Day rates in Asia-Pacific on the up

Day rates continue to climb in APAC while demand in the region increases and supply tightens. Although this trend presently holds true for many other regions in the world, a 100% marketed utilization rate for drillships and jackups in Southeast Asia and 100% marketed utilization level for semis and jackups in Australia is now driving day rates up in APAC.

Globally, marketed supply is tightening for high-specification categories across all rig types. While regions like the Indian Ocean and SEA have benefited from using older/smaller and cheaper units, the demand for newer, premium units is on the rise and supply for such units is also running low.

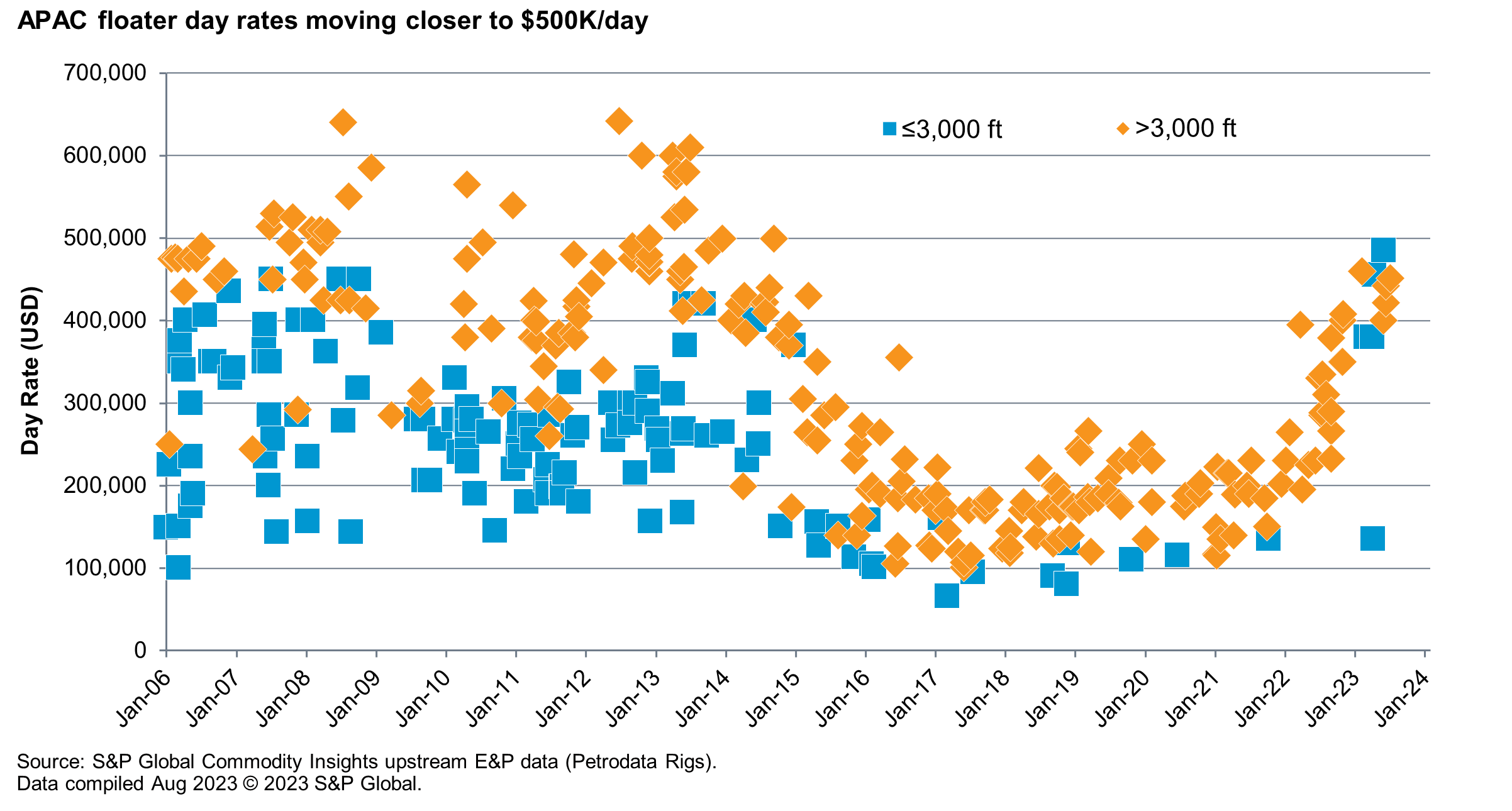

Day rates in APAC on the rise

Globally, day rates are approaching $500,000 per day for drillships and exceeding $400,000 for semis. Floater day rates in APAC have increased significantly over the last 12 months and are expected to continue to rise. In SEA, there are two hot drillships. One is contracted until August 2024 with one year of options unexercised, while the other is contracted until June 2025 with options until April 2026. The most recent charter fixed for drillships in SEA has seen a rate in excess of $440,000 and its options are expected to approach $500,00 per day. While the semi market is still relatively soft in SEA, Australia's semi day rates have jumped from the last reported $400,000 per day to $485,000 per day with two Transocean units mobilizing from NW Europe to Australia.

