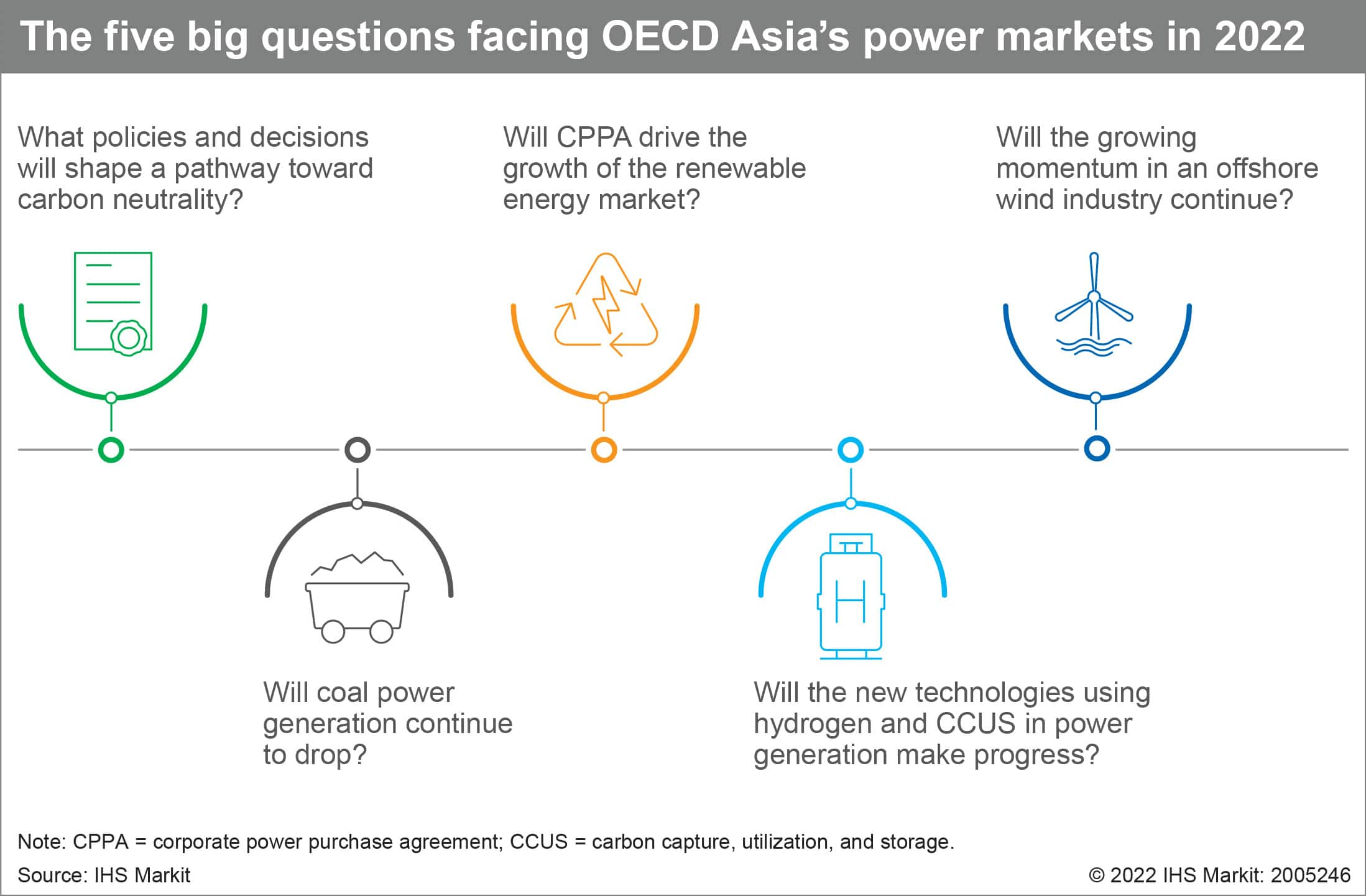

Five big questions facing OECD Asia’s power market in 2022

As 2022 begins, we look at five big questions facing the power markets in OECD Asia: Australia, Japan, and South Korea. We expect these questions spanning across policy, market, and technology development will shape the discussions around the power market in the region. IHS Markit Asia Pacific Power and Renewables team will closely monitor how the power market will evolve on the selected topics.

What policies and implementation plans will shape a pathway toward carbon neutrality?

