How do batteries make money in US power markets?

Battery energy storage systems (BESS) are on the cusp of rapid growth in US wholesale power markets. But the unique operating characteristics of BESS—notably rapid response speed, bidirectional capability, and energy limitations—mean the nature of BESS participation in power markets is poorly understood. What services will they provide? How much money can they actually make? What are their operational strategies?

These and other questions are at the heart of a new report which examines wholesale market transactions by BESS using FERC's Electric Quarterly Reports (EQR) database. The EQR database contains purchase and sales data for all FERC-jurisdictional generators on an interval by interval basis—which, in the case of batteries, often means hourly transactions in the day-ahead energy and ancillary services markets, and five-minute transactions in the real-time energy markets. This rich dataset provides tremendous insight into how existing BESS are actually being dispatched and compensated in wholesale power markets today.

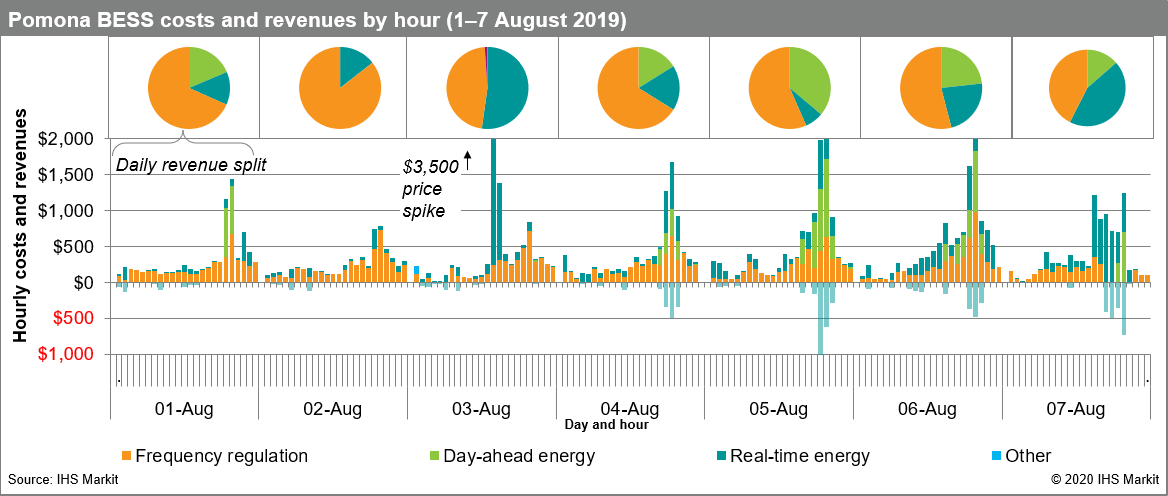

Figure 1 demonstrates the data quality by showing the hourly transactions for the "Pomona" BESS—a 20 MW, 80 MWh system in the California Independent System Operator's (CAISO) market—over the course of a week in August 2019. We observe several notable insights:

- The BESS appears to follow a consistent pattern of providing regulation throughout most of the day before dispatching into the energy markets during the evening ramp and peak period.

- Revenue-positive transactions greatly outweigh revenue-negative transactions—suggesting the BESS is charging during times when real-time prices are negative, or it is only providing down-regulation. In either case the BESS is effectively being paid to charge.

- There is significant volatility in the revenues from the real-time energy markets. We think this suggests the BESS is bidding small amounts of capacity into those markets hoping for a price spike—like on August 3rd—which leads to windfall profits.

- In several cases, the BESS earns revenues from frequency regulation, day-ahead energy sales and real-time energy sales within the same hour. Though the results vary from day to day, the general strategy of apportioning capacity across different market products—i.e. "value stacking"—appears to maximize revenues relative to a strategy dedicated to a single market product. In other words, the BESS's revenues are higher than they would be if it had bid its full capacity exclusively into the regulation market every day.

The dispatch patterns and revenues of the BESS's in our sample set vary across projects and markets, though a few common themes emerge. Most notably, the projects in our sample set are earning very high net revenues, ranging from $75-320/kW-year. Five of the eight projects earn over $150/kW-year. For context, gas peaker plants, to which BESS are often compared, typically earn $50/kW-year or less, though their revenues are concentrated in energy markets rather than ancillary service.

Another common theme is the emphasis on frequency regulation, and to a lesser extent the real-time energy market. On average across the sample set, two thirds of revenues are attributable to frequency regulation, and another 15% to the real-time market. The emphasis on these two markets makes sense as they are both well-suited to flexible resources that can quickly ramp up and down.

A final key theme we observed was how concentrated the hourly earnings were across projects. On average the BESSs earned over a third of their annual revenues across only 5% of total hours. In most cases revenues were still decent in the other 95% of hours, but all the cases demonstrated huge revenues over a small subset of hours.

Over the coming years, as more BESS flood into these markets, we can expect the smaller ancillary service products to saturate somewhat and their associated prices to decline. On the other hand, the continued growth of wind and solar should increase price volatility in the day ahead and real-time energy markets, making them more attractive to BESS. So while revenue streams and operational strategies are likely to shift in the coming years, the flexibility of BESS means they should remain well-positioned to capitalize on new opportunities.

IHS Markit closely monitors the global energy transition, publishing data, key insights and market analysis. Learn more about our research.

Sam Huntington is an Associate Director in the Gas, Power, and Energy Futures team at IHS Markit.

Oliver Forsyth is a Senior Analyst in the Gas, Power, and Energy Futures team at IHS Markit.

Posted on 21 November 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.