Global tight oil exploration – Can the tight oil revolution in North America be repeated?

Can the North American tight oil revolution be replicated in the world? This question has taken on great significance owing to what is unfolding at rapid speed in North America.

The North American tight oil revolution is reshaping the global energy paradigm and will have an increasing impact in the coming decade. Application of new drilling and completion techniques, including horizontal drilling and staged hydraulic fracturing, has enabled production from low-permeable beds in "tight oil" plays, also called continuous liquid resource plays. Production of tight oil in the US and Canada will ramp up to levels of 4.5 million barrels of oil and condensate per day between 2018 and 2034. Recoverable resources could well exceed 40 billion barrels.

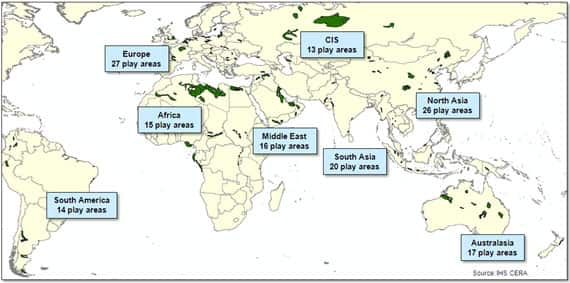

To understand where and when tight oil resources may be developed around the world, IHS conducted a global screening study to investigate the potential for Tight Oil outside North America; the new study, entitled Going Global: Predicting the Next Tight Oil Revolution, has just been released. A total of 148 potential play areas from Australia to South America were analyzed on key geological and geochemical characteristics such as thickness, lithology, porosity, permeability, pressure, organic richness, presence of natural fractures, brittleness, and oil maturity among others.

A comprehensive risking and ranking process revealed that 23 play areas can be considered as high-ranking and to be of similar quality compared to North America, or even better in some cases. Commercial potential is not limited to the twenty three high ranking tight oil plays. Local market conditions, government policies or innovative E&P activity could drive commercial developments in a number of the 125 additional plays that were screened in this study.

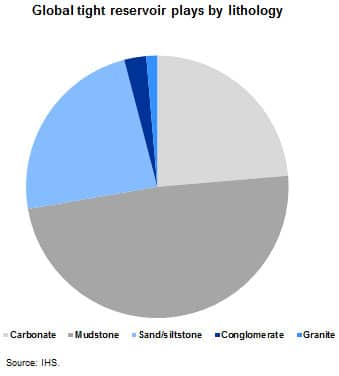

The list of plays include the obvious high-ranking geological horizons such as the Vaca Muerta Formation in Argentina, the Silurian "hot" shales in North Africa and the Bazhenov Shale in West Siberia, but also include less known geological plays in Europe, the Middle East, Asia and Australia. For the purposes of this study "tight oil" was defined as a continuous oil resource play which includes kerogen-rich (tight) shale or carbonate layers that have generated oil, in combination with or without associated low-permeability (tight) clastic or carbonate reservoirs. These horizons will contain oil over extensive areas with zero or limited structural control. The study shows a wide variation of potential geological horizons with multiple lithologies and facies, ranging from deepwater shale to shallow marine carbonate and deltaic sand-silt sequence. These lithologies match the same kind of rock characteristics observed in North America.

But even with the large uncertainty in prospectivity, since overall little production has yet been established to prove feasibility, some of these plays have characteristics that could well exceed the best of those in North America.

To better understand the potential of these horizons around the globe a comparison with the well-known North America Tight Oil plays has been made based on depositional environment and other relevant geological characteristics. The study shows that plays around the globe can be grouped along certain depositional types for comparison. Additionally, using correlations between certain characteristics like potential storage capacity and well recovery in the North American tight oil plays, an estimate can be made for the global potential.

In these early days for global tight oil, limited data are available to calculate a definitive recoverable resource potential. However, using consistent assumptions about geological risk factors and recovery factors and using comparisons with North American tight oil analogs, it is possible to show that the technically recoverable oil resources in the 148 plays analysed in this study could well exceed 288 billion barrels. By way of comparison, if such a volume were proven commercial, it would represent about a 12% increase in global conventional oil resources. And recoverable estimates will probably grow when serious drilling of these plays begins.

Although certain areas will disappoint when exploration starts, certainly before sweet spots are delineated, others will prove to have substantial potential. However, assuming similar well recovery to North America plays, thousands of wells would be needed to fully develop the global tight oil plays. The study shows that a large number of wells is very unlikely to be achieved in the coming decade because of a multitude of aboveground issues and constraints, including the need for modern rigs, trained well completion crews and modern hydraulic fracturing equipment.

A detailed analysis of a large range of variables from government policy, land access constraints, regulatory obstacles to water management issues shows that development will probably be slow in the beginning. Where favorable production conditions exist, capable service industries and adequate infrastructure will be made available through investment in the large opportunities that exist to tap the rich tight oil plays around the world.

Posted 23 July 2013

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.