From mild to wild: Coronavirus impact on China’s power and renewables sector

The novel coronavirus (COVID-19) outbreak has led to a slowdown of economic activities in China. This, in turn, is expected to affect the country's power and renewables sector - on both electricity demand as well as the different technologies that generate the power for the world's largest electricity market.

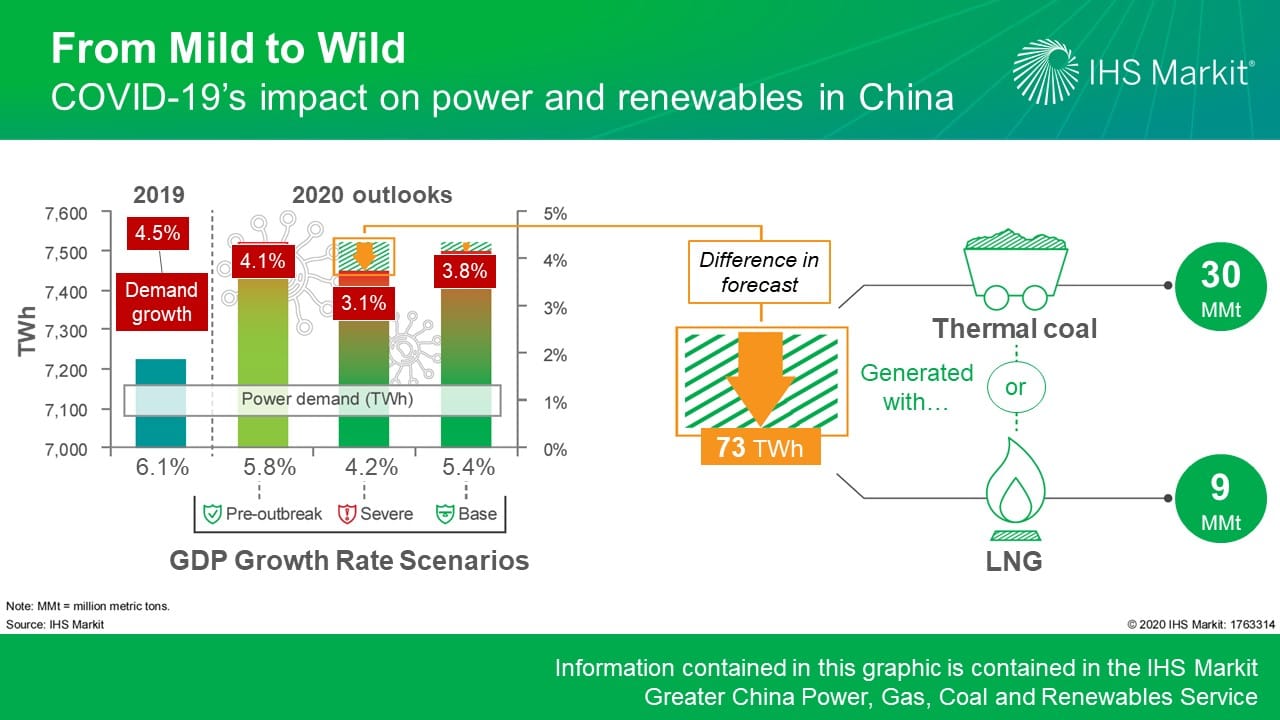

IHS Markit expects that the economic shock is likely to reduce China's 2020 GDP growth to 5.4% compared with the 5.8% growth rate in the pre-COVID-19 outbreak outlook. However, in a more severe scenario, GDP growth could drop to as low as 4.2%.

Base case: Electricity demand only moderatedly affected

To understand how electricity demand will respond, it is important to first understand China's power demand structure. The industrial sector currently accounts for roughly 70% of electricity used in the country, whereas the commercial sector and households account for roughly 14% each.

If the current outbreak stays relatively contained as authorities are starting to say - with economic impact limited mostly to the first quarter - we believe power demand will only be moderately affected.

The main reason is that many factories are seasonally closed around Chinese New Year anyway; should production resume in the second quarter, there will likely be some catch-up production activities to make up for the production loss during the first quarter, boosting power demand rest of the year.

The sector most impacted during the current outbreak is the commercial sector, e.g., restaurants, hotels, shops. These are lost activities that will not be re-generated during rest of the year, for example, Chinese New Year holiday trips, family banquets at restaurants. However, because these businesses only account for 14% of electricity demand, their impact on total power consumption - especially if only limited to the first quarter - will be moderate.

In addition, as people are advised to stay home during this period, we expect an increase in household electricity consumption from activities such as cooking and heating.

As a result, in our base case outlook, IHS Markit expects China's electricity demand to still increase by 3.8% in 2020, compared with our pre-COVID-19 outlook of 4.1%. This continues a deceleration trend (2019 demand growth was 4.5%) as part of a broader, longer-term economic deceleration.

Figure 1: From Mild to Wild: COVID-19's impact on power and renewables in China.

"Severe Impact" case: Electricity demand 1% lower than previous forecast

However, should the government not effectively contain the spread of COVID-19 and the disease control measures extend further in 2020, the impact on the Chinese economy - and the electric power and its related sectors - will be much more pronounced.

Under such an assumption - or the IHS Markit "severe impact" case - China's GDP growth during 2020 decelerates to only 4.2%, and the associated electricity demand growth will be only 3.1%, a full percentage point lower than our pre-COVID-19 outlook.

This 1% difference in power demand is equal to 73 Terawatt-hours (TWh) of electricity, which is roughly equivalent to Finland's annual demand. If coal is used to generate this demand difference, it would take roughly 30 million metric tons (MMt) of thermal coal (5,000 kcal/kg); if liquefied natural gas (LNG) is used, it would consume roughly 9 MMt of LNG. These figures for coal and LNG are slightly more than one month worth of Chinese imports last year.

Power supply: What impact on generation volume and annual additions?

On the power supply side, we believe baseload generation resources such as coal, nuclear, and gas-fired combined heat and power (CHP) will be weaker than expected - with coal plants impacted the most in operation hours. Renewable generation volume will unlikely be affected significantly due to their non-dispatchability and preferential status in the Chinese power system; the only sub-sector with more impact will be distributed solar PV generation for industrial and commercial customers impacted.

For new plant construction during the year, we believe that conventional power additions will unlikely be affected significantly because of their long lead time in development and construction. Renewable energy additions will be lower as a result of the suspended manufacturing and construction activities in the first quarter. Some of the impact on renewable additions will be partially offset by the rebound in the rest of the year—especially for solar photovoltaic (PV). Wind will be more affected, given the tight capacity in wind equipment manufacturing as well as engineering, procurement and construction (EPC).

Learn more about our coverage of the Greater China energy market through our Greater China Gas, Power, and Energy Futures service.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.