Flaring in Russia's oil and gas sector: A decade in review

Flaring, the controlled burning of natural gas for safety or when it is unprofitable for sale or use, has significant environmental and economic impacts. Understanding its scale is crucial for mitigating associated greenhouse gas emissions. This report examines flaring in Russia from 2012 to 2022, comparing satellite observations with official statistics reported to the United Nations Framework Convention on Climate Change (UNFCCC).

Flaring trends in Russia

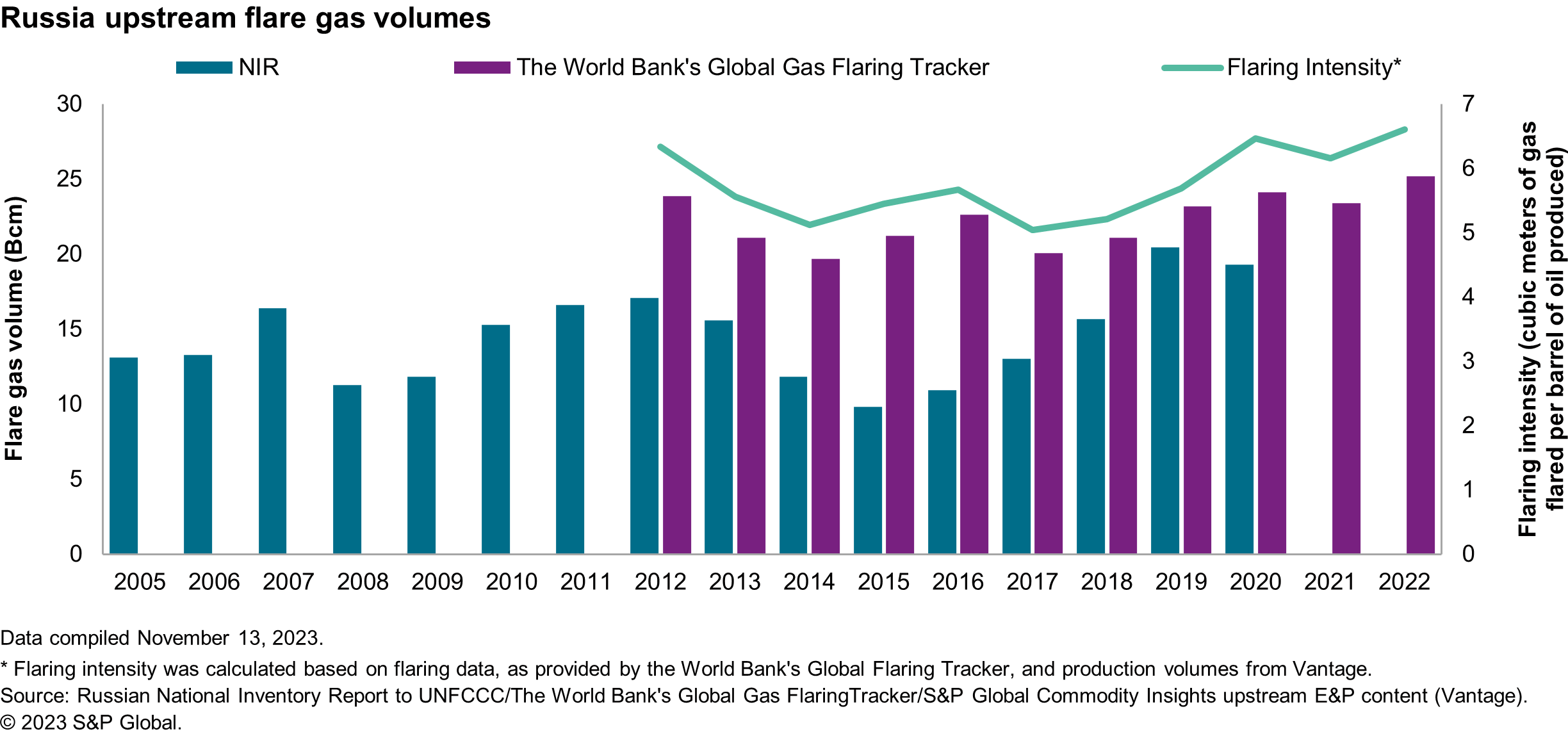

Russia is the absolute leader in global flaring volumes but ranks outside the top 10 in flaring intensity. S&P Global Commodity Insight's analysis has revealed that despite differences in absolute flaring volumes, there is a common trend between satellite flaring data provided by The World Bank's Global Flaring Tracker for the years 2012-2022 and the data reported in Russia's National Inventory Report (NIR) to the UNFCCC. Overall, data from all sources reveals a trend of increasing flaring volumes and intensity from 2017. This growth may be attributed to increased production in provinces with underdeveloped oil and gas infrastructure, particularly in Eastern Siberia and the Far East.