Australia, Japan, and South Korea all have a significant reliance on fossil fuels, with coal and natural gas making up more than two-thirds of the electricity supply. The governments in these markets all pledged to become carbon neutral by 2050, posing enormous challenges in transforming their energy system over the next 30 years. The pathway toward carbon neutrality is largely unknown yet, as policymakers and industry players are just beginning to contemplate various low-carbon fuels and carbon abatement technologies to deliver their climate target. The follow-up measures to be announced in the next 2-3 years will be critical in building and locking new energy infrastructure across the value chain for the next 30 years given its long lifespan.

In OECD Asia, we may witness a few signposts this year, signaling which fuels and technologies may have the potential to decarbonize the economy toward 2050.

Will coal power generation continue to drop in 2022?

With coal remaining one of the largest electricity sources, Australia, Japan, and South Korea all expect the large share of emission cuts to come from reducing coal power, as envisaged in their emissions targets.[1][2][3] In fact, these markets were already on a path to phase out coal power, even before their governments vowed to become carbon neutral by 2050.[4] Coal generation peaked well before 2020 and had already been on a declining trajectory, until the economic recovery and extreme weather conditions put a brake on the downward trend in electricity demand last year.

Whether coal generation will continue to drop in 2022 may signal if the region is on track to meet the governments' climate target.

Will CPPA drive the growth of the renewable energy market?

CPPA has gained momentum among many companies in Asia Pacific, as the suppliers face increasing pressure from their global customers to become green in sourcing electricity. The member of RE100, a global initiative with an aim to promote 100% renewable energy sourcing, soared to 315 in 2021 from 155 in 2018. Australia, Japan, and South Korea make up a quarter of total RE100 signatories in 2021, thanks to supportive policy environment and the growing interests among companies for going green. CPPA has become an economically attractive procurement option for electricity buyers, as the cost of solar PV and wind power declines at rapid pace. The minimal operating costs also make them an effective hedging instrument for electricity sourcing in a high and volatile commodity price environment.

Despite all these factors that would spur the growth of CPPA, the share of renewable energy in total electricity consumption has remained low—the RE100 members of three markets in OECD Asia reported that the share of renewable electricity was less than a quarter in 2021, mainly owing to regulatory hurdles and limited economic incentives to induce direct renewable energy sourcing. We may witness the easing of some of these constraints in 2022.

Will the growing momentum in the offshore wind industry continue in 2022?

Offshore wind in Asia Pacific has attracted many international developers and investors, as the governments announced various new policies to support this nascent sector. Policymakers have put in place ambitious installation targets as they expect the offshore wind to play a pivotal role in delivering the climate ambition: Japan aims to install 45 GW by 2040, South Korea plans to raise its current 2030 target of installing 12 GW, and Australia passed new legislation in 2021 that will pave the way for the development of an offshore wind industry. With the current policy environment aimed at making offshore wind project development easier at a lower cost, we may witness the first financial close on commercial-scale offshore wind projects in some markets this year.

Will the new technologies of using hydrogen and CCUS in power generation make progress?

Hydrogen and CCUS have been emerging as the most preferred low-carbon technologies by some governments owing to their multiple benefits, which solar PV and wind power could not provide. Hydrogen and CCUS offer low-carbon, reliable source of energy with a potential to alleviate concerns on the grid reliability, when the penetration of intermittent renewable energy rises. Both could harness some of the existing labor and infrastructure in coal and gas industries, helping to protect domestic jobs and economies during the energy transition. Some governments are moving ahead to reap these benefits by setting a new target on deploying new technologies—Japan plans to generate 1% of its power from hydrogen and ammonia by 2030, while South Korea envisages CCUS to capture 34-36% of the national gross emissions in 2050.

In 2022, new pilot projects are likely to be announced across the value chain apart from the power generation sector—including import/export terminals, shipping, distribution, storage, conversion, and application—given the majority will likely be imported from other markets where hydrogen and ammonia could be produced at a lower cost.

Learn more about our Asia Pacific energy research.

Vince Heo (Yoonjae Heo) is an associate director at IHS Markit, managing the Climate and Sustainability team in Seoul.

Logan Reese, is an associate director on the Asia Pacific Regional Integrated team at IHS Markit, focusing on Australia power and gas markets.

Kaori Tachibana is an associate director on the Climate and Sustainability team at IHS Markit and is based in Japan.

Posted 9 February 2022

[1] IHS Markit Insight: Australia announces a 2050 net-zero emissions target

[2] IHS Markit Insight: Japan's 6th Strategic Energy Plan aims to raise non-hydrocarbon energy source to 59% by 2030

[3] IHS Markit Insight: South Korea raises 2030 climate ambitions ahead of the UN climate conference

[4] IHS Markit Insight: How will power markets evolve in Australia, Japan, and South Korea amid the phase-out of coal?

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.