Finding the right measure: Estimating the GHG emissions of crude oil

For more than a decade, IHS Markit has been estimating greenhouse gas (GHG) emissions associated with hydrocarbon extraction, refining, and ultimately end-use. Over this time, we've seen a growing depth and complexity of questions about GHG emissions associated with hydrocarbon production- to-use. Governments have advanced polices that make use of GHG intensity estimates in an attempt to reduce emissions over the crude oil value chain. Investors are also more interested in understanding the competitive implications of energy transition and the relative GHG competitiveness of key assets and hydrocarbon companies.

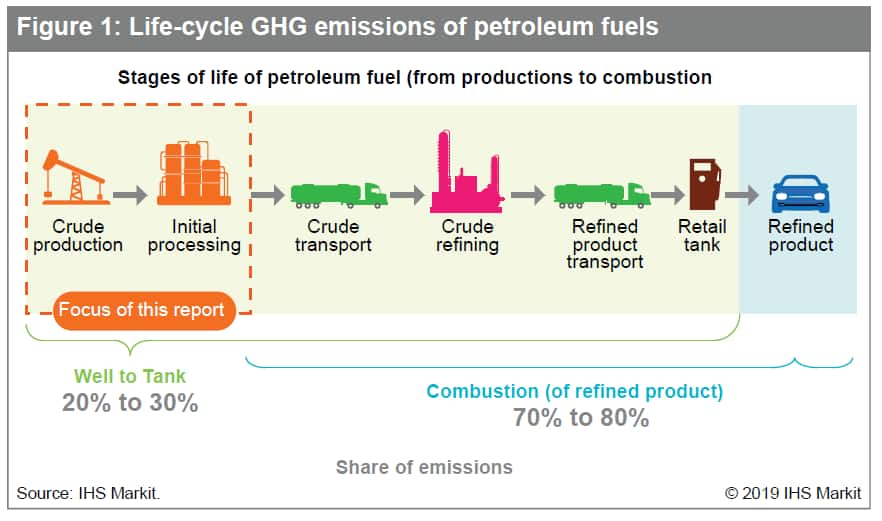

Yet understanding the competitive framework of the global oil and gas value chain is not enough. It is also important to understand how GHG emissions occur over each stage of the life of a crude oil from extraction to processing, retail, and ultimately combustion of refined products such as gasoline and jet fuel (see Figure 1).

Finding the right measure

Accessibility of GHG intensity estimates for select crude oils has increased over the past 10 years. Companies have increased disclosure, academia has produced more research, and various consultancies and non-governmental organizations are generating their own estimates. With this rising interest, the understanding of crude oil GHG emissions is improving. But much of the analysis is complex, requiring considerable technical understanding and assumptions. This can make it difficult to understand methodology differences between studies and estimates, leading to potential misinterpretation.

Not all life-cycle estimates measure the same thing. There are no set rules about what emissions to include or exclude. Some studies work from end-use transportation fuel up the value chain and account for all emissions that occurred to get to that fuel. Others consider all products created from a barrel of oil and account for the emissions associated with each product, regardless of where products are used.

The scope of emissions to include along the pathway can also differ, causing variance between estimates and confusion. Some methods draw a tight boundary around emissions and only include those that are a direct result of extraction, processing, and combustion. Others use a broader definition and account for other emissions that can be associated with the crude oil life cycle. For example, some analysis considers the upstream emissions of the fuels used in the extraction and processing (such as emissions associated with producing natural gas or diesel that is used to extract additional hydrocarbons). In turn, this requires an understanding of where those fuels are sourced and their own emissions pathway.

Some analysis includes all crude oil products that are combusted or have the potential to be combusted in the estimate of a crude oil pathway. Yet these estimates run the risk of unintended consequences or misinterpretation of efforts by industry to lower emissions.

Take the case of an oil production facility that consumes some associated gas for use in onsite power generation. Most life-cycle methods would include the combustion of those molecules for onsite energy use in the facility emissions (a direct onsite emission). But what if that facility installs solar panels to reduce its use of associated gas and lower its GHG emissions? In the method that attributes all emissions resulting from the barrel being produced, there would be no notable impact on the emissions intensity. There might even be an increase to account for any energy used in installation or maintenance of the solar panels. Other methods would argue the associated gas emissions should be allocated to the sector that consumes it. This sort of example has obvious implications as investors and governments seek to design portfolios and policies to reduce exposure to emission intensity sources.

Data is king… of uncertainties

Accounting for emissions at each stage can be complex and requires significant data. For example, extraction requires information on the type, quantity, and quality of fuels being used to produce the oil; the quality of oil and gas being produced; the extraction method used; its impact on land use; and any fugitive emissions, venting, or flaring that may occur. For downstream refining, factors such as the products being made from the crude oil, the complexity of the refinery expected to consume the crude oil, and the disposition of co-products and by-products can impact the analysis.

