Decarbonizing while growing: Energy transition in Southeast Asia’s power sector

View a full list of upcoming topics in our forthcoming Southeast Asia Energy Transition series.

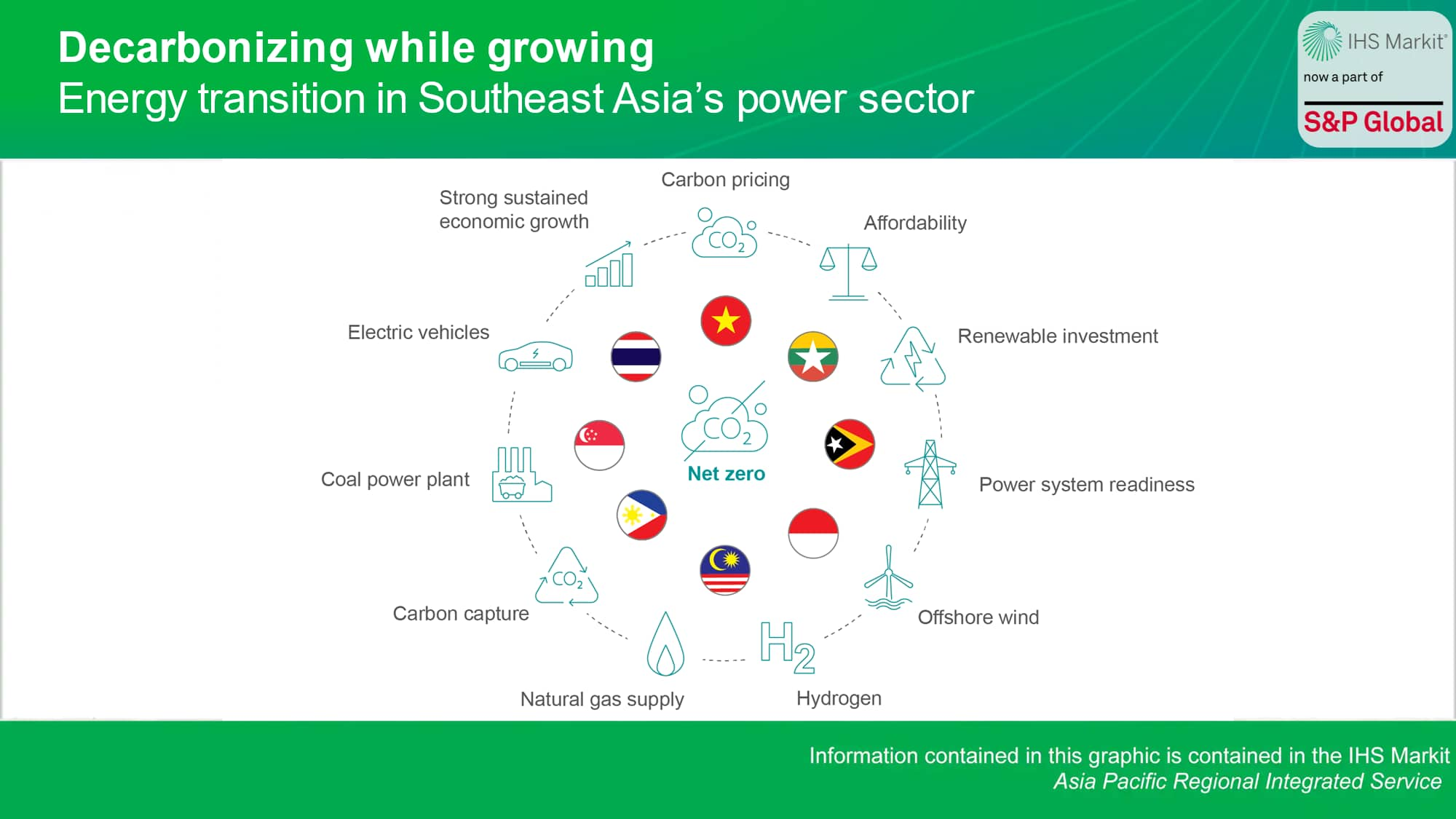

Southeast Asia's emerging economies have averaged 5% annual GDP growth over the past decade, while electric power demand outpaced the economy, growing at 5.7% per year on average. S&P Global Commodity Insights expects the region's economies to continue expanding at a similar pace through 2050, which is significantly higher than the global average growth of 2.5%. This means that the size of the region's economies will triple before 2050.

The associated industrialization, urbanization, and rise in living standards will all drive electric power demand growth in the decades ahead. By 2050, S&P Global Commodity Insights expects the region's power demand to triple from today's levels to 3,000 TWh. This incremental volume—2,000 TWh—is roughly equivalent to 80% of the European Union's power consumption today.

However, fossil fuel power plants are powering majority of the region's economies today, contributing to 75% of power supply. Coal accounts for 55% of total generation. As such, Southeast Asia will face an uphill challenge as it looks to decarbonize during a rapid growth period.

Energy transition is now an imperative

Like most countries in the world, Southeast Asia's economies have made their own nationally determined contributions commitments during UN climate conferences, most recently updated in 2021 during the Glasgow negotiations.

Accordingly, governments in the region have made effort to update their energy plans, aiming to promote renewable energy, slow down coal development, reduce operating coal capacity, as well as improve gas supply infrastructure and develop gas-fired power generation.

During the Glasgow climate conference in 2021, most Southeast Asian countries announced their new climate targets, with net-zero targets achieved between 2050 and 2065. The new targets are more aggressive than before and will require an accelerated energy transition to be achieved.

In our 2021 outlooks, the power sector in Southeast Asia is expected to reduce grid carbon intensity by 53% by 2050, with economy-wide emissions peaking in the late 2030s. By 2050, our outlooks indicate that total emissions will fall back to 2021 levels, but still not reaching net zero owing to the lack of policy and financial support.

Significant challenges ahead

Southeast Asia will face an uphill challenge as they embark on energy transition toward net zero, which will take place alongside continued strong economic growth as well as electrification.

The incremental power demand will be met partially by conventional fossil fuel generation, which raises the question on the fate of coal-fired power plants, adequacy of natural gas supply, and the prospects for emerging technologies, such as carbon capture and storage, hydrogen, and energy storage.

Renewables will need to meet an increasing share of the load growth. However, concerns remain on the power system's readiness to accommodate more intermittent generation sources and the ability to attract more investments into the sector.

Against this backdrop, governments will be faced with a balancing act, between energy transition and keeping power price affordable for consumers.

To help address the above and identify opportunities and risks for market participants, S&P Global Commodity Insights will be issuing a series of research in the coming months, with the aims of answering some of the thorniest questions on energy transition in the region and drilling deeper into each of the market we follow. We welcome you to join us in this journey and provide your feedback along the way.

Sign up to receive updates for this series.

Learn more about our Asia-Pacific energy research.

Xizhou Zhou is Vice President and Managing Director, Global Power and Renewables, S&P Global Commodity Insights.

Posted on 15 June 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.