For jackups, global rates for units are clustered around the $130,000 -$140,000 mark with some units approaching $150,000 per day. The highest day rates for APAC are currently registered at $151,000 in SEA and $180,000 in Australia. Jackup day rates are expected to exceed $160,000 in SEA before the end of the year.

Demand expected to increase in SEA

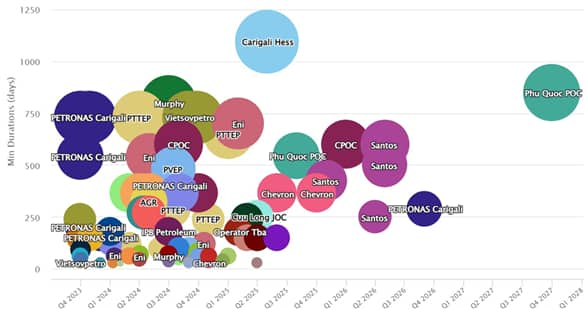

Demand is expected to increase, especially in SEA. Vietnam currently has 13 pre-tenders and tenders ongoing but most are short campaigns. Thailand currently has four ongoing tenders presenting campaigns of longer durations (one to two years with options). Thirteen units are currently contracted in the region with three possibly rolling off their current contracts after June 2024. In Malaysia, Petronas Carigali recently issued a market survey for a two-year jackup campaign and is understood to have enough work for three jackup and three tender-assist rigs in 2024. Demand in Indonesia is also rising however tenders have had to be cancelled or re-issued because of increasing day rates and a supply crunch in the region. For drillships and jackups especially low supply is slowing down the tender process. Due to a limited level of available supply, bidder numbers are limited. In a way, contractors can pick and choose which jobs they chase as they now have more leverage to strategize their participation and bid submissions.

Demand in Australia up but EP approvals stand in the way

While demand in Australia has picked up and returned to healthier levels since the last downturn and pandemic, environment plan approvals are keeping drilling activity low. Drilling at Barossa remains suspended pending approvals. While Santos sees potential for drilling to recommence before the end of 2023 if regulatory approval is given for the revised Environment Plan (EP), it is still pretty much a waiting game for NOPSEMA's final nod. Just this month, Woodside's planned seismic testing for its Scarborough gas project was temporarily blocked because of claims that it failed to consult traditional custodians, after approval was given by NOPSEMA in July. It is understood four vessels were on standby while the case was being heard and all activities will have to be put on hold until a further hearing in late September.

Contract durations are now longer

In addition to longer firm campaigns, option periods or the number of option wells tagged to contracts have also increased. One of the Transocean semis heading to Australia from Northwest Europe has 21 option wells for multiple operators. The two drillships in SEA each have options spanning 12 months. These options are either exercised for the operator's own use or novated/sublet to other operators in the same region. Some operators have also tendered for units to work in multiple campaigns in different countries, stringing work along within or outside the region.

Another common practice is to extend firm or option periods as operators add on new work/wells to existing charters. While recently, three- to 10-year extensions have been reported in the Middle East, in APAC, recent extensions have ranged from three to 12 months. Market sources indicate that Petronas Carigali is in the process of approving the further extension of semi Hakuryu-5, for which the operator has six outstanding option wells, which will keep the rig busy until third quarter 2024. Also, Valeura has reported its plans to utilize Borr Drilling's jackup Mist as fully as possible, including adjusting its program to accelerate the next phase of infill drilling offshore Thailand and keep the unit on contract until August 2024 with options after.

With utilization now at 100% for jackups, this is expected to last into early next year at the earliest as operators realise they need to act quickly to secure or keep choice units working. The first rig to roll off contract will be Murmanskaya in October 2023 and, according to market sources, discussions for follow-on work are already underway regarding the next few units rolling off contract before the end of the year. Only a handful of rigs could be available in the first half of 2024 and those rolling off contract are expected to be snapped up should they be released from their current commitments. Already, operators are working to put in place call-off contracts and carrying out direct negotiations to secure units possibly available in early 2024. With tight availability, rising day rates and longer charter durations, it would be most prudent for APAC operators to contract early.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.