For many crude oils, public data may simply not exist, requiring researchers to make numerous assumptions. For these reasons, variability should be expected between estimates, and reliability is an issue. Although data availability is often discussed in research, there are seldom transparent metrics developed and published on the confidence or accuracy of emissions estimates.

Accounting for reliability

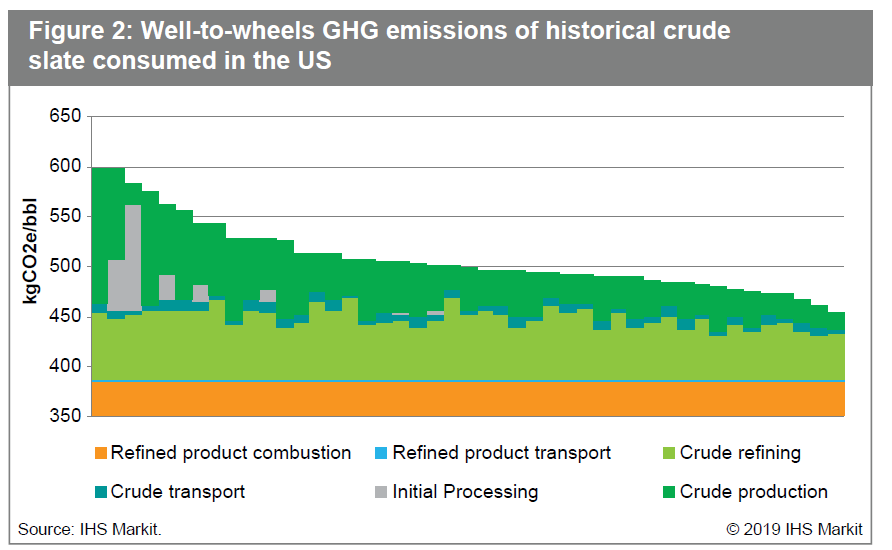

Variability and reliability are material to interpreting life-cycle GHG emissions estimates between crude oils. Because 70% to 80% of GHG emissions take place at combustion, the actual variability between estimates on a full life-cycle basis is relatively low (see Figure 2). In truth, the uncertainty that can occur between independent estimates of various crude oils can be larger than the differences indicated between different crude oils.

In IHS Markit analysis, the difference between the upper and lower range of GHG intensity of crude oil consumed or refined in the US ranges from 19% to -9%. In prior research, IHS Markit compared multiple studies and found that estimates of production emissions varied by an average of 30%. Depending on the crude oil analyzed, this level of error equates to between a 5% and 15% variance in the well-to-wheels life-cycle GHG emissions estimate.

IHS Markit GHG Accounting and Estimation

Life-cycle analysis can be a very powerful tool that improves the understanding of where and how emissions ccur and where the differences between crude oils exist. Interest from governments, financial institutions, and key stakeholders should be expected to drive more research in this space (including from IHS Markit) and pressure for additional oil and gas company disclosure.

However, life-cycle analysis is as much an art as a science. Assessments of the same crude oil between estimates can vary wildly due to different scopes of the emissions captured. The data requirements can be extensive and often numerous assumptions must be made. As a result, estimates can be uncertain.

Getting this right and understanding the limitations of life-cycle analysis of crude oil and natural gas is essential. Because of the complexity and integrated nature of the hydrocarbon system, the potential for distortion exists if the wrong measures are taken.

Crude oil is not homogenous, and it differs not only by emissions pathway, but also by refining intensity, availability, input cost, and value of the yield of the refined product. Even within a specific crude oil pathway, emissions can vary considerably. While it is common to see averages, such as "oil sands" or "North Sea," these may poorly represent the actual emissions of any one facility or pathway. A complete picture requires an understanding of not only emissions, but also how the value chain interacts chemically and economically to ultimately meet consumers' needs.

IHS Markit has launched an initiative to develop "The Right Measure." We will be partnering with industry and financial institutions to take stock of the current state of GHG life-cycle accounting and estimation. Then we will attempt to create consensus between key institutions on best practices and methods, while shedding light on measures we can put in place to increase transparency around estimate reliability.

We hope our initiative will help shape the future of life-cycle GHG accounting. Our learnings will be incorporated into a more sustained effort by IHS Markit to estimate the GHG emissions of hydrocarbon pathways, starting with crude oil and natural gas. Our objective is to blend our deep technical capabilities with our extensive data to help clients understand where emissions arise, how various crudes compare, and why and how energy transition may change the face of the global hydrocarbon industry.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.