Corporate US renewable procurement outlook: Optimism amid a pessimistic year

Procurement of solar and wind projects by corporations is on the rise globally. However, the United States continues to be the largest market for corporate driven renewable power purchase agreements (PPAs). IHS Markit's most recent estimate anticipates the corporate sector accounting for about 20% of utility scale renewable additions in the United States in the next decade (including direct PPAs, virtual PPAs, and green tariffs/sleeved PPAs).

Though the COVID-19 pandemic has delayed some construction plans, the growth in corporate contracting over prior years is expected to contribute to nearly 8 GW of wind and solar installations in 2020, an annual increase of over 45%.

Furthermore, despite COVID-19 impacting 2020 contracting, an increasing number of corporations are setting renewable targets and aiming to take advantage of tax credit availability in the short-term. There are about 220 companies operating in the US that are already procuring renewables or plan to do so and about 40% of these companies have targets that escalate through the early to mid-2020s.

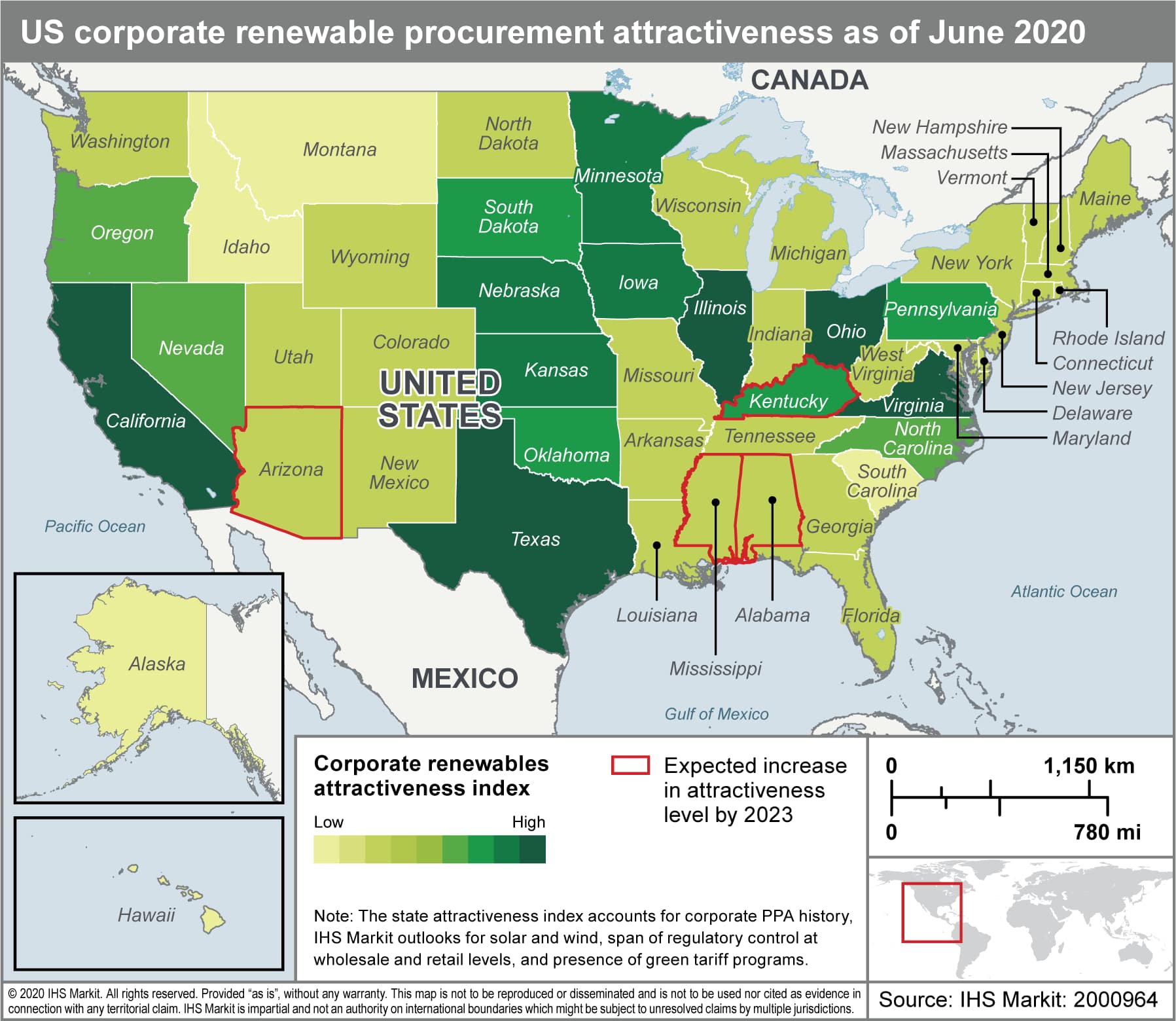

Activity to date has mostly occurred in states with organized wholesale power markets and retail choice, such as ERCOT.

Though unbundled power markets continue to see high growth, the increasing adoption of green tariff programs to meet corporate demand for renewable projects closer to load, will create new hot spots as well. Green-tariff programs typically have a megawatt cap on participation, but are frequently expanded after becoming fully subscribed, such as in Utah, Michigan, North Carolina, and Virginia.

Analysis of existing procurement trends, company targets, progress toward targets, power consumption patterns, potential entrants, state policies, solar and wind economics, and timelines for transitioning from contracting to installation provide insight into IHS Markit's recently released outlook for corporate procurement, which projects 44 GW of solar and wind additions from 2021 to 2030. The outlook reaches 72GW, in a case which has active companies escalating existing procurement strategies and a greater number of new corporations entering the segment.

To date, the technology sector has dominated corporate renewable procurement, but there is significant growth potential in sectors with high consumption patterns, ambitious targets, and low to moderate renewable procurement to date, such as manufacturing and telecommunication.

In addition to expanding sector participation, we expect to see a shift in technology as well. Incremental cost improvements, the rush to capture the ITC before its phaseout, and widespread resource availability enable solar to capture 65% of the total corporate renewable market in the next decade.

Learn more about our global power and renewables research.

Anna Shpitsberg is a director of global power and renewables at IHS Markit.

Thomas Maslin is an associate director on the Gas, Power, and Energy Futures team at IHS Markit, based in Washington DC, US.

Emma Xie He is a senior research analyst on the Gas, Power, and Energy Futures team at IHS Markit.

Josef Benzaoui is a research analyst with the Gas, Power, and Energy Futures team at IHS Markit.

Posted on 27 October 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.