How global integrated oil companies are dealing with the oil price downturn: Is conventional supply at risk?

This is the second article in a three-part series covering the impact of low oil prices on global integrated oil companies. Did you miss part one? Read our analysis on weaker balance sheets for GIOCs.

Conventionals have accounted for about 90% of current production in aggregate. This blog post takes a look at different scenarios to help portray the outlook and how different oil price scenarios might impact the longer term supply outlook.

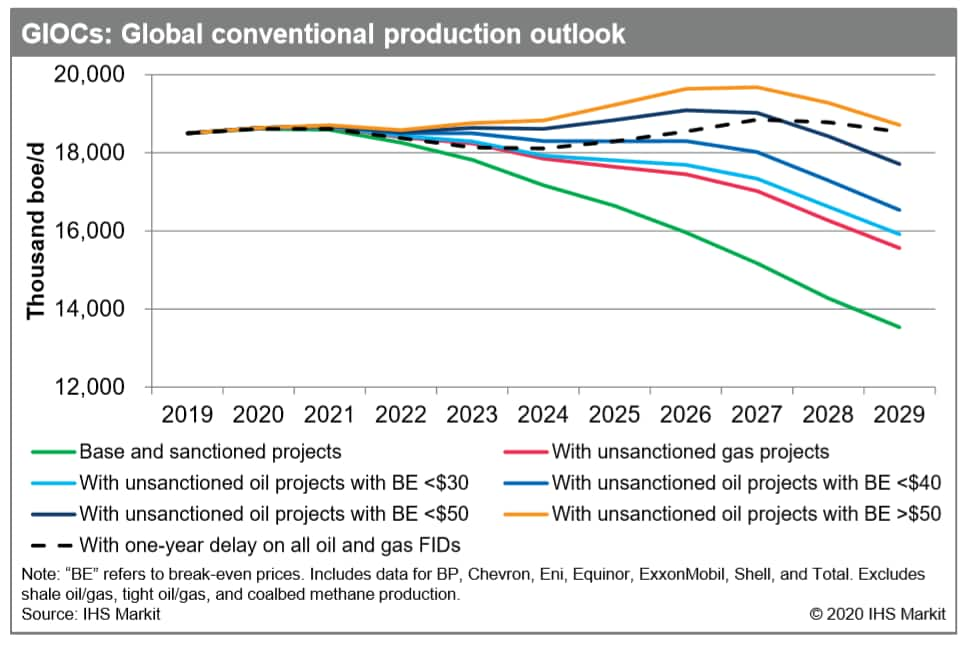

Global conventional oil and gas production, in aggregate for this group, shows a convergence in terms of the impact across all these different scenarios. If we look at production for 2020 through 2021 and 2022, we see a relatively muted supply impact, even as we take into account very extreme, different scenarios. Under an extreme scenario whereby there is an indefinite halt to all future FIDs, aggregate peer group conventional oil and gas output would remain flat through 2021, before declining at a 4% compound annual growth rate thereafter. A $40/bbl oil price would lead to relatively flat output through 2023, assuming continued gas project sanctioning. Assuming a one-year delay to all oil and gas FIDs through the mid-2020s, conventional output would fall by 2% between 2019 and 2024, rising thereafter.

Figure 1: GIOCs: Global conventional production

outlook

There are a few factors driving the conventional supply story. It's also important to note that this outlook is in stark contrast with the unconventional picture where we're likely to see a much more immediate supply impact.

One consideration is most sanctioned conventional projects are likely to continue progressing, just given the capital and operational resources that have already been committed and deployed. We believe it's likely that we'll see a few delays to these projects. We could also see situations where sanction projects get deferred by a few quarters as companies look to defer any spending that might be flexible. But, for the most part, we are assuming that the majority of these volumes go ahead on schedule.

The other thing driving that short-term impact is that we expect most of the existing production to remain online. For any of these companies to shut in existing production, we would need to see steep and sustained price declines.

If you look further out the curve, you start to see more of a divergence across these different scenarios largely based on breakeven prices. Assuming a flat $30 oil price scenario, all projects that are economic at those levels go ahead and we see a muted impact. We don't have a whole lot of projects in these companies portfolios that are economic at those levels. For the next scenario, oil projects with break-evens below $40 go ahead, we have a flatter decline. In fact, with production remaining flat, we make it towards the middle of the decade before it starts to decline. We have more projects that are economic in that price range. It's not until we get to the $50 price where we actually see some growth.

Finally, we assumed a blanket one-year delay to all FIDs for all the oil and gas projects in our portfolio. And in that case, we do see a near term decline sort of through 2023 and 2024 before production starts to pick back up and reach normalized levels by the end of the decade.

If we look at these different scenarios and diversions across these different outlooks, it really highlights the challenges that these companies are facing with respect to their conventional portfolios. In short, these operators have much more flexibility to adjust capital and drilling decisions based on short term market fundamentals.

