Finland: Gas Supply Recalibration Moves Forward with Hamina LNG Terminal Launch

Key implications:

- The launch of the grid-connected Hamina LNG regasification terminal opens a second gas import route to supply grid-connected customers in Finland, where the market has relied solely upon the bidirectional Balticconnector gas pipeline since 21 May 2022.

- The Hamina LNG Terminal has a grid send-out capacity of 4,800 MWh/d, making it small-scale, but it is strategically located in Finland's largest port and could expand send-out capacity in future years. LNG supply capacity in Finland will be further bolstered by the launch of the larger Exemplar floating, storage, and regasification unit (FSRU) in late 2022/early 2023.

- Worries over supply, price, and climate impacts are not conducive to expanding Finland's natural gas consumption, which may decline sharply in 2022. Longer term, wind, nuclear capacity growth, and biogas investments may increasingly marginalize natural gas in Finland's future energy mix.

On 6 October 2022, it was announced that the Hamina LNG regasification terminal started commercial operations. The LNG terminal is the first in Finland to be connected to the gas transmission network, with other operating LNG terminals in Pori and Tornio geared toward serving large off-grid industrial consumers.

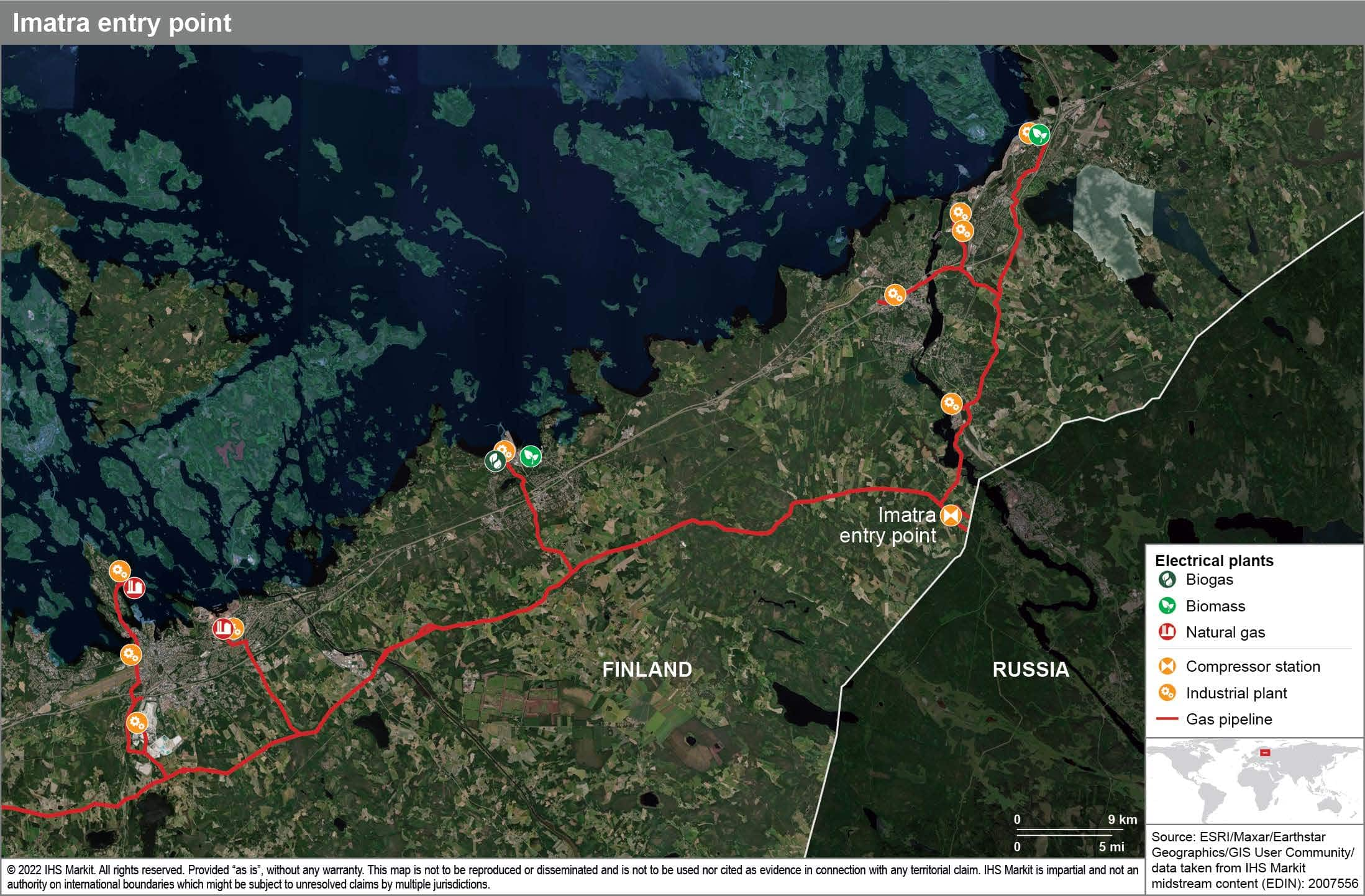

The launch of operations at Hamina is needed to increase Finland's gas supply. Finland has no domestic gas production and no underground gas storage. Gasum's supply from Gazprom Export was cut on 21 May 2022 as Gasum did not agree to Gazprom Export's new payment terms. Gas pipeline imports from Russia via the Imatra Entry Point in Eastern Finland were then halted. Figure 1 shows gas infrastructure around the Imatra Entry Point.

Since 21 May 2022, grid-connected customers have relied solely on imports via Estonia from the Balticconnector gas pipeline. The halting of gas supply between Gasum and Gazprom Export did not impact availability in Finland or the functioning of the gas market. The Balticconnector's capacity of 2.62 Bcm/y is slightly above Finland's average 2016‒20 gas consumption of 2.38 Bcm/y. Longer-term reliance upon a single bidirectional pipeline undoubtedly would have left Finland's gas market vulnerable to supply disruption, as gas via Balticconnector might not have been sufficient to cover peak winter demand requirements.

