Gas storage in China: When will the bottleneck be resolved?

China experienced a serious gas supply shortage during the 2017-18 winter. Overall gas demand grew significantly after a few months of aggressive coal-to-gas switch in industrial and heating sectors. Meanwhile, demand seasonality also became much more pronounced, putting pressure on winter gas supply. Domestic gas fields and LNG terminals ramped up to or even beyond their maximum capacity, but rationing was still required. Chinese companies' winter buying spree also pushed Asian spot LNG price to a three-year high of $12/MMBtu, signaling a seasonal tightness in global market.

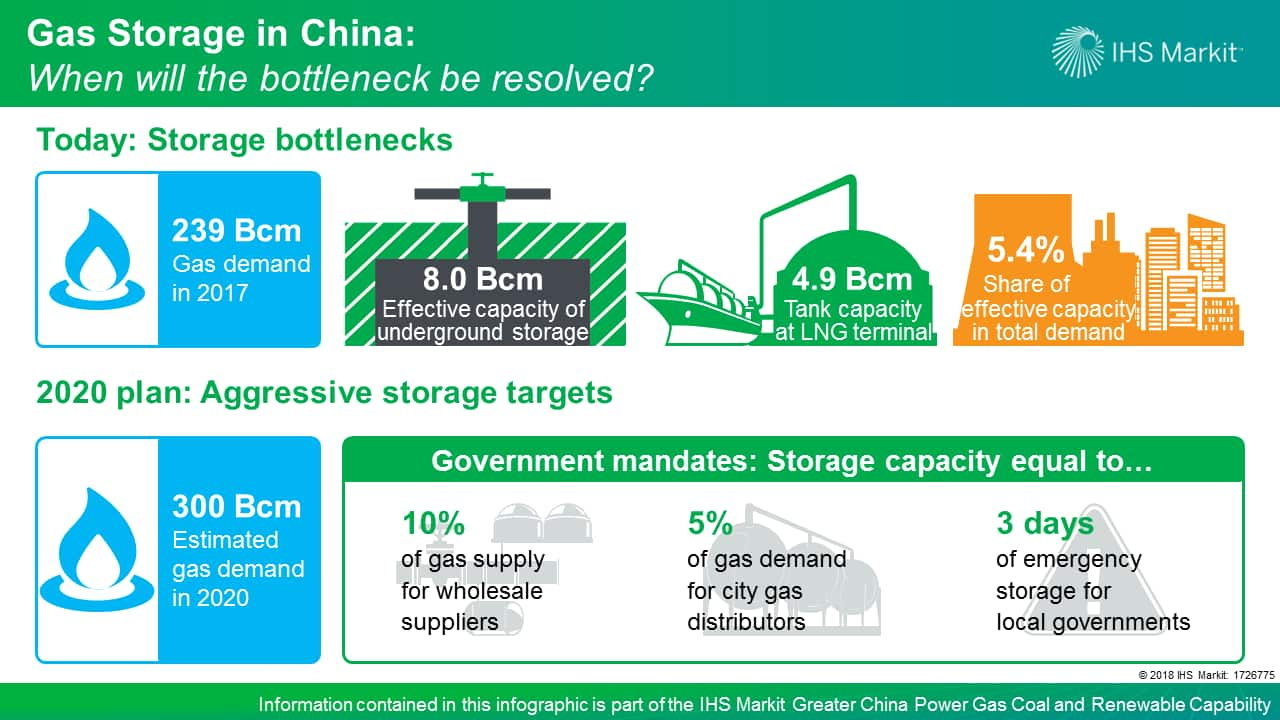

IHS Markit believes that the lack of storage capacity in China is the fundamental reason behind this supply shortage. We estimate China's total underground storage capacity available for peak-shaving to be only 8 Bcm as of June 2018. Together with another 4.9 Bcm of LNG storage capacity at all import terminals, total wholesale level gas storage accounts for only 5.4% of China's total gas demand in 2017. This is significantly lower than the international average of 15%. With increasing penetration of gas in the heating sector especially in northern regions, gas demand in China will only become more seasonal in the coming years. China is in urgent need for much more storage capacity.

The Chinese government has recognized this issue and has issued a few policies since 2017 focusing on storage buildup and the related pricing mechanisms. The 13th Five Year Plan on Natural Gas Development set a target for underground storage working capacity to reach 14.8 Bcm by 2020. In a recent policy issued in 2018, the government stipulated that all gas supply entities must have sufficient gas storages by 2020, with numerical targets. If these targets were met, China would be able to achieve a 16% storage level, in terms of the total gas consumption percentage, reaching similar levels as other large gas markets.

Figure 1: Gas Storage in Mainland China: When will the bottleneck

be resolved?

With strong government push, underground storage construction will accelerate and likely meet the 2020 target, but challenges remain. Lack of technically suitable storage site and a clear pricing mechanism, for example, will continue impede near-term storage expansions. Indeed, this will likely be a long-term process that will take time. Meanwhile, China will likely experience seasonal tightness in its gas supply.

Learn more about our coverage of the Greater China energy market through our regional power, gas, coal, and renewables service.

Xiao Lu is a Senior Research Analyst covering the gas

and power market analysis on Greater China.

Posted 27 June 2018

IHS Markit and CNPC ETRI are jointly presenting the International Energy Executive Forum 2019 in Beijing, China on December 13, 2018. Now in its 6th year, the Forum will address pertinent issues, like the ones covered in the article above, and a wide range of topics concerning global energy development with top executives, government officials, and thought leaders. Registration will open in September 2018.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.