Impact of Brexit Uncertainty on the Imports of Polyester and Nylon Fibers in the United Kingdom

Brexit uncertainty has cast a dark cloud on the UK economy since

the referendum in June 2016 when the United Kingdom chose to leave

the European Union. Since then, there has been slow down in foreign

investments and new manufacturing capacity. Consumer confidence has

also taken a hit. Leaving the European Union with or without a deal

has created a high degree of uncertainty for the textile industry

also.

Currently as part of the European Union, the United Kingdom enjoys

free movement of goods within the union. Being part of the EU, the

UK is also a member of many duty-free and duty-preferential

treatments with other countries for a variety of products which

include textiles and its raw materials, such as polyester and nylon

fibers (staple fibres and filament yarns). Currently, the importing

of polyester and nylon fibers into the EU from a non-member

country, with no free trade agreement or Generalized System of

Preferences (GSP) benefits, incurs a 4% import duty. In the UK, the

major demand of these products is met by imports. The following

article discusses whether there has been any change in the supply

pattern of these products to the UK from EU countries and non-EU

countries in recent times.

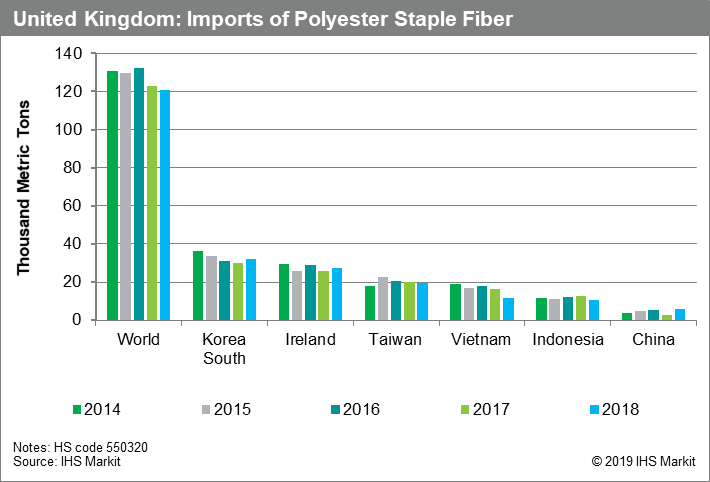

Polyester Staple Fiber:

UK imports of polyester staple fiber (PSF) have reduced

from 131 kta in 2014/2015 to 121 kt in 2018. The quantities reduced

by 9% from 2016 to 2018. The top 5 PSF exporters to the United

Kingdom in 2018 were South Korea, Ireland, Taiwan, Vietnam and

Indonesia. These 5 countries met 80% of the UK's PSF demand.

Imports have reduced from most of the exporting countries. The main

reduction is observed in imports coming from Vietnam, with a 35%

reduction from 2016 to 2018. There is about a 5% reduction in

imports from Ireland and Taiwan in this time frame.

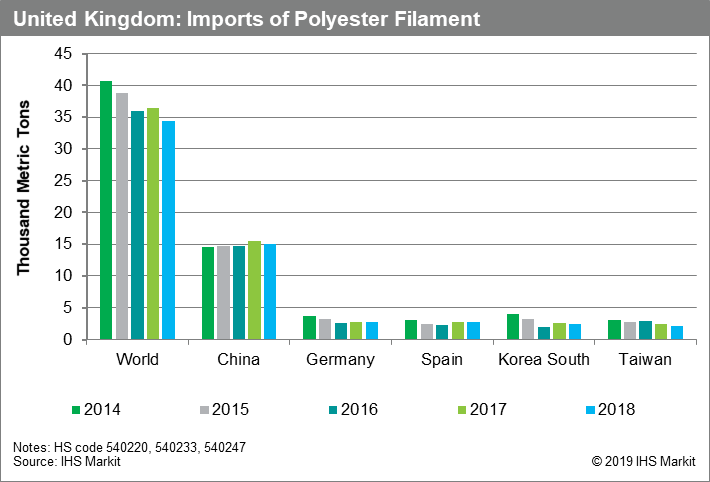

Polyester Filaments:

The imports of polyester yarns have also been in decline.