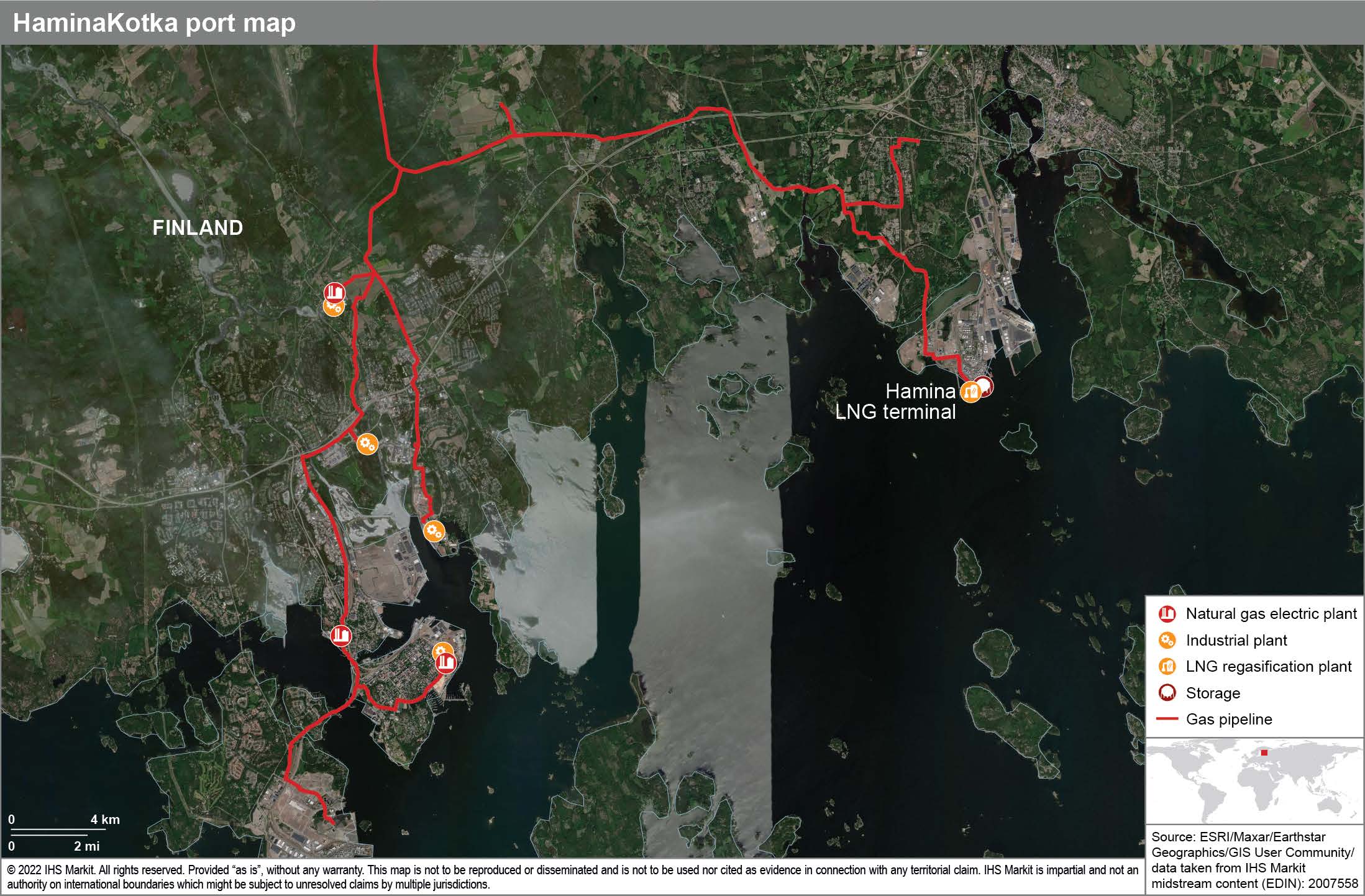

For Finland, the Hamina LNG Terminal launch is a welcome alternative gas supply source, particularly as it is operational before the onset of winter. While the terminal is relatively small-scale—with a regasification capacity into Finland's gas transmission grid of 4,800 MWh/d—it is strategically located in Finland's largest port of HaminaKotka, where there are a number of industrial and power sector consumers. Figure 2 from the IHS Markit Energy Infrastructure and Markets Database (Midstream Essentials)—which provides comprehensive coverage of oil and gas pipelines, terminals, and storage infrastructure—shows pipeline infrastructure and large gas consumers in the port.

The Hamina Terminal also offers bunkering services and has a truck loading capacity of 3,600 cubic meters per day, so it is capable of supplying off-grid consumers in the industrial and transportation sectors. The terminal was partially conceived to promote LNG, both as a clean fuel for the shipping sector and to supply off-grid inland customers as far away as Kainuu region. However, highly volatile European LNG prices—driven by surging European LNG demand and lower Russian pipeline gas imports—will challenge efforts to promote LNG as a clean fuel alternative for off-grid industrial or transportation consumers. During winter 2022/23, Hamina may primarily be used as a peak supply source for grid-connected consumers.

