Governments increasingly adopt incentive schemes to encourage decarbonization of the oil and gas industry

Oil and gas producing countries across the world are rolling out policies and regulations to boost investment in emission-reduction technologies and decarbonization of the of the upstream sector.

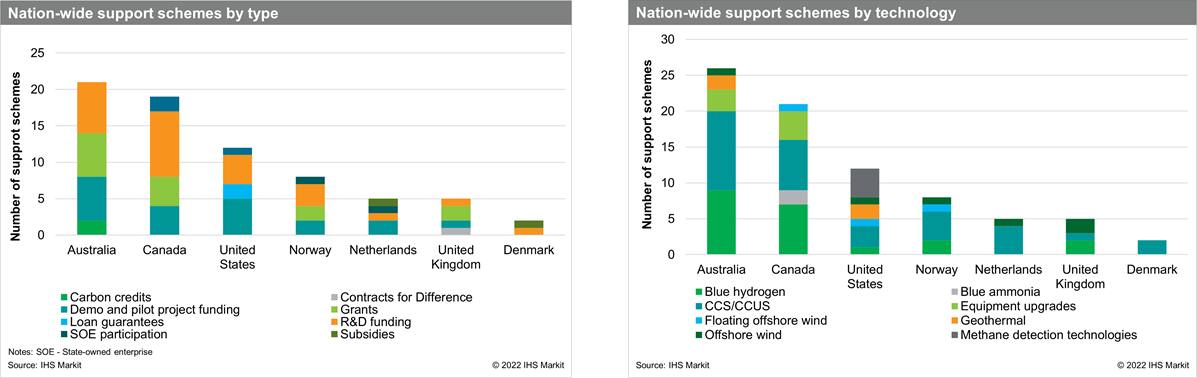

In recent years, seven diversified producers - Australia, Canada, Denmark, Norway, the Netherlands, the United Kingdom, and the United States - have led global efforts in establishing regulatory frameworks to facilitate the energy transition in the oil and gas industry. The emerging mechanisms include a mix of support instruments from research and development (R&D) funding to tax credits that are expected to remain important drivers of low-carbon investment over the longer term.

