GHG intensity of offshore Brazil production in 2022

Offshore Brazil, particularly Santos Basin and Campos Basin, is the country's most significant petroleum producing area, accounting for 96% of total production in 2022. The first wave of development was in the late 1970s and targeted postsalt shallow water discoveries. By the late 1980s and early 1990s, activity had begun to shift toward deep water with the discovery of large oilfields in Campos Basin. Beginning in 2006, a series of presalt discoveries in the Santos Basin marked the start of the third wave of offshore development in Brazil, which is currently experiencing rapid growth in investment and production capacity. Development of the Santos presalt play presents significant technical challenges due to the operating environment and unique subsurface characteristics. In particular, high gas-oil ratios (GOR), high temperatures and pressures, and high CO2 contamination require important adaptations in FPSO topside design, subsea systems and reservoir drainage strategies.

To gain insight into the greenhouse gas (GHG) intensity of offshore Brazil oil and gas production, the Scope 1 emissions profiles of all producing projects were analyzed using data from S&P Global Commodity Insights' Vantage. Estimates of GHG emissions include carbon dioxide, methane, and nitrous oxide (CO2, CH4, N2O) and their sources, which consist of fuel gas and diesel combustion, flaring, fugitive, and venting emissions. For this study, 85 oil and gas projects across 6 basins were consolidated into 37 main assets. We focused on the Santos and Campos basins, as they accounted for over 99% of total offshore production in 2022. We also categorized production by reservoir play.