Factors influencing flaring

1. Shift of production to the regions with underdeveloped infrastructure

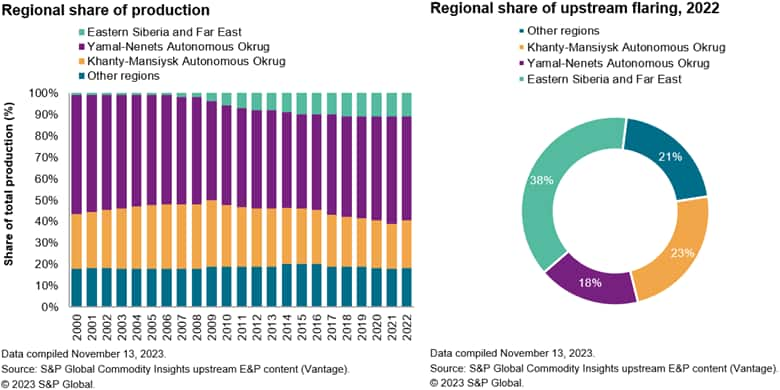

Most flaring volumes stem from Russia's primary oil and gas provinces — Khanty-Mansiysk and Yamal-Nenets Autonomous Okrug. These regions accounted for 70% of Russia's hydrocarbon production and 41% of all flaring volumes in 2022. Eastern Siberia and the Far East[1] represented 38% of flaring volumes despite contributing 11% of the total production.

According to Russia's Mineral Resources Development Strategy, there is a focus on exploring and developing hydrocarbon resources in the eastern part of the country. Notably, the Krasnoyarsk Territory and the Republic of Sakha (Yakutia) are among the leading regions for conducting geological exploration alongside the Yamal-Nenets and Khanty-Mansi Autonomous Okrug.

According to our analysis, the production share of Eastern Siberia and the Far East will continually increase and reach 20% by 2040. Therefore, we can expect that the rising trend in flaring in Russia will continue until sufficient for viable exporting or utilizing the associated petroleum gas (APG) options appear.

2. Predominant share of oil projects in the developing producing regions

Our analysis of industry practices shows a decreasing trend in flaring volumes as operations stabilize, although this varies by region and infrastructure availability. In the Commonwealth of Independent States (CIS), oil projects show a slower flaring reduction than gas projects due to the nature of oil production, where APG is often flared in the absence of infrastructure. Specifically, oil projects in the CIS see a 30% reduction in flaring per production unit in their second year, versus a 93% reduction in gas projects[2].