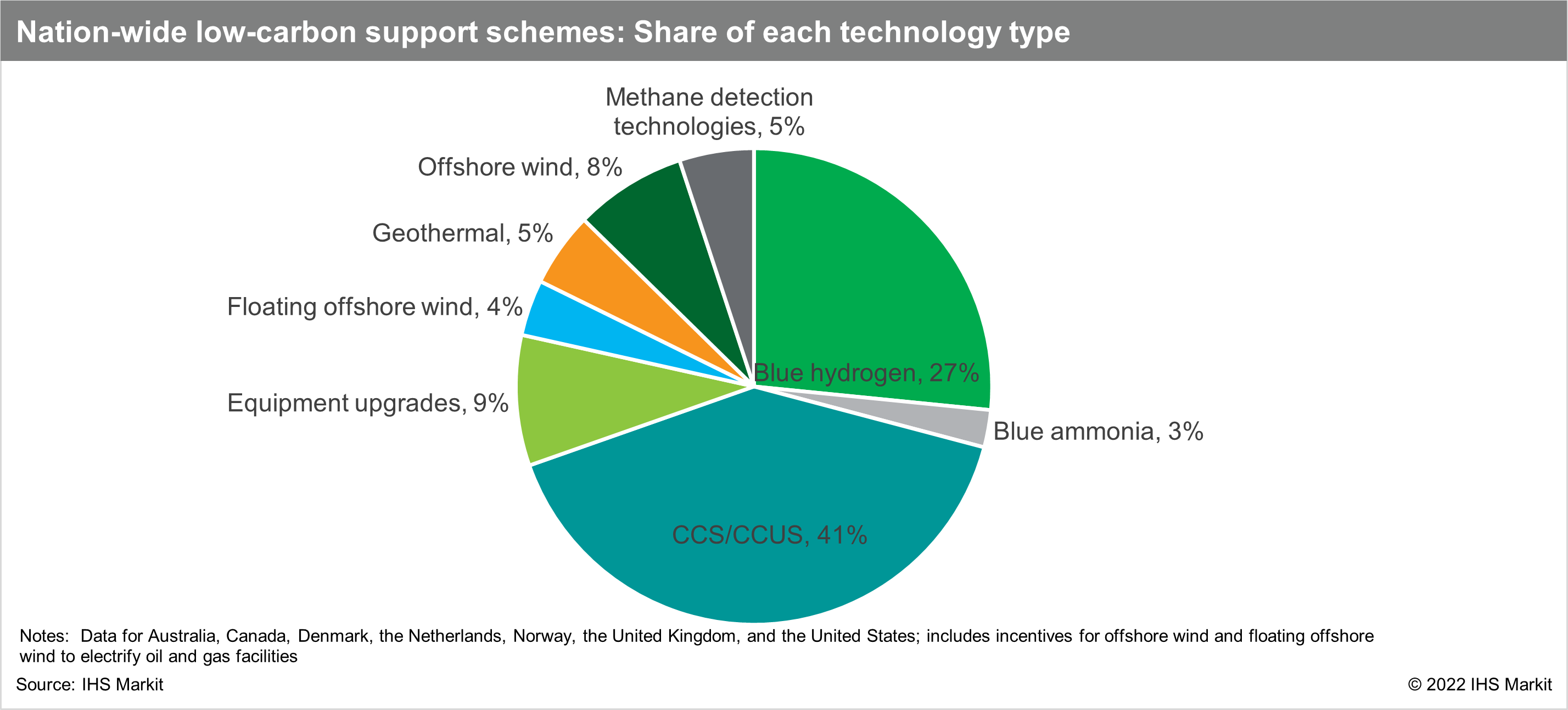

Key focus on CCUS, blue hydrogen

Among large-scale commercial projects, carbon capture, utilization, and storage (CCUS) and blue hydrogen remain a priority area. Governments are funding CCUS R&D and pilot and demonstration projects to encourage cost reductions, while also partially covering the cost of commercial-scale developments through direct financial participation or tax credits. Blue hydrogen projects are closely related to CCUS facilities and additional support programs are expected to be introduced over the medium-to-longer term when more carbon storage infrastructure is in place. The larger share of these technologies in the support scheme mix could be also attributed to the availability of CO2 storage capacity and natural gas resources that could be monetized via hydrogen production.

Offshore wind and floating offshore wind used to electrify oil and gas platforms have also enjoyed strong government backing, particularly among the North Sea producers. In the United States, the Biden administration is considering offshore wind leases in the Gulf of Mexico, which could open new opportunities to decarbonize producing platforms.

State engagement varies between regions

In North America and Australia, host governments pair budgetary funding of research and demonstration projects with loan guarantees and tax credits to incentivize low-carbon investment. This approach is in line with an established policy of limited intervention in the oil and gas industry with a focus on market mechanisms. It is also worth noting that in addition to federal-level programs and fiscal instruments, there are sub-national support schemes that help create a favorable above-ground environment for low-carbon investment. Australian states run a total of 19 initiatives to encourage the energy transition in the oil and gas sector, while producing provinces in Canada have 14 active incentives.

In the meantime, European host governments are more directly involved in low-carbon projects intended to cut emissions from upstream operations, and tax credits are not as common. In the Netherlands and Norway, state-owned enterprises participate in CCS projects and coordinate collaboration between different segments of the value chain. The Norwegian government has also provided substantial budgetary funds to the Hywind Tampen floating offshore wind farm and the Northern Lights CCS facility. The support scheme mix continues to evolve, particularly in the United Kingdom and Denmark, but states are expected to remain active players in the low-carbon segment and provide financial and operational capacity to advance decarbonization developments.

Recent announcements signal further support to come

In the first five months of 2022, several of these producers have advanced policy initiatives that underscore their strong commitment to improving the investment climate for decarbonization projects in the oil and gas sector.

Australia

In the 2022-23 budget introduced in March, the federal government allocated A$300 million to support low-emissions LNG, blue hydrogen, and associated CCUS infrastructure in Darwin, a step towards a potential future low-carbon energy hub.

With Labor winning the May 2022 elections, support for emissions reductions is set to continue, with green hydrogen and renewables favored, alongside expanded carbon credits. While there are likely to be fewer new incentives for blue hydrogen and CCUS, several incentives introduced by the previous government extend over the coming decade, ensuring support will continue.

Canada

In early April, the federal government introduced a tax credit for CCUS projects as part of the 2023 budget. The CCUS investment tax credit will apply to investment in CCUS projects that permanently store captured carbon dioxide in dedicated geological storage or in concrete, but not for enhanced oil recovery (EOR). The tax credit rate varies from 37.5% to 60% of investment, depending on the type of equipment used. In addition, the government authorized a C$2.2-billion recapitalization of the Low Carbon Economy Fund, which finances provincial decarbonization initiatives.

United States

In early May, the Department of Energy announced the $2.25-billion Carbon Storage Assurance Facility Enterprise (CarbonSAFE) Initiative, which targets site characterization and permitting, Front End Engineering Design (FEED), and construction of a demonstration site for the commercial storage of at least 50 million metric tons (MMt) of CO2 within a 30-year period.

Alongside the development of the supplemental methane rule by the Environmental Protection Agency, Congress could also approve the allocation of federal funds to support oil and gas equipment upgrades and the installation of methane detection technologies to mitigate emissions from upstream and midstream operations. Despite the administration's growing support for such incentives to balance increased near-term production with emission-reduction goals, multiple lawsuits against federal agencies and midterm elections are likely to delay decisions on such support well into 2023.

United Kingdom

The Conservative government recently committed to adopt the Energy Security Bill (likely before the end of 2022), which would codify business models for CCUS projects. These models are expected to provide de-risking arrangements and additional mechanisms to support carbon storage projects.

Stable policies coupled with clear and transparent incentive schemes are likely to be critical factors in the expansion of decarbonization projects in the oil and gas industry. The implementation of support programs is expected to be accompanied by regulatory improvements that would streamline project reviews and approvals, further bolstering the attractiveness of investment in low-carbon developments.

***

Want to learn more about our coverage of how upstream is transforming due to the energy transition? Try free access to the Upstream Oil & Gas Hub to explore selected energy research, analysis, and insights, in one integrated platform.

Already a subscriber to our Upstream Transformation service? Check out our new low-carbon incentives dashboard.

***

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.