IMF conditionality after the COVID-19 pandemic

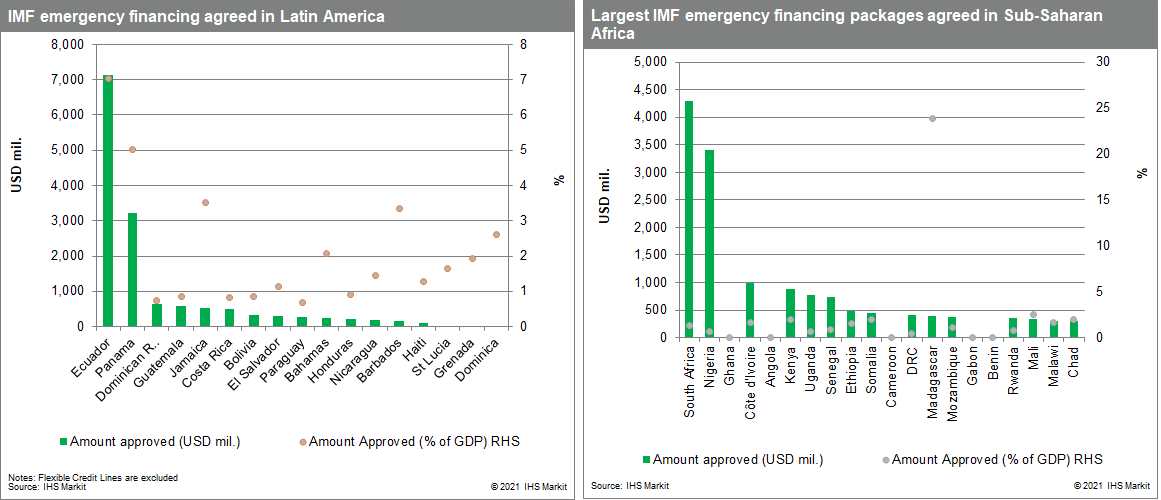

The International Monetary Fund (IMF) has approved USD102.3 billion in emergency coronavirus disease 2019 (COVID-19)-related assistance to 83 countries in 2020, of which 62.3% (USD63.8 billion) was granted to 21 Latin American and Caribbean countries, and 16.4% (USD16.8 billion) was granted to 34 countries in sub-Saharan Africa. The funds have been key in creating the fiscal space for governments to deal with the negative economic effects of COVID-19 and were disbursed with very little of the IMF's traditional conditionality. In the wake of COVID-19, the conditionalities underpinning IMF lending are set to evolve as countries in Latin America and sub-Saharan Africa transition to official programs.

Transitioning from emergency support

Funding disbursed through the International Monetary Fund's (IMF) emergency Rapid Funding Instrument (RFI) and Rapid Credit Facility (RCF) has involved virtually no conditionality. It was granted without specifying fiscal deficit targets, with its one main requirement being to demonstrate that proceeds would be spent on pre-determined coronavirus disease 2019 (COVID-19) virus pandemic-related response efforts. By allowing beneficiaries to "do whatever it takes but keep the receipts", public spending to sustain social programs and provide financial aid to those affected by the pandemic has been maintained. Furthermore, the IMF in October 2020 extended by six months the annual quota available for eligible countries to access financing under the RFI and the RCF, whereby 100% of a country's annual IMF quota can be used to access funding until 6 April 2021. As this emergency support ends, countries in Latin America and sub-Saharan Africa will transition to more traditional IMF lending programs, involving more stringent demands for reform and economic adjustment.

Returning to fiscal consolidation

A common factor in the latest IMF programs is the need for continued fiscal consolidation, with this policy advice also being cited in several large RFI and RCF programs. Where IMF programs were agreed prior to the pandemic, a return to fiscal consolidation is expected after the impact of the COVID-19 shock has abated. The characteristics of post-pandemic conditionality vary depending on the circumstances of each country, but common characteristics include:

- An expectation that fiscal consolidation will resume from late 2021, or once the COVID-19 virus pandemic has abated

- Reducing wage bills and/or implementing civil service hiring freezes

- Freezing spending to specified levels on goods and services

- Suspending specific capital expenditure outlays

- Broad increases in tax revenue, particularly where tax-to-GDP ratios are low

- Implementing or expanding VAT regimes

- Reversing pandemic-related expenditures, such as fiscal outlays for healthcare and social protections.

There are also signs of continued flexibility with respect to the type of conditionality and how conditions are expected to be met - namely by permitting the immediate disbursement of funds with reviews being deferred by 12 months, or otherwise re-phasing the disbursement of funds under existing programs. In any case, the return to fiscal consolidation in 2021-2022 to assist countries in restoring their debt sustainability will signal renewed efforts to impose spending cuts, threatening an increased risk of political opposition and protests within Latin America and sub-Saharan Africa.

Facilitating coordinated debt restructuring

Traditional IMF programs and monitoring will also be reasserted through the facilitation of coordinated debt treatments, in principle involving official bilateral and private creditors. The Group of 20 Nations' (G20) Common Framework for Debt Treatments launched in November 2020 specifies that participants are expected to undertake an IMF Debt Sustainability Assessment (DSA) and commit to an IMF program, including policy reforms sought by the IMF in return for additional financing. At present, the scheme is only accessible to the 72 International Development Association (IDA) borrowing countries, in addition to Angola, but the IMF and the World Bank have advocated for expansion of the Common Framework ahead of the next G20 finance ministers' meeting that is scheduled to be held on 26 February. The Fund's DSA examines the sustainability of a country's debt profile and provides an assessment of the sovereign's ability to pay: lower confidence implies stricter program conditionality to restore debt sustainability and access debt treatment provided under the Common Framework.