Growth, competition, and consolidation: The future of the energy storage system integrator in a maturing industry

The energy storage industry continues to rapidly expand, creating opportunities for new entrants and incumbents alike. As the market grows, many system integrators are evolving their business model to create a stronger competitive footing. To capitalize in the long term, different stakeholders focus on growing their market share as the industry accelerates. While this creates price pressure for incumbents, both upstream component suppliers and downstream developers are also looking at ways to diversify and protect their own margins. With the influx of capital to the industry, this creates the perfect platform for diverging competitive scenarios and a fascinating position to explore how the industry could develop.

Rapid growth and an influx of capital set the scene for an evolving competitive landscape

IHS Markit projects a tripling in annual grid-connected energy storage installations from 2020 to 2025, reaching 15.1 GW / 47.8 GWh. This growth is accelerating competition across the industry and is driving the creation of a more global supplier landscape. Despite some recent market consolidation, the industry is attracting significant investment. Targeting this market - and in particularly focusing on the role of system integrators - battery and component manufacturers, and increasingly major energy companies and technology conglomerates are joining incumbents in a highly competitive market. Simultaneously, fresh capital from investors looking to diversify into clean energy technologies, is facilitating incumbents and new entrants to compete for market share through the industry's next phase of rapid growth.

What is a system integrator?

- A system integrator is a company that specializes combining component subsystems and ensuring that these subsystems function together as a whole.

- In the energy storage industry, a system integrator supplies the full battery energy storage system (BESS). As such it is usually responsible for procuring individual components (primarily the battery modules / racks, power conversion system (PCS) and other balance of plant); assembling the system; providing a wrap on warranties; integrating the controls and energy management system (EMS); often providing project design and engineering expertise; and providing operation, monitoring and maintenance services.

- As the industry continues to evolve many system integrators vary in the degree of both upstream and downstream integration, with specific responsibilities often varying by contract and customer requirements.

