BLOG

May 07, 2018

Cost Curve Scenarios from IHS Markit

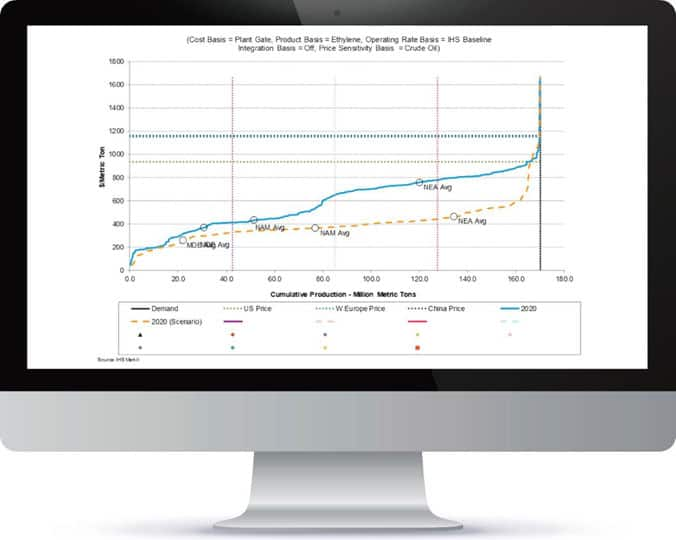

What would happen to the world cost curves for Ethylene and Polyethylene-HDPE if oil prices don't rise to the IHS Markit forecast?

World Cost Curve: Ethylene

- The Middle East average cost advantage vs. North America increases from $67 to $106, largely a consequence of cracker feed mix region to region, as directionally the United States is getting lighter as Middle East is getting heavier.

- At the same time, Northeast Asia becomes much more competitive in comparison to both North America and the Middle East.

- This should translate to more competitive Chinese and other North East Asian ethylene derivatives.

- This can be clearly seen for HDPE for integrated economics for those producers with ethylene production.

World Cost Curve: Polyethylene - HDPE

- The average NAM cost advantage for HDPE delivered to China compared to domestically produced Chinese HDPE is reduced by $162 per ton for the lower oil price scenario.

- The Middle East cost delivered cost advantage is reduced by about the same magnitude.

- IHS Markit Competitive Cost & Margin Analytics can help you assess the cost and margin positions of operating chemical plants according to geography, capacity, time, technology, feedstock, operating rate and integration level.

For more information visit us at Competitive Cost & Margin Analytics.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcost-curve-scenarios.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcost-curve-scenarios.html&text=Cost+Curve+Scenarios+from+S%26P+Global+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcost-curve-scenarios.html","enabled":true},{"name":"email","url":"?subject=Cost Curve Scenarios from S&P Global | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcost-curve-scenarios.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cost+Curve+Scenarios+from+S%26P+Global+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcost-curve-scenarios.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}