Global Integrated Oil Companies strategies for growth in low-carbon sector

Acquisitions and spending

The seven largest Global Integrateds (GIOCs) are becoming meaningful participants in the low-carbon sector, including renewables, owing to stepped up acquisitions and growing organic capex.

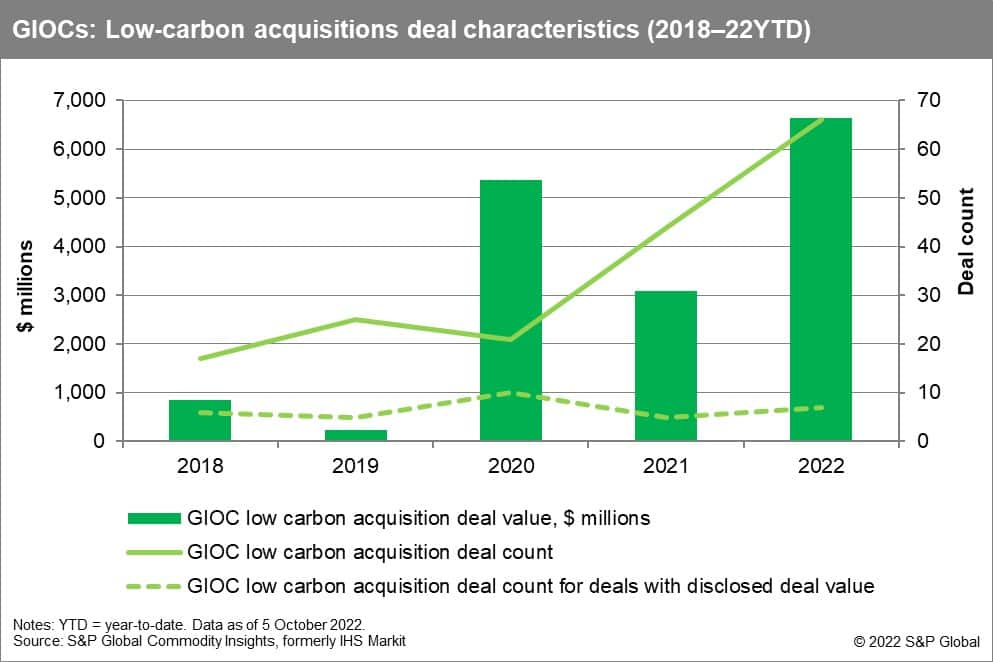

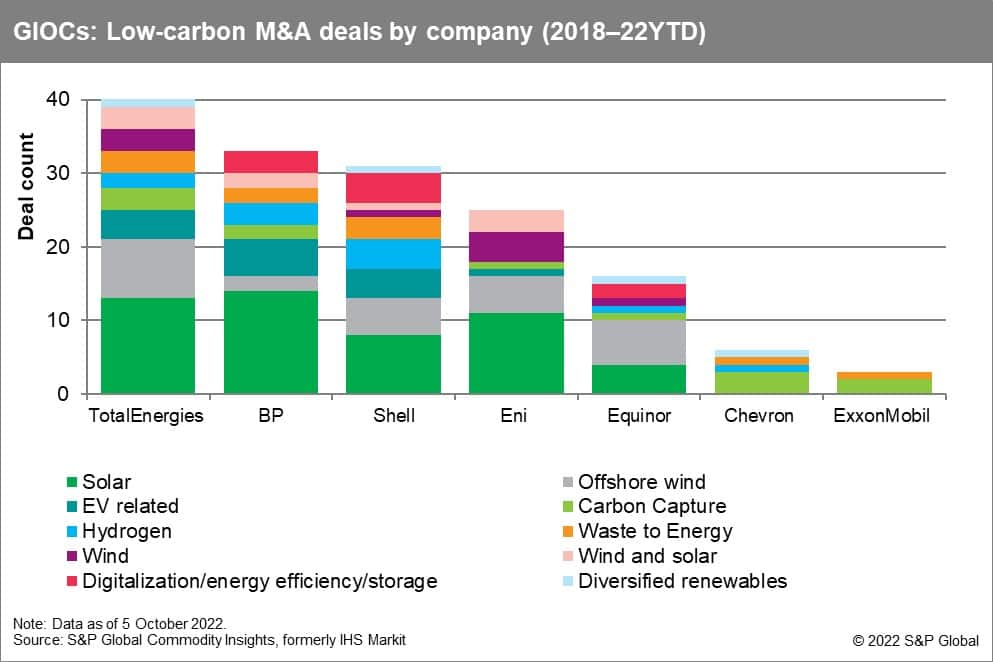

• To date, over 2018‒22 year to date, these GIOCs have been low-carbon acquirors in more than 170 deals, worth well in excess of $16 billion, with less than 20% of these deals disclosing deal value.

• In addition, these companies are expected to invest at least $90 billion in organic low-carbon activities over 2020‒25. By 2025, some GIOCs are expected to have annual renewable spending comparable to pure renewable power players.