Import volume has dropped from 40.5 kt in 2014 to 34.3 kt in 2018,

a reduction of 10%. In the last three years, import volumes reduced

by 5% in 2018 when compared to 2016. Until 2015, about 8 kta of

Partially Oriented Yarns (POY) was imported in the UK, however,

these quantities reduced to 2 kt in 2016 and were almost negligible

in 2017 and 2018 implying that polyester texturizing has now

declined to minimum in the UK. Textured import quantities increased

from 18 kt in 2017 to 19 kt in 2018 however, Fully Drawn Yarns

(FDY) import quantities have reduced from a level of 9 kt per year

in 2014/15 to 6 kt per year in 2017/18.

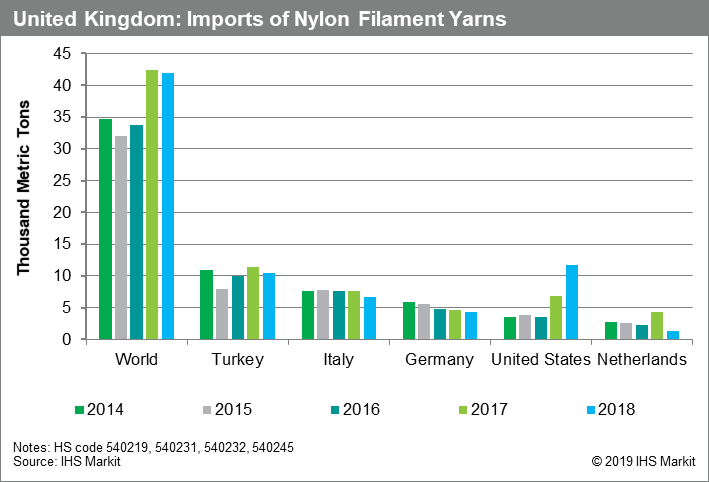

Nylon Filament Yarns (Textiles, Industrial and BCF for

Carpets):

The import quantities of nylon filaments have increased

from 25.5 kt in 2014 to 33.3 kt in 2018. The major imports

quantities increased in 2017 and 2018, mostly in Bulk Continuous

Filament (BCF) yarns, which are meant for carpets end use. BCF

quantities increased from 15 kt in 2016 to 22.5 kt in 2018, which

represents an increase of about 50% in just two years.

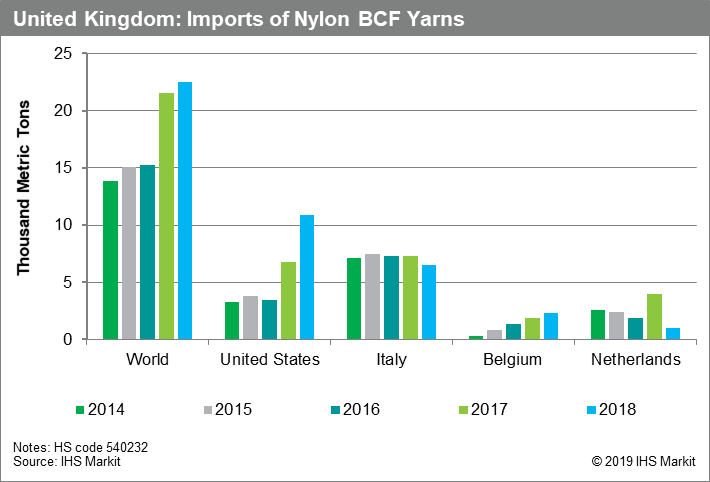

The major exports of BCF to the United Kingdom have come from the

United States, Italy, Belgium and the Netherlands. Import

quantities increased significantly from the United States in the

last two years, from 3.5 kt in 2016 to 11 kt in 2018. BCF yarn

quantities have increased from Germany while they declined from the

Netherlands in 2019.

UK imports of nylon industrial yarns have been stable in the range

of 7-8 kt per year since 2014. Similarly, the import quantities of

nylon textured yarns have been stable in the range of 11-12 kt per

year, except in 2015 when 8.5 kt was imported into the UK. Nylon

Fully Drawn Yarn (FDY) quantities have reduced from 1.7 kta in 2013

to 0.5 kta in 2018.

As of now, the custom tariffs in the UK for polyester and nylon

fibers will remain unchanged until the announced Brexit date of

31st October 2019. There has already been some change in

the import patterns as explained above. We feel that the product

flow of these products between the UK and the EU countries will be

impacted further if non-EU 3rd country duties come into

place between the European Union and United Kingdom in the event of

a no deal.

Similarly, many such analyses and the expected impact of current market factors are covered in our World Analyses for Polyester and Nylon Fibers. Such subscription will provide deep market insight into the major challenges these industries are facing.