Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 24, 2024

How could Labour’s proposal to remove the Energy Profits Levy's investment allowance affect UK field development economics?

As the UK approaches the General Election on July 4, 2024, it seems inevitable that the Energy Profits Levy (EPL) will remain in place in order to generate much needed tax receipts to fund political Parties pledges. With the Labour Party leading in the polls, there is growing speculation about the potential implications for UK field development economics if Labour were to come into power.

Labour proposes to increase the tax rate from 75% to 78% and extend the sunset clause to 2029, a move already put in motion by the Conservative government in March 2024. However, in addition to the tax increase, Labour is removing the Investment allowance (IA), which provides a 91.4% tax relief on capital expenditure.

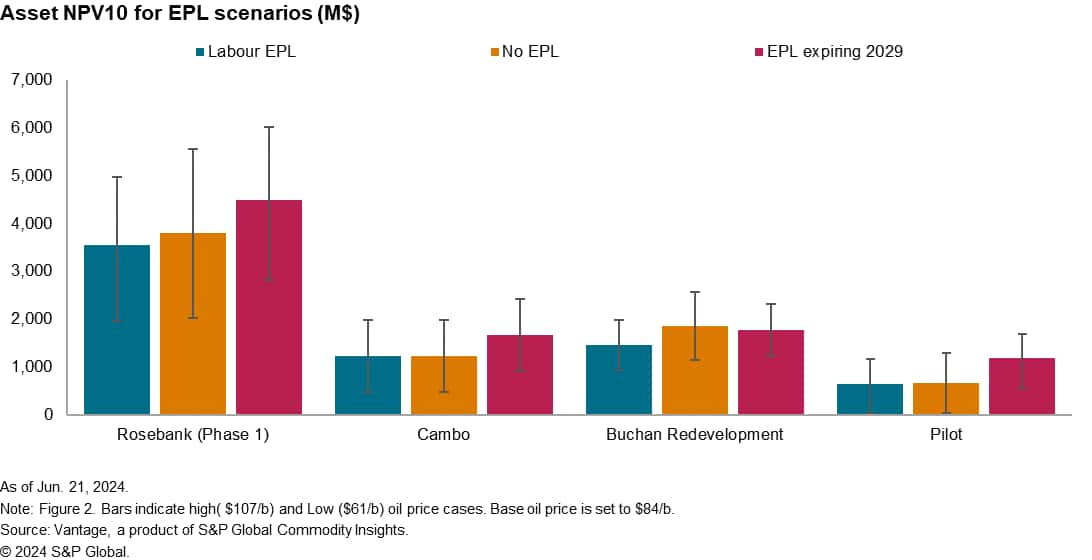

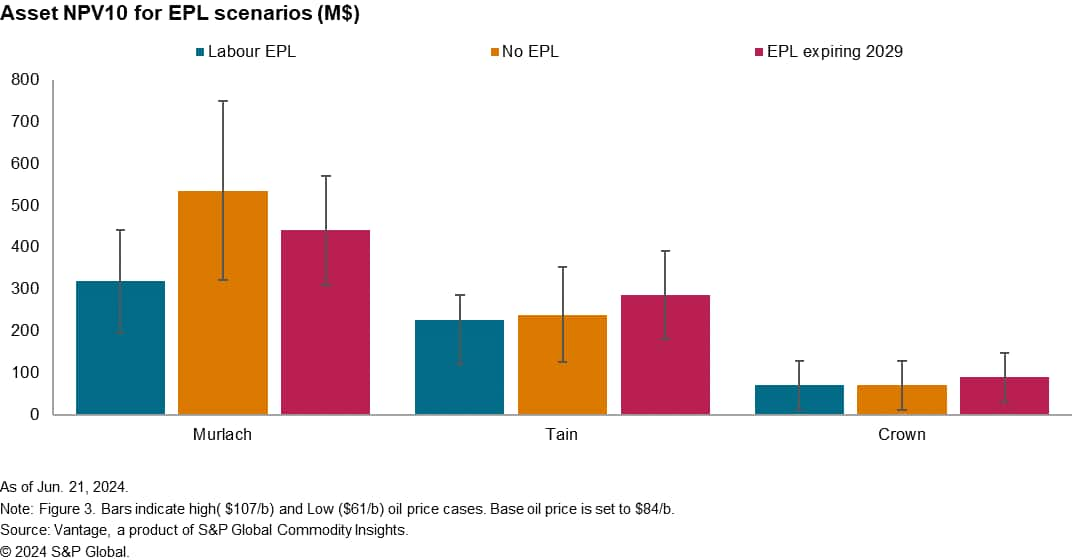

The impact of Labour's proposal would reduce the Net Present Value (NPV) of both high and low capital expenditure projects, primarily resulting from the removal of the IA. This is highlighted by projects such as the largest undeveloped field in the UK, Rosebank, and BP's Murlach redevelopment, a low capex subsea development, which both experience an NPV reduction of over 20% compared to the current fiscal regime.

