Can the Eastern Mediterranean fully harness its deepwater gas potential?

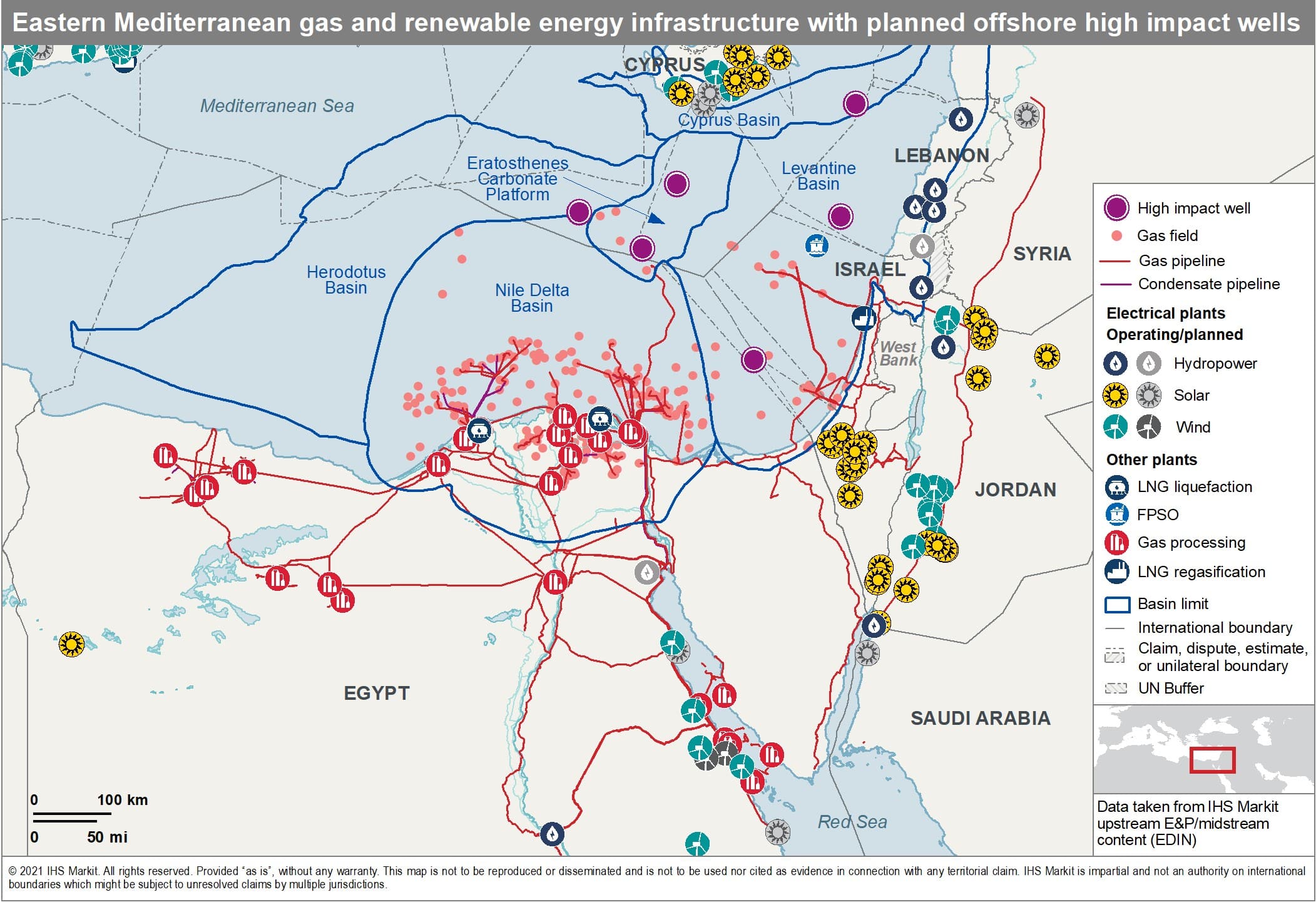

The Eastern Mediterranean region has proven remarkably resilient to broader upstream industry pressures of the energy transition and portfolio concentration - attracting significant interest from Global Integrated Oil Companies (GIOCs) in offshore exploration license awards - as well as new entry by smaller E&P players focused on onshore and shallow water areas. The region currently generates gas production of about 7.8 Bcf/d from total discovered recoverable resources of 144 Tcf, with significant upside exploration potential located offshore Egypt, Cyprus, and Israel.

The outlook for upstream growth in the region is promising, with the creation of the East Mediterranean Gas Forum (EMGF) by host states, the recovery in global gas markets, the transition within the region's energy sector toward cleaner power sources and the continued success of deepwater exploration efforts which have been set back by COVID-19 pressures, but which are expected to re-emerge in earnest in from 2022.