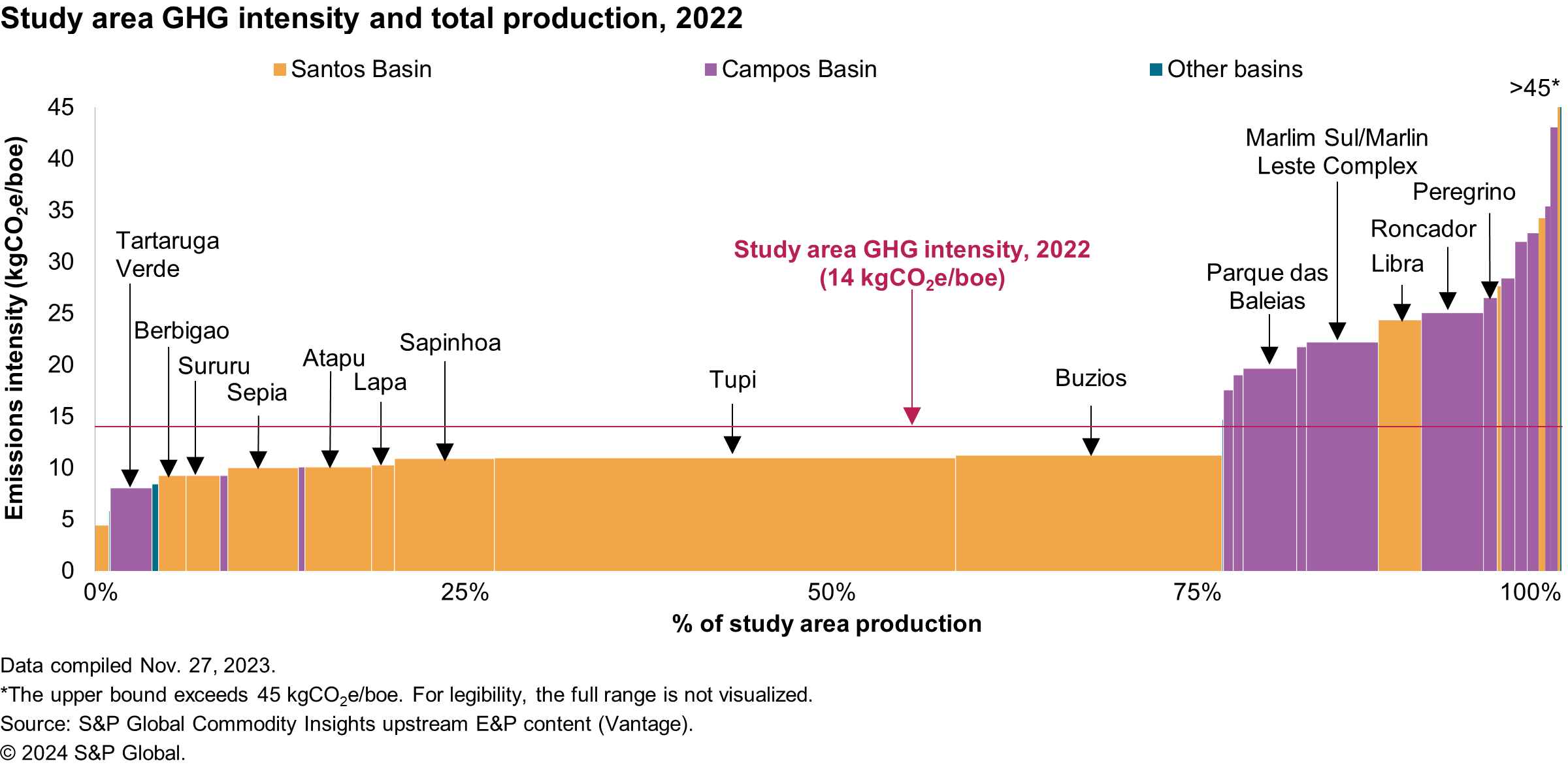

Our study found that the total absolute emissions of offshore Brazil in 2022 were 16 million metric tons (MMt) of CO2e and that the production weighted average GHG emissions intensity was 14 kilograms of CO2 equivalent per barrel of oil equivalent (kgCO2e/boe) in 2022. In comparison to other regions examined by Commodity Insights, the emissions intensity of offshore Brazil was not significantly higher than the intensity of 11 kgCO2e/boe for North Sea production but was two times higher than the emission intensity of the US Gulf of Mexico production (7 kgCO2e/boe) and was almost three times higher than upstream Northwest Australia production in 2022 (5 kgCO2e/boe) (excluding integrated upstream-LNG assets).

Since 76% of offshore Brazil production came from the Santos Basin (emission intensity of 12 kgCO2e/boe), the emissions profile of that basin as well as that of offshore Brazil was heavily influenced by presalt production (emission intensity of 12 kgCO2e/boe), which accounted for almost all the Santos Basin production. In contrast, Campos Basin production was almost two times more GHG intensity than Santos Basin (emission intensity of 22 kgCO2e/boe), with most production coming from postsalt reservoirs (emission intensity of 22 kgCO2e/boe). This can be attributed to the maturity of Campos Basin assets and to the high productivity of presalt reservoirs, which have not reached peak production.

The emissions intensity of offshore Brazil was 14 kgCO2e/boe but we observed a degree of variability of asset level emissions intensity throughout the region, ranging from 4 kgCO2e/boe to 35 kgCO2e/boe for over 99% of production. 77% of the total production occurred below the study area average, in a similar trend observed in the US Gulf of Mexico (78%), Northwest Australia (70%), and North Sea (62%), meaning that larger assets are usually more efficient. It is worth noting that Santos Basin assets represent 94% of production below the study area average.