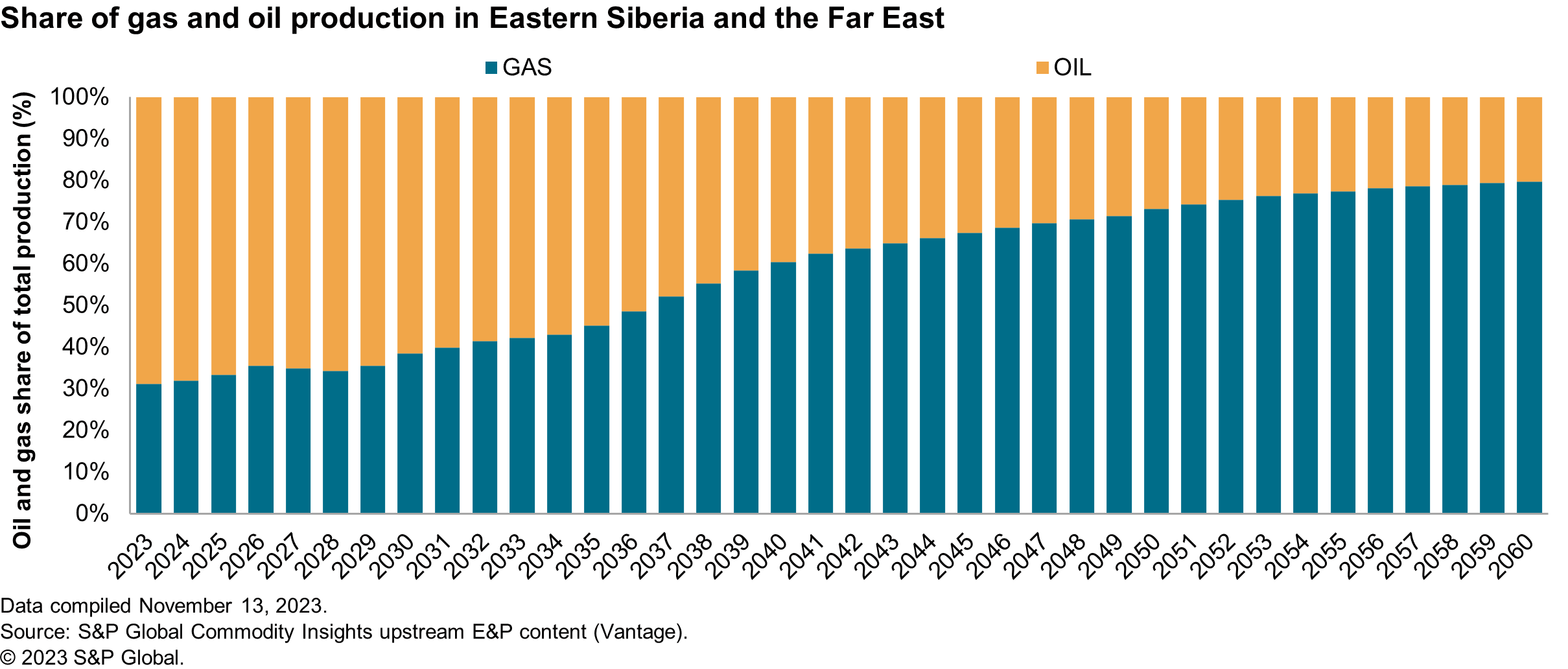

In 2022, oil production in Eastern Siberia and the Far East accounted for 73% of total regional output, leading to higher initial flaring volumes. However, projections indicate a rise in gas production in these regions by 2040, likely enhancing APG utilization from oil fields.

Legislation and economic implications

In the case of commercialization in the domestic market, the sale of 23.35 Bcm of natural gas could have generated revenue amounting to almost $1.47 billion in 2022[3]. Despite the implementation of legislative restrictions aimed at reducing APG flaring, their effect appears to be limited. Notably, the Russian government's decree of January 8, 2009 (No. 7), established a target to curtail the flaring of APG to no more than 5% of the total extracted volume, including penalties for surpassing this limit. However, the situation in 2022 revealed a minimal improvement in flaring intensity compared to a decade earlier (6.61 cubic meters of gas flared per barrel of oil produced in 2022 versus 6.34 in 2012). This ongoing challenge underscores the difficulties operators encounter in finding viable solutions for gas commercialization or utilization despite its potential for revenue generation and penalties for combustion.

Conclusion

S&P Global Commodity Insight's satellite data analysis from 2012 to 2022 highlights persistent challenges in reducing flaring volumes in Russia, despite legislative efforts and potential revenue losses. Both the satellite flaring data provided by The World Bank's Global Flaring Tracker and the volumes reported in Russia's NIR to the UNFCCC showed a similar trend between 2012 and 2020, with the reported data exhibiting higher fluctuations.

The recent trend for rising flaring volumes can be attributed to a shift in exploration and production focus towards Eastern Siberia and the Far East — regions with less developed infrastructure and a predominance of oil production. Both these factors are causing issues with APG selling and utilization. As production volumes in these regions are projected to grow, we foresee their main potential being tied to the development of gas fields. This trend, in the long term, is expected to significantly contribute to a reduction in flaring, aligning with global environmental goals.

[1] In this report we analyzed the following territories within Eastern Siberia and the Far East: Chukotka Autonomous Okrug, Irkutsk region, Kamchatka territory, Krasnoyarsk territory, Republic of Sakha (Yakutia), Sakhalin region, Sea of Okhotsk.<span/>

[2] Flaring in gas fields may happen for reasons like safety, equipment testing, or in cases where infrastructure is temporarily unable to handle the natural gas volumes.<span/>

[3] Vantage fiscal model Russian domestic gas price is $1.78/Mcf.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.