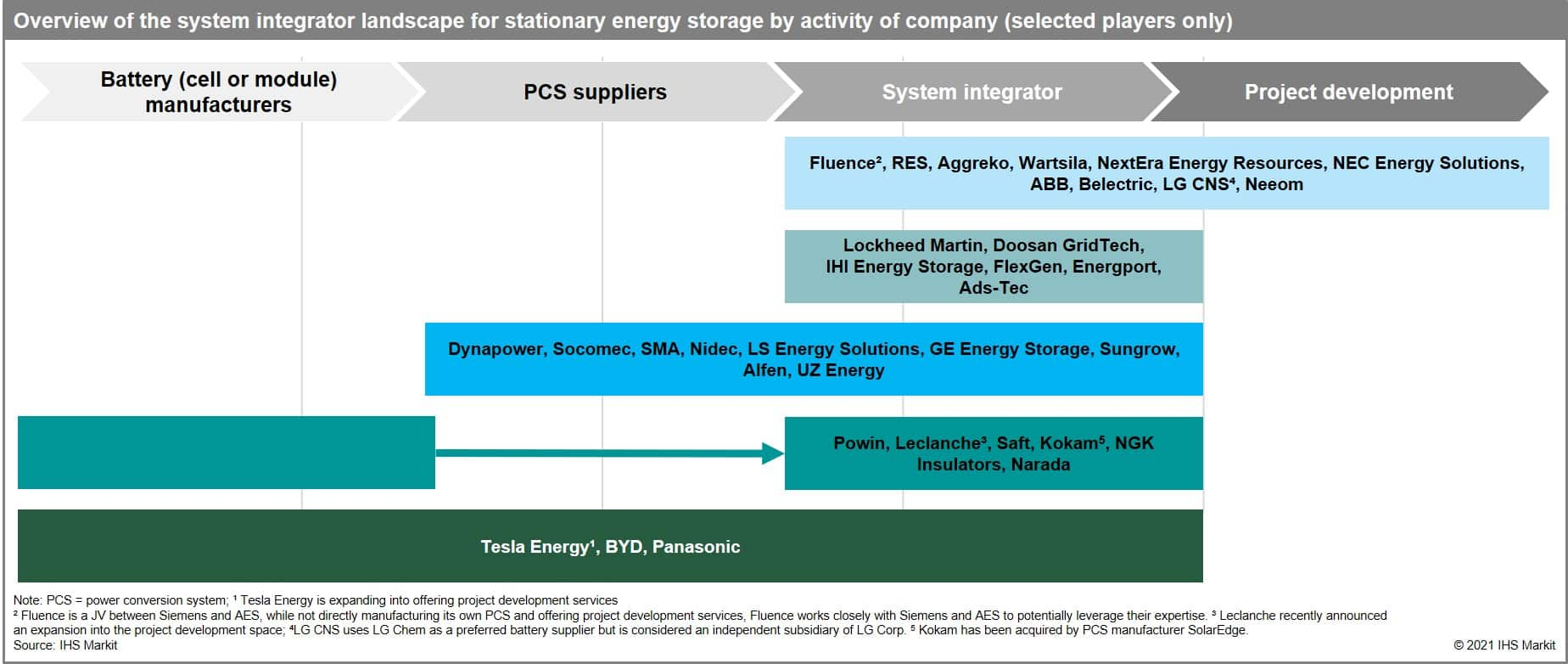

Figure 1 - Overview of the system integrator landscape

The competitive landscape is diversifying. With significant project pipelines, dwarfing the existing installed base, energy storage inverter (power conversion system - PCS) manufacturers are expanding their presence targeting solar plus storage applications and existing integrators are challenging the incumbents. As Figure 1 highlights, there are many players active across individual or multiple segments of the value chain, with especially inverter (PCS) manufacturers moving across to offer fully integrated solutions.

There also remains a large degree of regional diversity in the market. As the energy storage market initially grew in selected regional pockets, many local technology firms and new entrants targeted the segment. Following a first phase of acquisitions around 2017, and the development of new regional markets, an increasing number of global players is emerging. Some markets such as Germany, South Korea and mainland China however remain dominated by local players.

The traditional system integrator model will be challenged by new entrants and potential disintermediation

Despite the growth in the market and the continued diversity of suppliers - especially on a regional level - challenges in the system integrator model are being laid bare. In the long run, simple procurement, and assembly of components without any further vertical integration will lead to erosion of margins and eventual exit.

New entrants and potential disintermediation will increase price competition, as the addressable market for system integrators simultaneously shrinks. While pure-play (i.e. without in-house manufacturing of components) integrators will face heightening competition and lower hardware margins, they can also pursue a range of strategies to mitigate against decreasing margins from the hardware business.

Changing product and solution strategies will help strengthen the system integrator model, but the supplier landscape will inevitably change

To thwart the threat of vertically integrated suppliers, new entrants, and potential backward integration from developers, the energy storage system integrator must evolve. This evolution will be characterised by offering more holistic solutions that include stronger software and operations offerings and superior project execution. Product standardisation will help reduce system assembly cost and drive procurement scale. Lastly integrating upstream component expertise or downstream project development and operations capability - mainly through acquisition - will help diversify revenues and stack margin.

Nonetheless, energy storage is characterised by a unique mix of technical, commercial, regulatory, and development challenges, that will play into the strength and experience of traditional system integrators to take on and offer a full wrap of technology risk. Therefore, the system integrator model will not become obsolete in the coming 5 years. Instead continuous evolution of their business models will create a smaller number of solution providers, while hardware commoditises, and smaller regional players consolidate.

To learn more about our energy storage research, visit the page for our Global Clean Energy Technology service.

Julian Jansen in associate director in the Climate and Sustainability Group at IHS Markit and leads consulting activities on clean energy technologies and market.

Posted 10 February 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.