Graff – Shell’s high impact Namibian well

Namibia is again under the spotlight as Shell bank on the highly anticipated Graff-1 to unlock frontier plays in the Orange Sub-basin. The deepwater exploration well was spud by the Valaris DS-10 drillship just days after Venus-1, the TotalEnergies operated wildcat in the neighbouring PEL 56 licence. Shell have indicated the success of Graff is independent of Venus, targeting shallower plays within the major delta system. If successful, Graff-1 could spark significant international investment to a region which has had minimal E&P activity over the last 25 years.

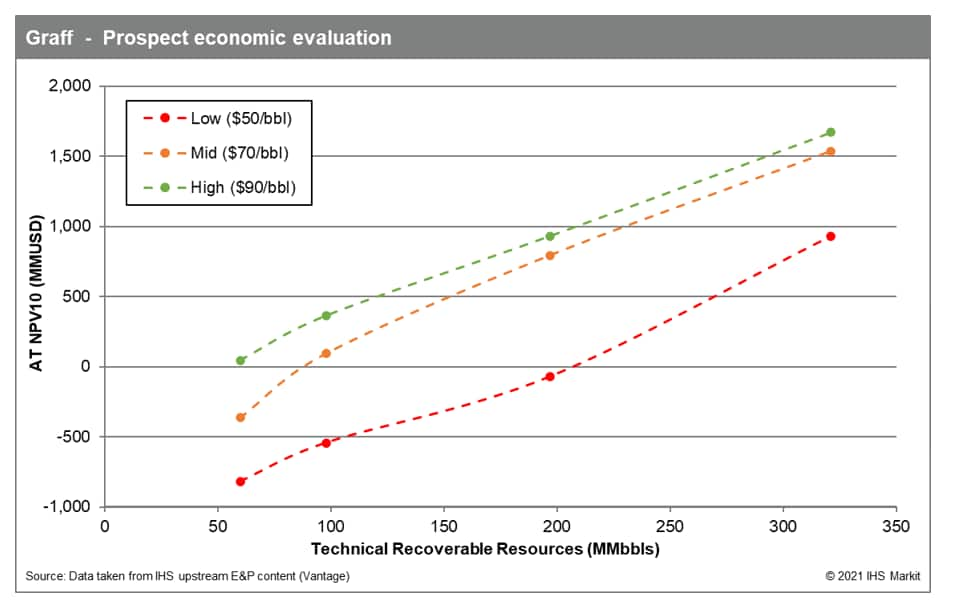

However, success at a geological level does not imply economic or commercial success. Analysis of the Graff prospect suggests a minimum economic field size of around 85 MMbbls at $70/bbl and a potential NPV of around USD 1.5 billion with a discovery size equal to 320 MMbbls. Cost curve analysis indicates an average BEP price for new projects offshore West Africa of $50/bbl. With this as a minimum long term price expectation, Shell is likely targeting at least 210 MMbbls recoverable. It is also worth noting that there is additional upside potential with several key prospects already identified nearby.

Figure 1: Graff - prospect economic evaluation

For more information regarding well, field & basin summaries,

please refer to EDIN.

For more information regarding asset evaluation, portfolio view, and production

forecasts, please refer to Vantage.

For more information regarding our country activity coverage, please

refer to GEPS.

For more information regarding E&P costs please refer to IHS

Markit Que$tor.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.