Growing significance, especially among Euro integrateds

Signs of growing significance of low-carbon to GIOCs include greater M&A commitments to the sector such as increasing average deal size, more corporate deals, as well as preferences for undeveloped projects and maintaining operatorship. In the current decade, solar and offshore wind have dominated GIOCs deal activity, but in 2022 the biofuel sector has been particularly active.

GIOCs strengths include their experience managing large-scale development projects, ability to collaborate and partner, global market reach, and their substantial financial resources with the ability to fund acquisitions with cash and/or equity. The timing may be right for GIOCs to make more substantial low-carbon acquisitions.

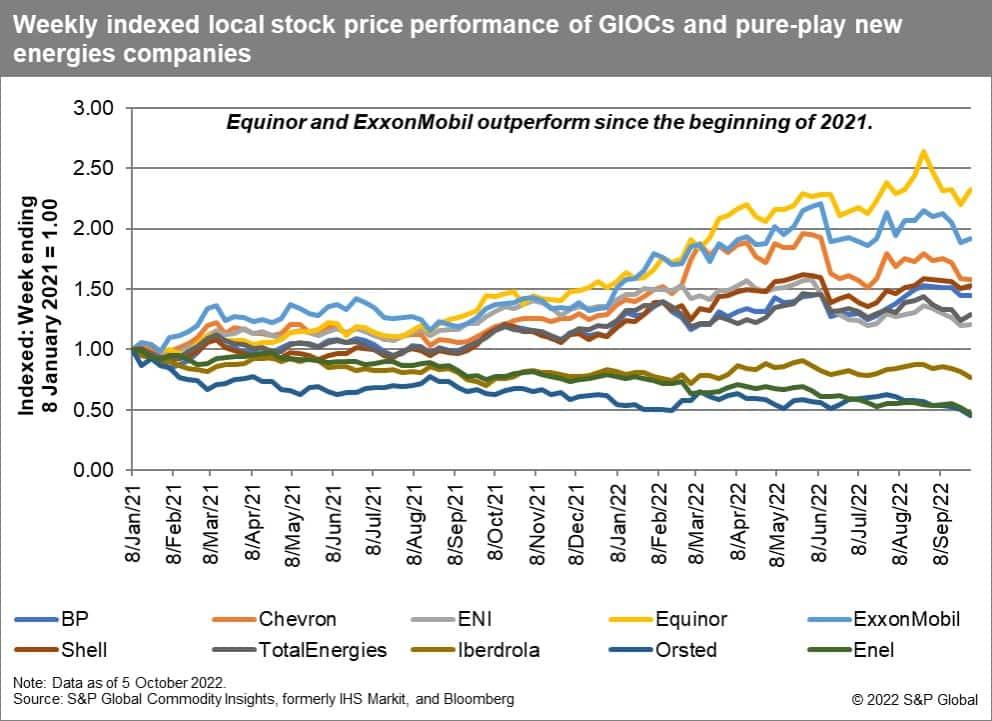

Share equity strength provides currency for acquisitions

GIOCs share equities are relatively strong versus those of low-carbon/renewable pure-play company common equities which are being impacted by rising costs caused by inflation and supply chain constraints.

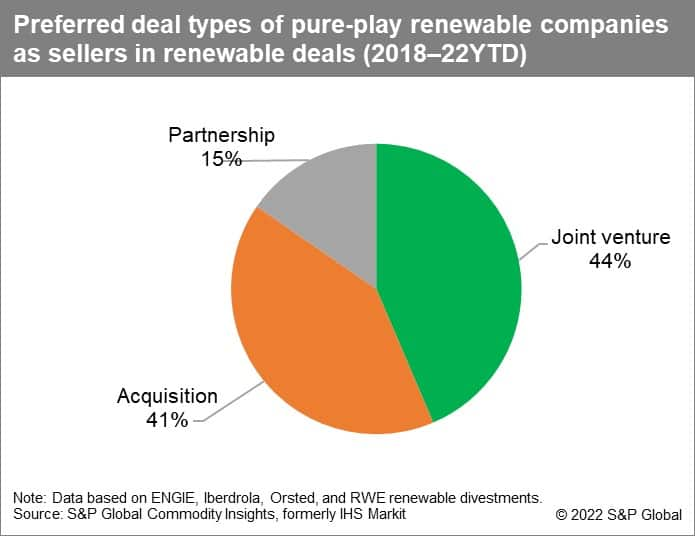

Preference for partnerships and joint ventures maybe changing

Historically, pure-players have preferred partnership or JV deal structures for partial divestments. Will rising costs force portfolio high-grading and full-fledge divestments?

GIOCs are not the only players with growth appetite for the renewable sector. Financial players are also placing big bets on the sector. Since 2018, Credit Agricole has invested more than $4.5 billion in low-carbon acquisitions while Brookfield Asset Management has invested more than $5 billion in renewables.

***

This blog is an extract from the study and the full report is available for S&P Global Commodity Insights Connect platform Upstream Transformation subscribers only.

Want to learn more on this topic and access similar reports? Try free access to the Upstream Oil and Gas Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.