Green day-ahead market: A growing market segment for renewable capacity in India

In early October 2021, the Central Electricity Regulatory Commission (CERC) approved the petitions filed by the Indian Energy Exchange (IEX) and Power Exchange of India Limited (PXIL) for the launch of green day-ahead contracts (GDACs)[i] and the integrated day-ahead market (IDAM)[ii], respectively. Following the approval from CERC, IEX launched the green day-ahead market (GDAM), a new market segment to trade the day-ahead contracts (DACs) for renewable generation. Since the GDAM's launch on 27 October 2021, a total volume of 326 GWh has been traded in GDACs, which represents roughly 1.4% of total renewable energy generation and about 1.5% of the total short-term market.

The framework introduces integrating the trading of renewable energy power with conventional power in the day-ahead market (DAM), with separate price formations for renewable energy and conventional power. Read our article on GDAM's structure.

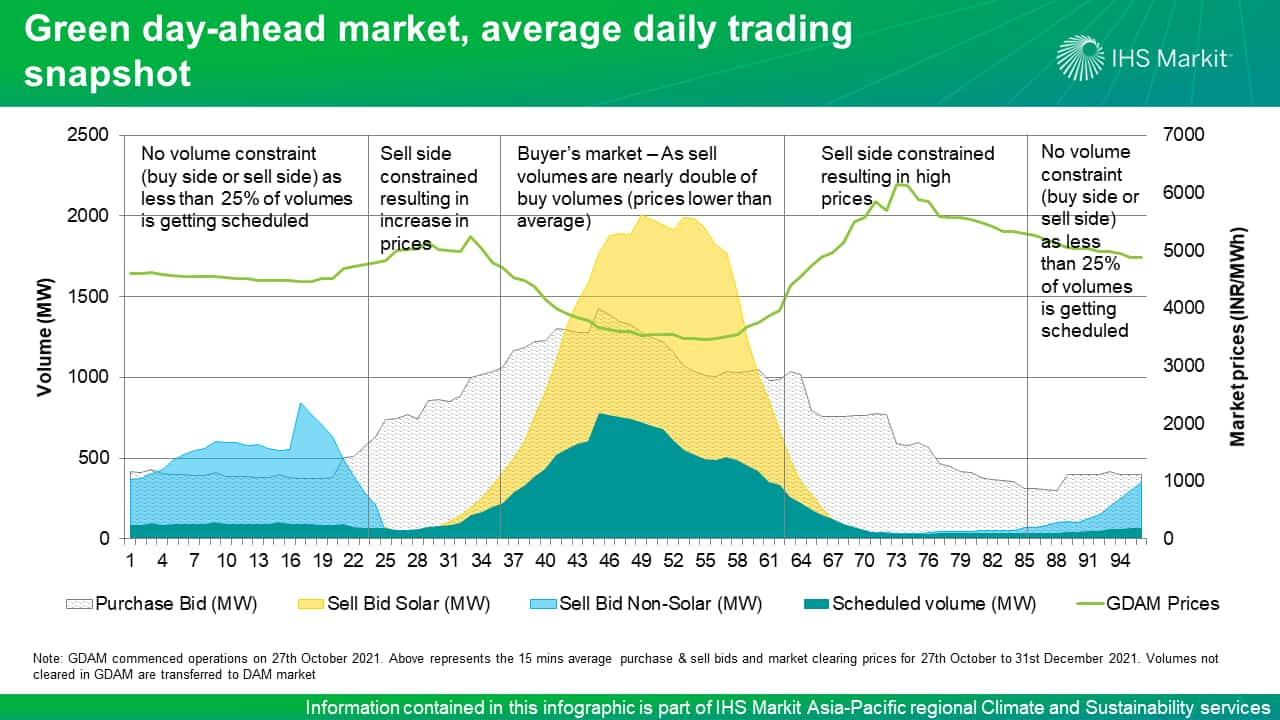

Some of the key observations in GDAM:

- GDAM dominated by solar bids and limited clearance of volumes. On average, purchase bids with capacity of 723 MW were received for each time block, against the average sell bid capacity of 611 MW. Of the total sell bids, the majority (70%) of them are solar bids (and consequently concentrated during the daytime). Further, of the total sell bids, only 34% of them were cleared (36% of solar and 27% of nonsolar), indicating price and demand challenges for the buyers and seller.

- Market experienced sell-side constraints during early morning, late evening to night hours, owing to limited non-solar merchant capacity resulting in price spikes.

- Prices continue to be divergent between the GDAM, the DAM, and RECs primarily due to the absence of an intermarket optimization structure, which is inherent in the overall market design.

- The GDAM is offering better prices for non-solar generation. However, for solar generation, the DAM plus REC market offers better pricing.

- Buying from the GDAM results in a lower cost to buyers. The cost advantage may increase further as the Central Electricity Regulatory Commission (CERC) implements the direction given by the Ministry of Power (MoP) on the transmission charge waiver for GDAM transactions.

- Low liquidity in market: In the first two months of the market, the volumes in the GDAM remained low, owing primarily to limited merchant renewable generation capacity in the country.

Is the GDAM an interim market framework for promoting renewable energy?

With the expected implementation of the market-based economic dispatch (MBED) framework (phase 1 starting in April 2022), liquidity in the DAM is expected to increase significantly. This situation will pave the way for implementation of other structural changes like the forwards and derivatives market, the ancillary service market, allowing interplay between the DAM and RTM, and merging the security-constrained economic dispatch (SCED) with MBED. As India's power market structure evolves, and transmission charges become applicable for renewable energy capacity as well, the GDAM can be expected to be merged with the DAM.

Learn more about our Asia Pacific energy research.

Ashish Singla, associate director with the Climate and Sustainability team covering research and analysis on Power and Renewable for South Asian countries at IHS Markit.

Posted on 28 January 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.