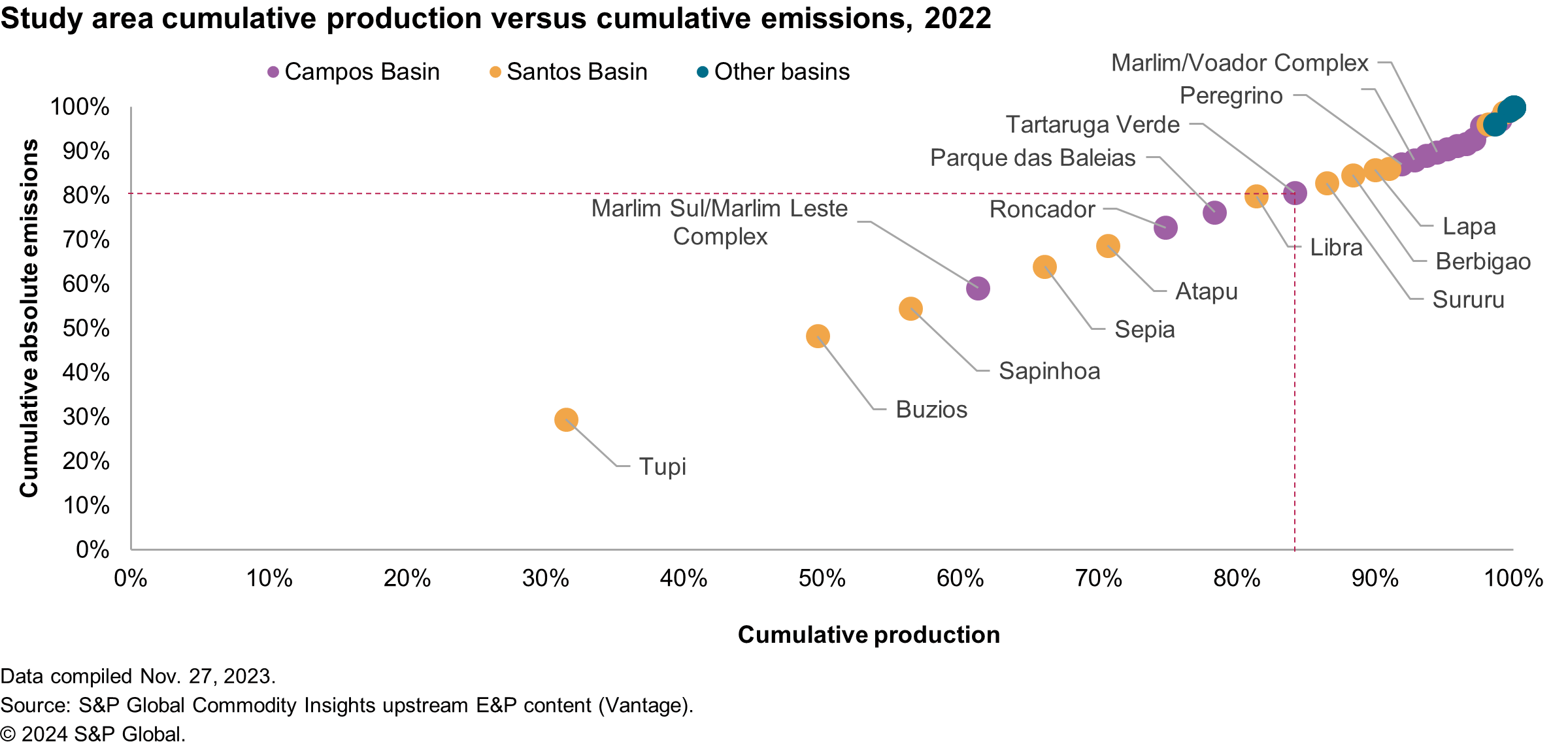

When the contribution of an asset to the total absolute emissions is plotted against its share of the total production volume cumulatively, the trend of larger assets having a lower emissions intensity observed in the US Gulf of Mexico and North Sea is not apparent in offshore Brazil. Here, we observe a linear trend where the 10 largest assets accounted for around 85% of the total production and were responsible for over 80% of the total emissions in 2022. This can be contrasted to the US Gulf of Mexico, where the 10 largest assets accounted for more than 50% of the total production and were responsible for less than 30% of the total emissions. Although higher productivity still tends to cause higher absolute emissions, the emissions intensity of assets offshore Brazil appears to be less sensitive to production than it is in the other regions.

Evaluating the total proportion of emissions by source (fuel gas combustion: 72%; diesel combustion: 7%; flaring: 18%; venting: 3%) reveals that presalt production had a significantly higher flaring proportion (20%) than postsalt production (15%) and other plays (8%). This shows that oil reservoirs with high GOR and high CO2 content, coupled with limited gas treatment and export infrastructure are significant factors when considering the GHG emissions for the study area production.

The environmental feasibility of presalt development was due to an innovative solution developed by Petrobras, combining carbon, capture, utilization, and storage with enhanced oil recovery (CCUS-EOR). FPSOs are equipped with topside gas processing and compression units that allow for separation and reinjection of CO2 into the producing reservoir using water alternating gas injection wells. In 2022, over 11 MMt of CO2 were reinjected in Santos Basin reservoirs, which is equivalent to ~6 million cars[1]. In a hypothetical scenario where these CO2 volumes were vented, the average emission intensity of offshore Brazil would have jumped from 14 kgCO2e/boe to 24 kgCO2e/boe. It is worth noting that a large share of the natural gas was reinjected along with the CO2 due to limited gas export infrastructure.

Commodity Insights' comprehensive and rapidly evolving GHG modeling capabilities enabled analysis of the Scope 1 emissions profiles of all major producing assets offshore Brazil in 2022, providing timely insight into the GHG intensity of one of the world's most significant regions for oil and gas production. This insight is part of a continuing series of analyses from Commodity Insights' upstream GHG dataset. Find out how we can help guide you on your emissions journey here.

[1] Assuming average emissions of 2 metric tons per year, an assumption based on UK average CO2e emissions of 170g/km per car and mileage of 7,400 mi/yr (11,900 km).

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.