In particular, if we're talking about Greenfield conventional projects, we're looking at sort of a three to five-year lag time between a final investment decision and first oil or first gas. That means companies need to maintain a longer-term view of oil prices. The question for these companies is not "what is the oil price today", but "what will the oil or gas price be when this project comes online?"

There are other considerations beyond just project break-even prices that will impact final investment decisions. So, we'll continue to monitor those developments and adjust our outlooks.

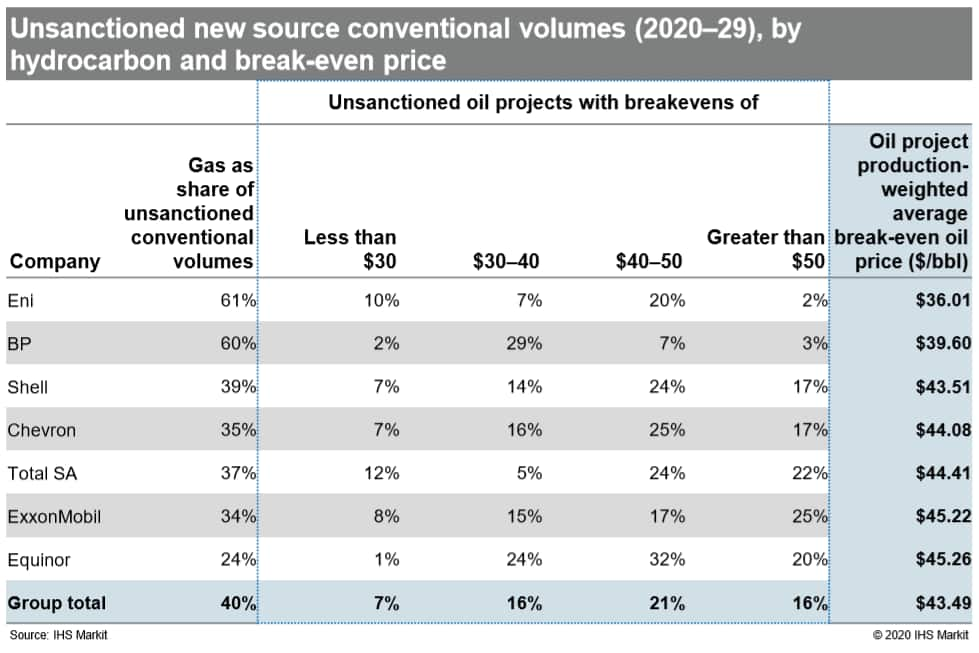

Production portfolios have become increasingly resilient

GIOCs have increased the resilience of their portfolio significantly in recent years, particularly following the 2014 price declines. An array of elements came into play to make company portfolios more efficient, including cost reductions, project redesigns, prioritization of higher quality projects and divestitures of non-core assets. All of these have made the overall portfolio more resilient to a low-price environment.

Figure 2: Unsanctioned new source conventional volumes

(2020-29), by hydrocarbon and break-even price

We see significant discrepancies within the portfolio—more than half of the oil volumes that we see in these unsanctioned portfolios are tied to projects with a break-even above 40. That said, if we factor in the gas projects that we see as being economic and going ahead in the current environment, we get to a situation where about two thirds of the unsanctioned oil and gas portfolios for these companies are economic in a $40 oil price environment.

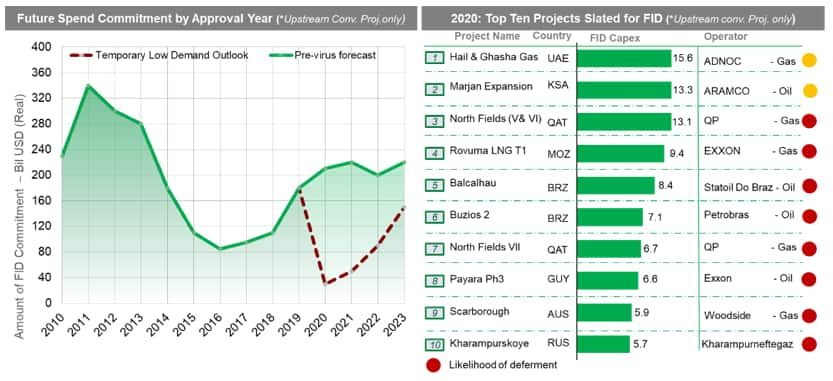

Challenging Economics for Project FIDs

One of the critical ways we gauge the pulse of the industry in challenging times such as these, is to assess the commitment of IOCs to capital spending (FIDs). Upstream projects for final investment decision face a double whammy of challenges: a low oil price that has shaved off a significant amount of their economic value and project delays that could erode further value.

Figure 3:Future spend commitment by approval year and

top 10 projects slated for FID in 2020

At the turn of the year (pre-COVID-19), with the oil price in the lower $60/bbls, we had a forecast where the aggregate value of FID approvals for 2020 would be approximately 20% higher than 2019 figures (at approx. $215 billion). Unfortunately, the drop in the oil price makes that forecast untenable, and so we have revised our forecast as shown in figure 5.

