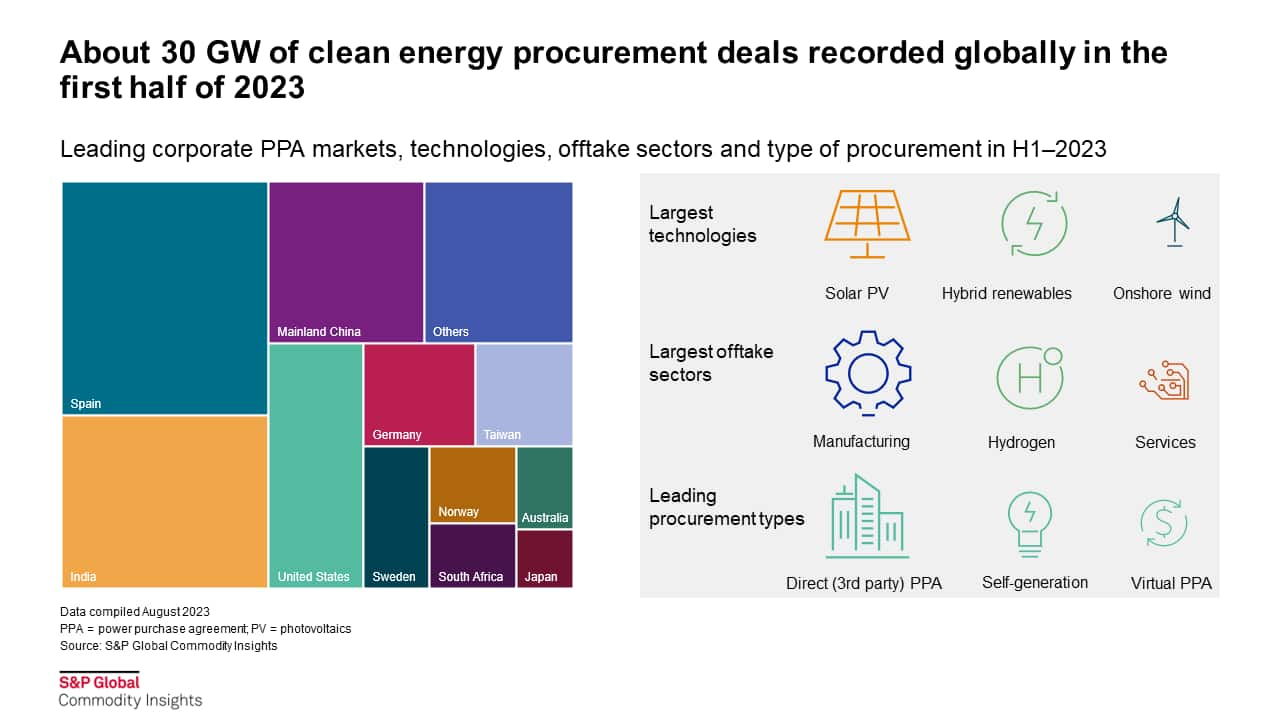

- More than a thousand clean energy procurement deals were recorded in the first half of 2023 across the globe.

- Europe emerged as the largest region announcing corporate procurement deals of 13 GW closely followed by Asia Pacific with 12 GW renewables procurement.

- Solar PV continues to be the preferred technology for corporates, followed by hybrid renewable projects in 2023.

Corporate renewable procurement announcements jump by 60% in the second quarter of 2023 in comparison with the previous quarter of the year. A total of 30 GW of renewables is contracted in 2023 across the globe, 18 GW of which was recorded in second quarter 2023. Spain, India, and mainland China are the top three markets constituting more than half of the total announcements during the first half of 2023.

Spain-based energy company Cepsa announced the largest corporate PPA deal of 2023 with procurement of 5 GW solar, wind and hybrid renewables through a third-party PPA with Ibereolica Renovables. The planned renewable projects will supply electricity for green hydrogen production by the company.

Third-party power purchase agreements (PPAs) are preferred in a 60% majority of the contracts in this period, followed by self-generation and virtual PPAs which constitute another quarter of the contracted capacity. Solar PV is the most preferred technology for clean energy procurement globally constituting about 38% of the total capacity contracted. Hybrid renewable capacity constitutes 30% of the volumes procured in the first half of 2023.

Manufacturing, hydrogen, and services sectors constituted more than three-quarters of all clean energy procurement deals. Manufacturing and materials sector companies lead procurement for renewables in largest Asia-Pacific markets, while services companies are the largest renewable offtakers in North America and Europe.

PPA prices in Europe trend toward a stabilization near the end of the first half of 2023 after increased volatility in power and commodity prices. Also, green electricity prices ease down in India owing to an improved supply situation in the summer months. Meanwhile, green power prices in mainland China trend about slightly higher with a premium of more than 15% over the base coal price.

Policy reforms in emerging markets are a key driver for adoption of corporate PPAs. While India has put the plan to introduce carbon trading in motion with the final carbon credit trading scheme released earlier this year, as well as providing incentives to procure renewables for green hydrogen production in the country.

Similarly, Japan also made strides towards its net-zero target for 2050 by bringing a green transformation bill in May 2023. The legislation will allow the Japanese government to secure funds by issuing energy transition bonds along with its carbon pricing scheme. Before introducing a carbon pricing mechanism, the government is planning to implement a carbon credit market from 2026-2027, after voluntary trading over 2023‒26.

While in several European markets, updated National Energy and Climate Plans (NECPs) were released in June 2023. These revised plans set forth more ambitious targets for renewable energy expansion.

You can learn more about our PPA pricing insights from our Clean Energy Procurement service.

Ankita Chauhan, associate director at S&P Global Commodity Insights, focuses on renewable energy research for South Asian markets.

Posted on 6 September 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.