Regional gas balances are shifting

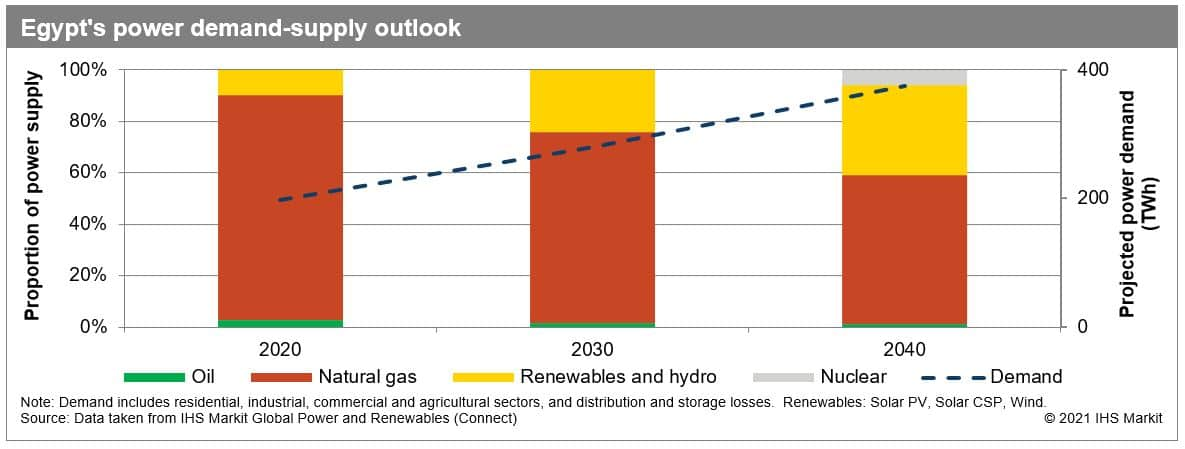

Egypt's gas balance is on a knife's edge though, as the long-term

production outlook for the Mature phase Nile Delta Basin assets is

one of decline. Power demand in Egypt has increased significantly

over the past decade thanks to a growing population, urbanisation

and an expanding economy; and despite major advances in renewable

energy with over 16 GW of projects in the pipeline, natural gas is

projected to remain the dominant fuel for power generation until at

least 2040.

Large gas discoveries within the Emerging phase Levantine Basin and Eratosthenes Carbonate Platform have proven to be pivotal for the region, and Israel, which was once dependent on Egypt for gas, now has gas surpluses to offer to both Egypt and Jordan. While 2021 has seen a significant market recovery for LNG exports, with increased spot prices allowing Egypt to restart its second LNG export facility at SEGAS in February 2021 and re-establish material volumes of exports during the year, reliability of production is becoming an issue and Egypt's LNG plants could once again risk potential shutdown, unless short-cycle supply and new resource additions are secured, whether from Egypt or from the wider region.

Major upstream investors see region's

potential

Despite steeper fiscal terms than neighboring littoral states,

Egypt has retained interest from majors such as Eni, BP and Shell

and attracted new exploration interest from majors such as Chevron,

TotalEnergies, and ExxonMobil, all of whom are keen to explore the

pre-salt clastic and carbonate plays of the Eastern Mediterranean

offshore basins. Many of the leading players have been reassured by

regional political collaboration to the extent of taking

cross-regional positions with a focus on exploration.

Regional dynamics could shift again on further

discoveries

Six high impact wells are planned in neighbouring basins within

Cypriot, Israeli and Lebanese waters within the next two years.

Competing forces such as conflicting national policies, boundary

disputes, differing corporate interests and an evolving landscape

of gas demand all have the potential to influence development

strategies and timelines. Even so, a significant new gas find could

be a game changer as littoral states explore mutually beneficial

commercialisation routes for Eastern Mediterranean offshore gas

resources beyond the current focus on regional demand and Egyptian

export facilities.

For more on the region's offshore gas opportunities and challenges, sign up to IHS Markit's 2021 Explore: Energy event, which will be hosting a deep dive into the Eastern Mediterranean offshore basins on 16th November.

References

For more information regarding commercial and strategic insights

into basins in Europe, the Middle East and Africa, please refer to

Plays and Basins

For more information regarding Middle East and North African

contractual, fiscal and above-ground risk, please refer to

PEPS

For more information regarding well, field and basin summaries and

midstream infrastructure, please refer to

EDIN

For more information regarding asset evaluation, portfolio view,

and production forecasts, please refer to

Vantage

For detailed E&P activity coverage and context by

country/territory, please refer to

GEPS

For more information regarding our power service, please refer to

Global Power and Renewables

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.