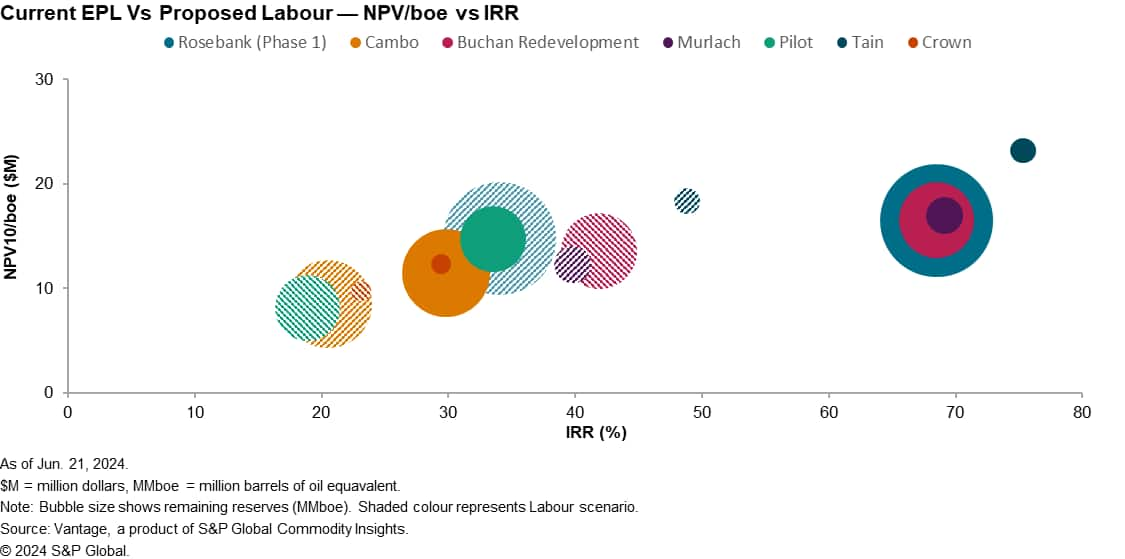

While some projects may still proceed due to their resilience to market conditions, such as Tain and Rosebank, there is a potential overall reduction of approximately 37% in the Internal Rate of Return (IRR) for the seven projects outlined in Figure 1. Labour's proposed revision could deter investment across the UK and further contribute to the decline in oil and gas production.

The greatest effect is expected for Rosebank, which has a committed investment of $3.8 billion. The latest Conservative Party revision resulted in a minimal reduction of approximately 4% in the NPV of the project. However, thanks to the IA, the NPV of the project increased by $800 million over a no EPL scenario. Without the IA, the NPV would have been reduced by 19%, highlighting the positive impact of the IA on large capex projects (see Figure 3). In a proposed Labour scenario, Rosebank will see an IRR reduction of over 50%, however, due to its significant NPV, the project does still remain profitable. Even in a low oil price case without the addition of the IA, Rosebank is expected to yield over $8 NPV per barrel of oil equivalent (boe). In contrast, the current fiscal regime is projected to yield over $16/boe in a base case oil price scenario in 2029.

Projects that will experience a similar NPV in both a Labour or no EPL scenario are the Pilot and Cambo fields, however, these show a significant uplift where the IA is present. The Pilot field gains an NPV uplift of ~$530 million where the IA is applied helping to justify the project. The same can be seen for the Cambo field which gains 9% IRR and $3 NPV/boe. The Pilot field is more sensitive to fluctuations in oil price due to its reliance on the IA and its relatively lower return on investment compared to Rosebank. In a low oil price scenario, the NPV drops to approximately $30 million under a Labour government and no EPL scenario.

For subsea tiebacks, the effect of the EPL and IA is not as clear cut when compared with larger developments. This is because of factors including both the development schedule and concept having a significant influence on the differing EPL scenarios. The Murlach development, for example, experiences a reduction of $50 million in NPV due to the 2029 EPL terms, compared to a scenario without the EPL. Conversely, the Crown development benefits from the one-year EPL extension, allowing an additional year of IA to be applied to the capex that is planned in 2028 and 2029.

It is worth noting that NPV alone is not the only metric to consider when evaluating project viability. The Tain project, a smaller 12 million boe asset, demonstrates strong returns in the 2029 fiscal regime, with over $23 NPV/boe and an IRR exceeding 75% in a medium oil price scenario. The project also remains resilient to oil price and fiscal changes due to the project timing and low capex resulting in a strong return on investment. In a Labour scenario the project also yields the best returns out of the other evaluated assets with a > $18NPV/boe and IRR ~49%.

In conclusion, the extension of the EPL and the potential removal of the investment allowance have significant implications for the UK energy sector. The revisions to the fiscal regime have both positive and negative impacts on project economics, with large capex projects being particularly affected with the removal of the IA. The most damaging element has been the constant revisions to the policy with companies lacking the confidence to commit long-term investments as a result. An example of this has been Harbour Energy who are on track to complete the takeover of Germany's Wintershall DEA in the fourth quarter, 2024. The deal aims to diversify its portfolio away from the UK with assets in Germany, Mexico, Norway and Argentina following the continual changes to the EPL policy. Industry awaits the outcome of the general election and the potential consequences of Labour's proposed changes.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-could-labours-proposal-to-remove-the-energy-profits-levys.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-could-labours-proposal-to-remove-the-energy-profits-levys.html&text=How+could+Labour%e2%80%99s+proposal+to+remove+the+Energy+Profits+Levy%27s+investment+allowance+affect+UK+field+development+economics%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-could-labours-proposal-to-remove-the-energy-profits-levys.html","enabled":true},{"name":"email","url":"?subject=How could Labour’s proposal to remove the Energy Profits Levy's investment allowance affect UK field development economics? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-could-labours-proposal-to-remove-the-energy-profits-levys.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=How+could+Labour%e2%80%99s+proposal+to+remove+the+Energy+Profits+Levy%27s+investment+allowance+affect+UK+field+development+economics%3f++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-could-labours-proposal-to-remove-the-energy-profits-levys.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}