In search of better days: Five anticipated trends in 2021 for global power and renewable markets

The COVID-19 pandemic made the year 2020 unprecedented for power and renewable markets worldwide, with significant demand disruptions, declines in fuel prices, changes in energy consumption profiles, asset sales and acquisitions, and new initiatives to green the power sector.

As 2021 begins, IHS Markit considers five key trends that could profoundly define global power and renewable markets this year.

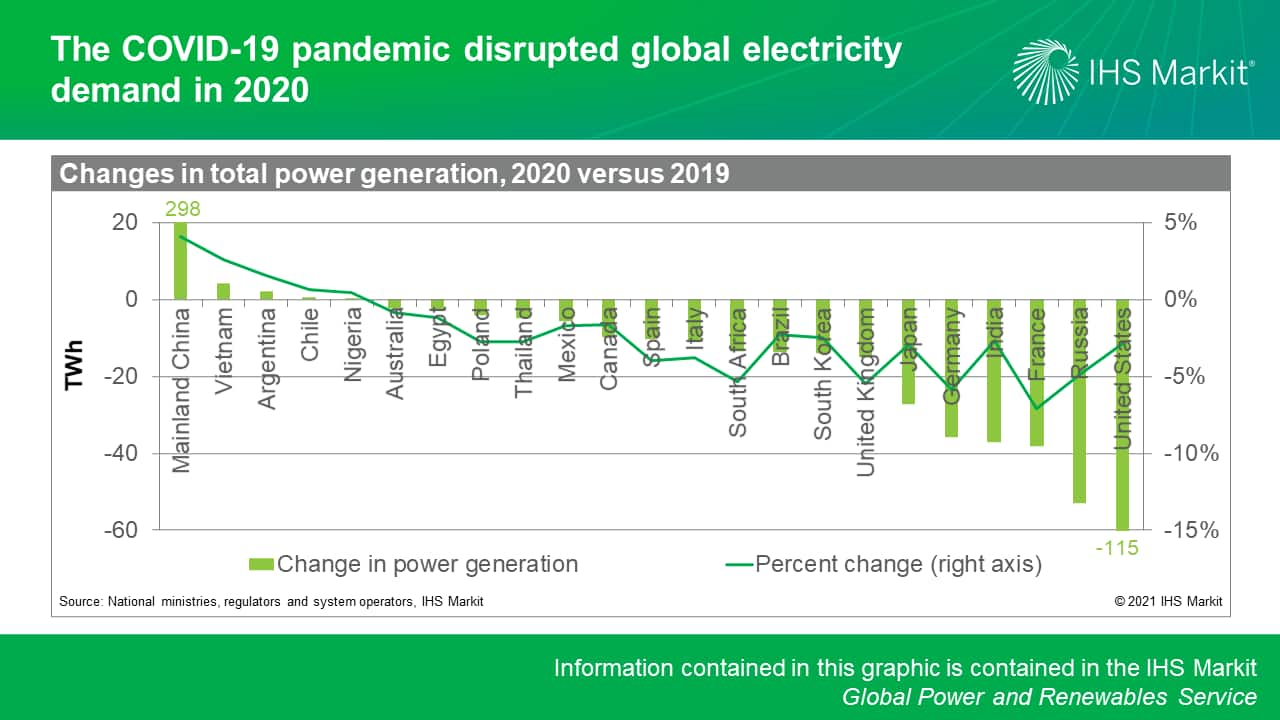

Power demand will slowly recover from COVID-19 disruptions

The COVID-19 pandemic disrupted global electricity demand in 2020. In the United States, retail sales were down by about 4% in 2020 compared with 2019. In the EU27, total demand contracted by 6% year on year. In India and Brazil, consumption fell by 2-3%.

Still, power demand has been notably resilient. Out of the 39 countries studied by IHS Markit, representing about 90% of global power consumption, 33 countries had power demand declines in 2020 that were smaller than their GDP declines (or in a couple instances, demand growth higher than GDP growth).

It is not yet clear how much or how fast demand will recover in 2021. Nevertheless, IHS Markit expects global GDP to grow healthily in 2021 and this provides the seeds for power demand to begin recovering in most countries. For example, according to our reference forecasts, US and European demand should return to 2019 levels by 2022 and 2026, respectively.

Net-zero pledges and climate targets will shape power supply trends

Interestingly, the uncertainty caused by the current economic crisis has stimulated a power sector transition from fossil fuels to cleaner energy sources.

Mainland China's momentous 2020 pledge to become net zero by 2060 sets 26% of today's GHG emissions on a path toward eradication. The United States rejoined the Paris Agreement in January 2021. In Europe, the European Commission will this year start reviewing its renewables target, its carbon market and possibly a carbon border tax.

These pledges—and those of the private sector—have several consequences for power markets worldwide: more countries are turning to carbon trading schemes, coal plant retirements will accelerate, investments in new gas-fired plants could be risky yet the fuel is often needed for system reliability, and flexibility in technology choices is needed.

