EMEA-focused independent peer group upstream capital expenditures and total production are expected to surge in 2023

(Note: This blog is an excerpt from a Companies and Transactions report published in March 2023, full report is available to subscribers.)

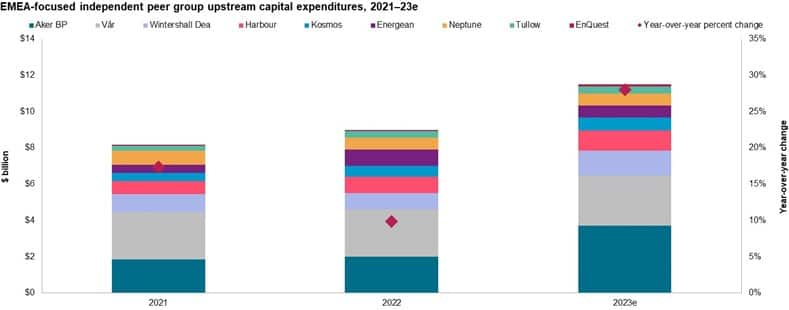

Capital expenditures for our group of nine Europe, Middle East and Africa-focused independents is expected to increase in 2023 by nearly 30% from 2022, which is nearly double and triple the year-over-year spending increases recognized by the companies collectively in 2021 and 2022.

Note: EnQuest = EnQuest PLC; Harbour = Harbour Energy PLC; Tullow = Tullow Oil PLC; Vår = Vår Energi AS. Capital expenditures exclude acquisitions, decommissioning and abandonment.The midpoint was used if a range was given for 2023 forecast spending. Wintershall Dea excludes Russia.

The financial impact of the UK Energy Profits Levy has led some UK-focused producers, such as Harbor, to reduce 2023 spending in the UK and seek diversification opportunities. Despite improved disclosures about emissions reduction initiatives and specifics of project advancements, decarbonization spending is not currently detailed or broken out by peers and is presumably included in company-reported upstream capital expenditures.

The forecasted escalation of spending in 2023 is being driven by a few companies investing in significant near- and medium-term production growth, mainly Aker BP and Wintershall Dea. For the group, total oil and natural gas production is estimated to increase 20% in 2023 from 2022, doubling the growth achieved from 2021 to 2022. Natural gas weighting of production is forecasted to remain around 40%, consistent with the previous two years.

Aker BP is forecasting an 85% increase in spending in 2023 as it enters a heavy investment cycle, with spending expected to be elevated through 2026 followed by a material reduction in 2027 as projects come online and the investment cycle concludes. Investments will support an exploration campaign targeting the discovery of 250 million boe by 2027 and nine development projects in Norway that will contribute to boosting production to 525,000 boe/d in 2028. In 2023, which will be the first full year of production acquired in the Lundin transaction, total oil and gas natural production is expected to increase more than 40%. Aker BP is forecasting production to dip in 2025 and again in 2026, followed by a ramp-up to target production in 2027 and 2028. Gas weighting of production is also expected to increase to nearly 25% in 2028, up from 17% in 2022.

Wintershall Dea is adjusting following its exit from Russia in response to the ongoing Russia and Ukraine conflict. The company plans to invest, through organic spending and acquisitions, to diversify and replace production to achieve an annual production target of 350,000-400,000 boe/d, equivalent to an 8% to 25% increase from 2022 production of 321,000 boe/d. Wintershall intends to maintain a gas-weighted production portfolio. In 2023, Wintershall expects to increase spending 55% from 2022, investing $1.4 billion in developments, including Ghasha in the United Arab Emirates, two operated and six nonoperated developments in Norway and the Fénix gas field in Argentina.

Energean PLC accounts for the only material spending reduction among the group expected in 2023. Energean plans to spend nearly 25% less in 2023 than in 2022. The decrease corresponds to the completion of four out of six key development initiatives in 2023, with the remaining two to be completed in 2024. These six developments are expected to drive gas-weighted total production to 200,000 boe/d; the geographic allocation is as follows: 70% Israel, 18% Egypt, 8% Italy and 4% other. Karish, Karish North and Tanin, the company's major natural gas fields offshore Israel, are the primary drivers of this forecast production growth. First gas from Karish was achieved in October 2022 while Karish North and other developments in Israel are expected to be completed by the end of 2023. In 2023, total oil and gas production is expected to more than triple with natural gas accounting for 75% of total production.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.