Under the current reality, where the oil price is languishing at sub-$40/bbl levels, our forecasts show that approx. 85 - 95% of FIDs for this year are at risk of being deferred or postponed. Many of the projects that will be impacted by these deferments are large oil, large gas-to-power and gas-to-LNG developments, which are capital intensive, and have high economic break-even prices.

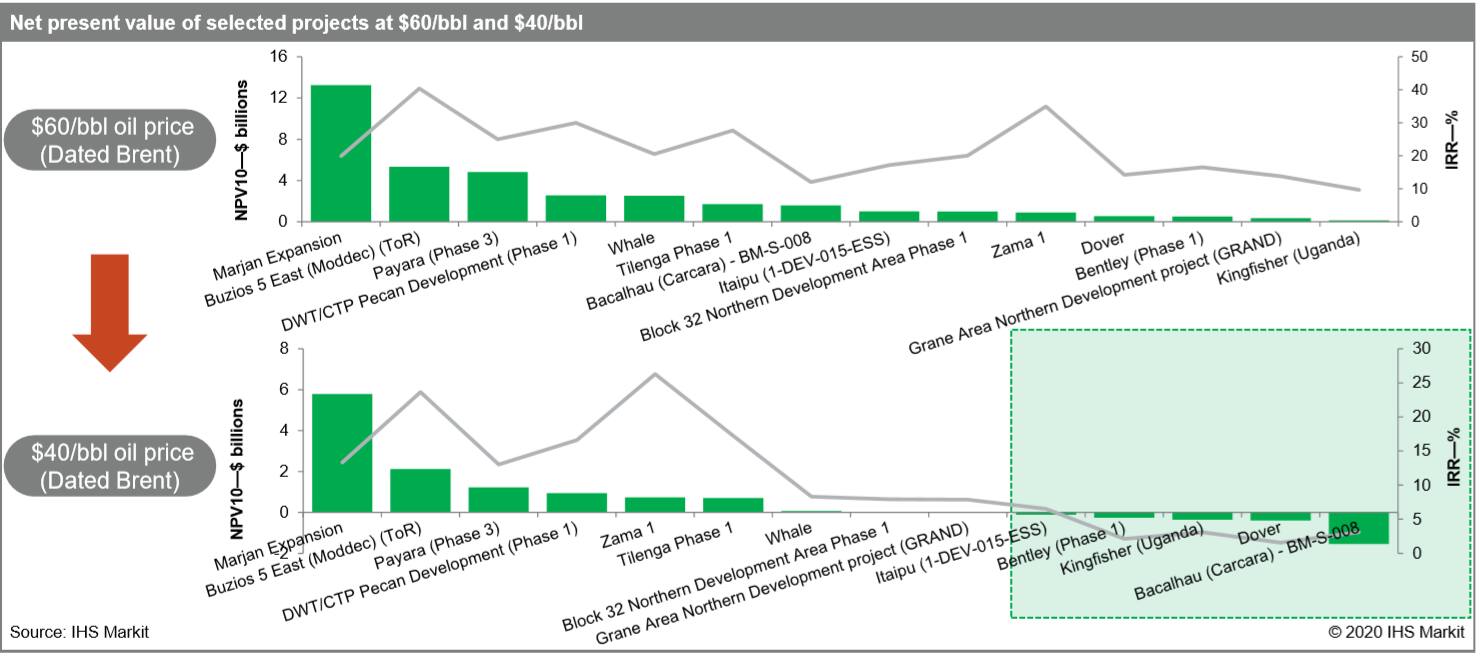

Figure 4: Net present value of selected projects at $60/bbl and

$40/bbl

To illustrate why many projects will likely face delays, in figure 6 we have outlined the net present value analysis of several projects at two price points $60/bbl and $40/bbl. At $60/bbl most of the projects show relatively attractive economics (decent NPVs and IRRs in the 20%s). With the oil price down to $40/bbl, the economics of the projects becomes challenged -with many showing negative NPV and IRRs. On the average, 55% of the value of key projects was shaved off -which suggests that project cashflows will be significantly impacted and are therefore likely to be deferred or postponed.

In summary, many of the projects which may be deferred may come back into consideration in 2021 and 2022, however , they will undergo significant redesign, field development plan (FDP) revisions, etc., to be made "fit" for the new lower oil price world.

That said, there is a risk that for some projects, the combination of delays, the low-price environment, and the accelerating energy transition may mean their economics become very challenged—thus they could become "stranded assets" and never see sanction.

Given the constant changes in the state of the oil markets, these various scenarios and potential outlooks for global integrated oil companies, are in flux.

Learn about our upstream companies and transactions service.

Read the final article in the series, where our experts share insights on low-carbon investments.

Chris DeLucia is an associate director of research & analysis at IHS Markit.

Posted 08 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.