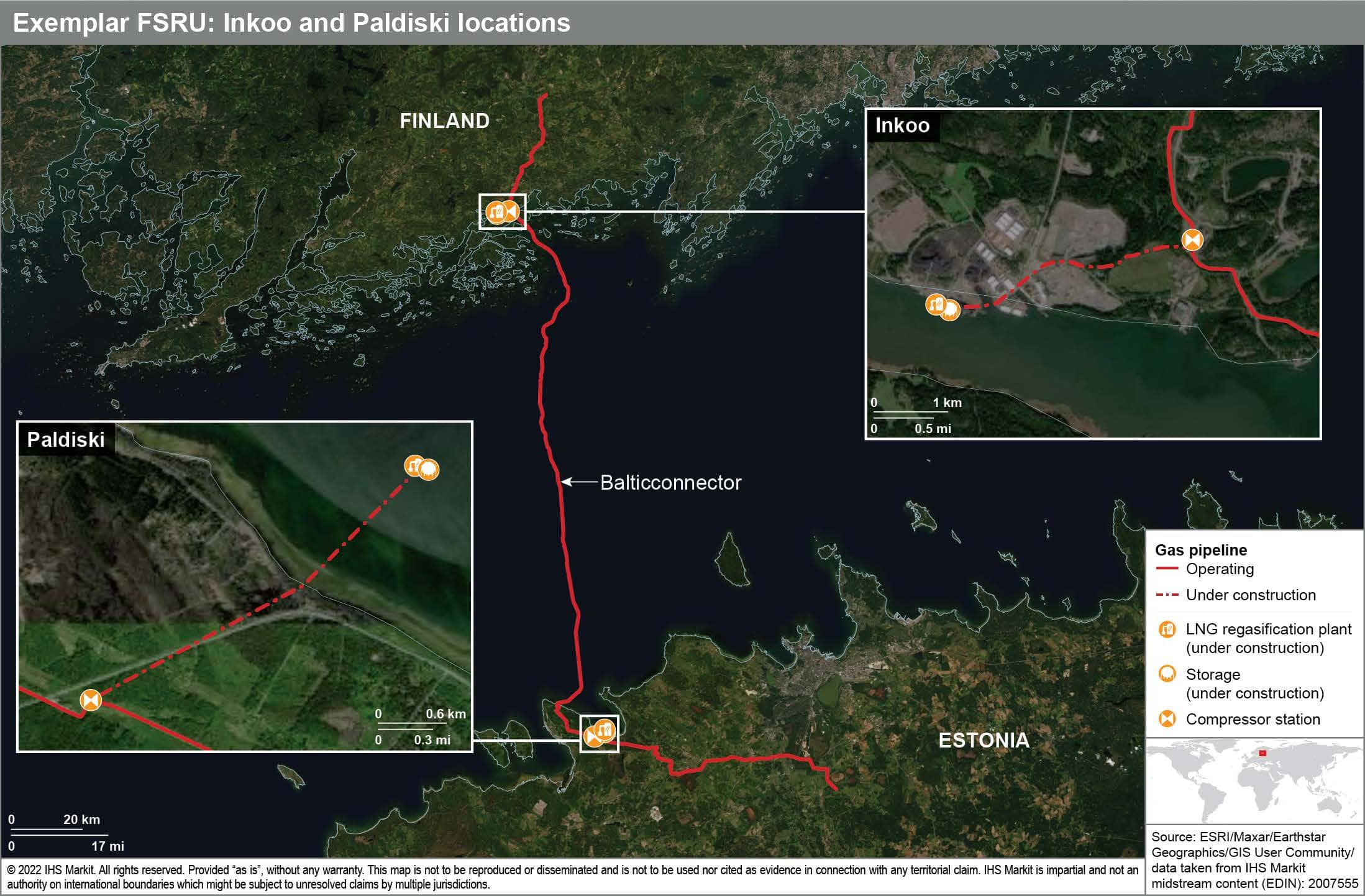

Finland's gas supply will be more significantly reinforced by the leasing of the Exemplar FSRU, a project recommended by Finland's Ministerial Committee on Economic Policy in April 2022 following Russia's 31 March decree that payments for contracted gas from states deemed "unfriendly" should be made in rubles. Driven by urgent supply security concerns, the Exemplar FSRU project has been fast tracked, demonstrated by the simultaneous development of two sites in Inkoo, Finland and near Paldiski, Estonia. On 10 October 2022, Finland's Ministry of Employment and the Economy stated that the FSRU would be located at Inkoo. Inkoo was selected as the location for the vessel as it is a deepwater port able to accommodate the Exemplar FSRU and supplier LNG tankers and is situated approximately 2 km from the Balticconnector gas pipeline—reducing the costs of linking into both the Finnish and Estonian gas grids. The Ministry of Employment and the Economy has stated that siting the vessel in Inkoo would more securely support gas-fired electricity production in Finland that could serve the common electricity market. The siting decision also reflects Finland's supply security interests and the leading investment role of Gasgrid Finland in the project. Nevertheless, infrastructure at Paldiski will continue to be developed to reduce project risks, allowing movement of the FSRU if necessary. Figure 3 shows the two locations that are being developed for the Exemplar FSRU.

The Exemplar FSRU is far larger than the Hamina Terminal with a regasification capacity of up to 5 Bcm/y, which considerably surpasses combined gas consumption in Finland and Estonia of 2.8 Bcm/y in 2020. When commissioned, the Exemplar FSRU will provide enough capacity to meet Finland's gas needs, although the current price environment will mean high supply costs. Record gas prices are likely eroding consumption in Finland, reducing the risk of supply shortages. IHS Markit estimates 2022 consumption at only 0.75 Bcm/y compared with a projected 2.3 Bcm/y in 2021.

