Going back to the future for lower cost tight conventional plays

Low commodity prices pose huge economic questions—how can operators manage portfolios to survive the downturn and position themselves for the future. In the US, core sweet spots in the successful unconventional oil and gas plays are tightly held and many new play unconventional candidates have been tested without much success. Does the US offer sufficient additional opportunities to sustain success over the next decade? Can the strategies and tactics that drove the successful US unconventional oil and gas revolution be exported?

Horizontal drilling and hydraulic fracturing are the most cited technological keys for unlocking commercial oil production from tight rocks, including the tighter, more challenging portions of older, mature conventional plays. A new IHS report finds that the tight conventional domain is benefiting from the export of technology used to unlock true unconventional zones. The report identifies formations that are being drilled today plus opportunities in other formations with little drilling to date.

The average global recovery factor for a conventional oil reservoir is 34% with two-thirds of the oil still in the ground. Many tight conventional oil reservoirs demonstrate recovery factors of 15 percent or less – substantially lower than the average 34 percent for conventional oil reservoirs. There is significant upside potential to boost recoveries from tight conventional reservoirs from application of unconventional technologies. Because these tight conventional reservoirs are in areas with older vertical wells that can be re-entered for horizontal drilling and because the rock properties do not require the size and cost of a hydraulic frac job needed for an unconventional zone, completion costs can be significantly reduced. Also with delivery infrastructure already in place, overall breakeven costs to develop the projects are much lower.

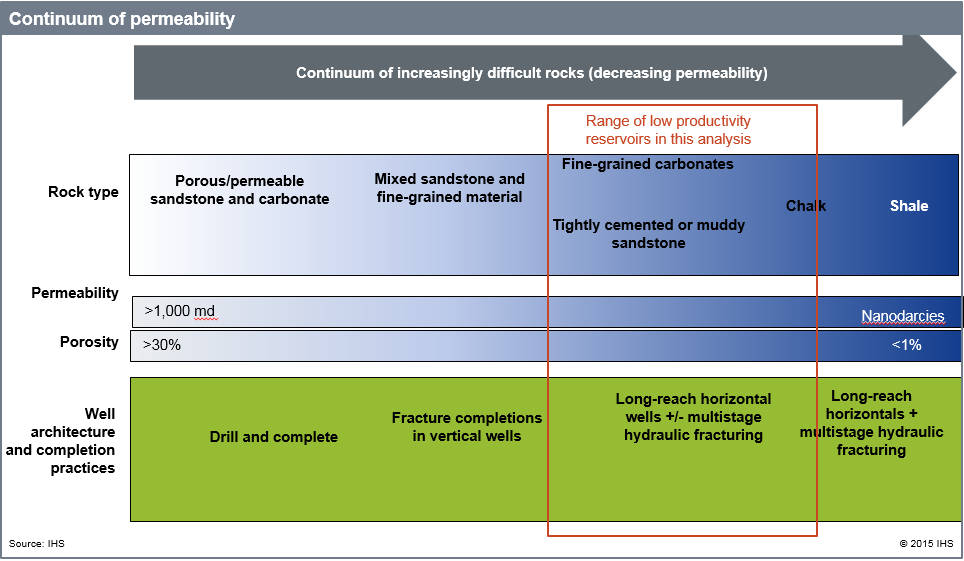

Tight conventional reservoirs are those with permeabilities in the 0.01-2.0 md range that have tended to be sub-commercial in the conventional domain in the past. They were primarily drilled with vertical wells. Figure 1 below shows the continuum of increasingly difficult to produce economic volumes of oil and gas from tight rocks (based on permeability). Our analysis focused on rocks within the red rectangle.

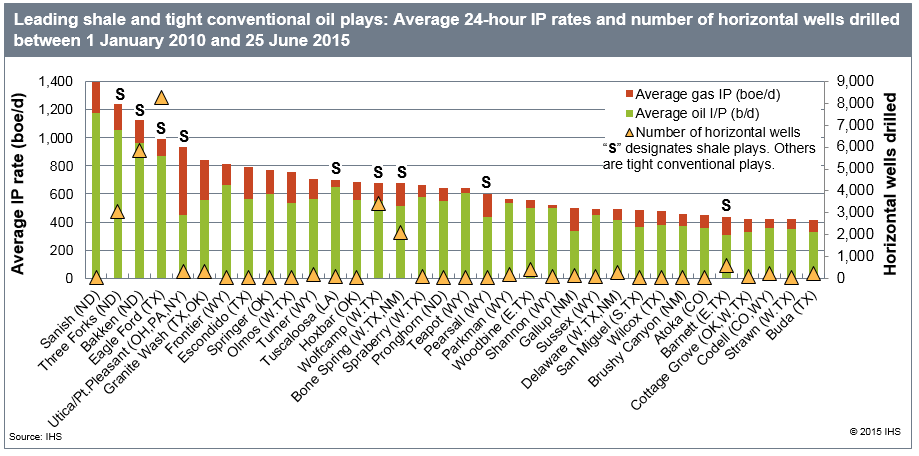

IHS Energy identified tight conventional plays that were tested with horizontal wells in the last five years. Average initial potential test rates for the leading tight conventional plays compare favorably with those for established shale oil plays. The top tight conventional plays identified by the study are in the Rockies, Texas and the Mid-Continent. The study also identified onshore potential “sleeper” plays with few horizontal wells and average Initial potential test rates greater than 200 b/d and shallow formations <9,000ft that also offer future potential development with horizontal drilling.

Figure 1: Range of Low Productivity reservoirs analysed

Summary Statistics

- Between 1 January 2010 and 25 June 2015, 45,744 horizontal oil wells were drilled in the United States. This includes both shale and conventional reservoirs.

- These wells drilled into more than 400 individual reservoirs, up from just over 300 in mid-2013.*

- Of the total wells, 25,128 wells were in 13 shale plays.

- The remaining 20,616 horizontal wells were completed in underperforming and generally tight (0.1–2 md permeability) conventional carbonate and clastic plays.

- In this period, 427 individual shale and tight conventional reservoirs were drilled. This represents 294 plays.

- Among the 294 plays represented:

- 123 had average IP rates greater than or equal to 100 boe/d

- 31 had average IP rates between 100 and 500 boe/d

- 13 had average IP rates greater than or equal to 1,000 boe/d

- Of the 294 plays, 266 were tight conventional

- The tight conventional plays being redeveloped now compare very well with the nine leading unconventional plays as illustrated in the Figure 2 chart. However, of the 26,232 wells represented on this chart, only 10% have been drilled in the tight conventional plays. This suggests considerable upside potential in the tight conventional plays should the activity levels increase to that of the shales.

Figure 2: Initial Potential Test Comparisons for Unconventional and Tight Conventional Plays

Applying unconventional technology to these underperforming tight conventional reservoirs provides a key relief for those companies not in the tightly held sweet spots in unconventional plays. It offers a tremendous upside potential as the industry moves back to the future as prices slowly recover over the next year.

Keep pace with the latest developments in select basins. Learn more.

Stephen Trammel is Director, North America Well and Production, IHS Energy

Posted 9 May 2016

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.