Europe is pressing on the green accelerator: What impact for power?

The greening of Europe's fuel mix will continue, driving prices lower when renewable availability is high. On the policy front, the discussion of Europe's Green Deal and 2050 climate target will dominate the coming years. Any agreement to boost the 2030 climate ambition will have a deep impact on the power market in the 2020s.

Europe's fuel mix is changing. Europe's energy transition is unfolding rapidly: coal capacity continues to fall and renewables additions remain strong. Low gas prices, supported by a moderate carbon price, will continue to pressure coal production across Europe. The drop of coal capacity has been very marked in the UK where coal capacity has fallen from an all-time high of 30 GW to 6 GW in 2020, an 80% decline. The drop is even more stark in terms of generation; this century coal generation peaked in 2006 at 150 TWh and generated just 7 TWh in 2019, marking a 95% decline. Recently Drax, once the UK's largest carbon emitter in power, announced that its remaining two coal-fired units will close in 2022—ahead of the phase-out deadline.

At the same time, renewable additions will continue at a sustained pace: solar capacity is expected to grow by 15 GW, onshore wind 10 GW and offshore wind 2.8 GW in 2020. IHS Markit expects that the Spanish and French markets will remain dynamic; but a question mark hangs over Germany's onshore wind prospects and more generally, local opposition is creating a challenging environment for onshore wind deployment.

Growing weather risk in the wholesale market. As renewable capacity increases, so does the impact of weather variation on wholesale prices: periods of high solar or wind production are increasingly pressuring daily prices. When demand is low, prices are turning negative. This was illustrated in 2019 when prices in German fell below zero during 211 hours up from 134 hours in 2018. For the first time in the UK, on one December day, the day ahead price was negative. February 2020 was unusually windy, as a result, the spot price for Germany averaged 21.9 €/MWh, half what it had cleared at in February 2019. Windy or sunny weather are now major drivers in the market, alongside commodity prices. As renewable penetration grows we expect it will result in a decorrelation of annual wholesale prices from the cost of producing power with thermal plants.

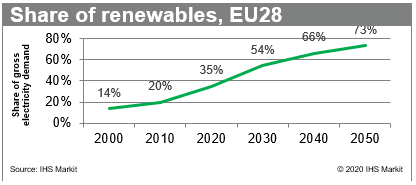

Figure 1: Share of renewables, EU28

Europe considering higher 2030 targets. In 2020 Europe aims to agree to achieve carbon neutrality in 2050. This bold target implies raising the current 2030 ambition. Currently, the EU aims to reduce emissions by 40% by 2030 compared with 1990. To reach a climate neutral target in 2050, a higher climate target will be required for 2030. The European Commission is due to assess the current path that Europe is on and make a proposal to increase the 2030 greenhouse gas (GHG) target in September 2020, followed by a proposal to align the GHG sub-targets: the carbon market, the emissions ambition outside of the carbon market, the renewable and the energy efficiency ambition in June 2021. The Commissions' proposals will need to be reviewed and approved by the heads of state and the European Parliament, a process known as Trilogue which can take several years.

While Europe is close to a consensus on a net zero carbon ambition for 2050, agreeing a bolder 2030 target is still far from given.

Coralie Laurencin is a senior director of Gas, Power,

and Energy Futures at IHS Markit.

Sylvain Cognet-Dauphin is a senior director of Gas, Power, and

Energy Futures at IHS Markit.

Posted 13 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.