The launch of the Hamina LNG Terminal is a milestone in the recalibration of Finland's gas supply. It has been stated that the Hamina LNG Terminal's send-out capacity could theoretically be doubled each year to reach 24 GWh/d, presumably by late 2026. The expansion of the Hamina LNG Terminal could aim to provide supply security to consumers in eastern Finland, who no longer receive pipeline gas from Gazprom Export.

Nevertheless, Finland's natural gas market is not on a long-term growth trajectory. Gas consumption has been in long-term decline over the past decade, and while Finland plans to abandon coal in power generation by 2029, the fuel is already marginal in the power mix; therefore, benefits for gas power plants will be limited. Furthermore, burgeoning wind capacity and the launch of the Olkiluoto 3 nuclear reactor—which reached its full net electrical power capacity of 1,600 MW during commissioning at the end of September 2022 could weigh on power sector gas consumption, which has historically been higher than in the industrial or residential sectors. Concerns over natural gas supply may lead Gasum to emphasize development of its biogas business as a long-term alternative to natural gas. Biogas relies more on domestic feedstock and is more insulated from international price volatility while supporting government decarbonization policy. Worries over price, supply, and climate impacts may mean that the challenges faced by Finland's natural gas sector in 2022 simply accelerate the long-term marginalization of natural gas in Finland's energy mix.

You may also contact one of our specialists for a free

product demonstration.

Karl Lindstrom: karl.lindstrom@spglobal.com

Julien Zigliani: julien.zigliani@spglobal.com

Tom Grieder: thomas.grieder@spglobal.com

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.