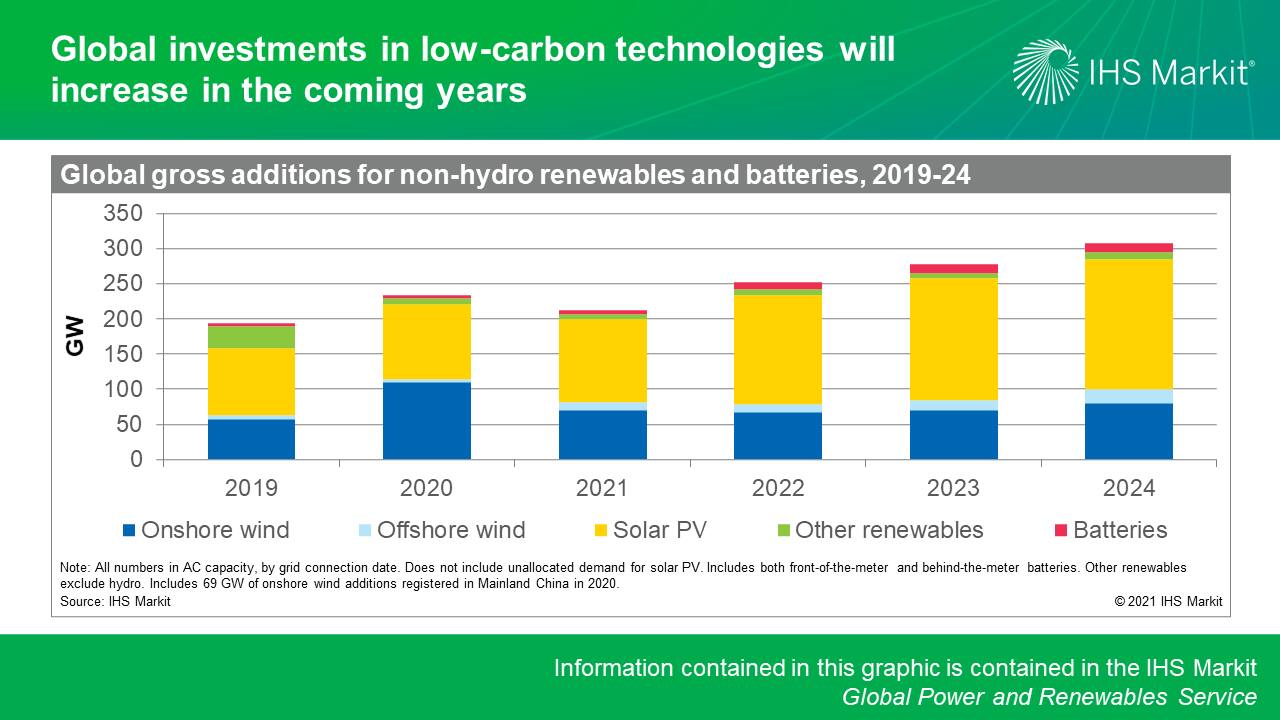

Cost declines will encourage greater penetration of new technologies

Annual solar installations are predicted to grow by more than 10% in 2021. Onshore wind additions will experience a rush of new installations this year in markets facing subsidy cuts, including the United States and mainland China. Offshore wind deployments will double in 2021 compared with 2020, with 11 GW planned for commissioning.

The drivers of this growth vary by technology. Solar PV and onshore wind deployments will often depend on auctions and corporate activity. For example, India may tender about 40 GW in 2021 to meet its renewable targets.

In contrast, growth in more nascent technologies will lean heavily on government support. IHS Markit predicts that global sales of electric vehicles will rise about 70% in 2021, with mainland China and Europe as the largest markets. Energy storage systems will make big inroads with, for example, every new solar project in California currently coming with a battery attached. Finally, policies encouraging low-carbon hydrogen should advance in 2021.

New players will actively partake in the power sector

M&A activities could be vigorous in 2021 as companies streamline portfolios or invest in new opportunities after a period of lower energy demand and prices, high competition, and low project margins.

Many large and primarily European oil and gas (O&G) companies have significant expansion plans for renewable energies over the coming years. According to IHS Markit data, O&G companies made 18 acquisitions in the solar and wind generation sector in 2019 and 17 in 2020, compared with 9 in 2018.

On the power demand side, corporations have increased their focus on power procurement to green their consumption. Corporate renewable energy deals in the United States nearly matched those of all other US renewables contracting in 2020. In Europe, corporations signed about 4.7 GW of renewable power purchase agreements (PPAs) in 2020. The entrance of new companies in this space suggests that the PPA consumer base will expand globally, providing an outlet for new renewable production.

System adequacy and reliability will be more prominent in policymaking

The drop in 2020 demand and associated rise in renewables penetration caused by the COVID-19 crisis accelerated discussions on how to cope with high renewable power systems. In 2021 and beyond, many countries will work on boosting energy market resilience through better grid management, the remuneration of nonenergy services, and new market designs.

First, more active grid operation and grid interventions—such as renewables curtailment and redispatching—may become more common.

Second, calls for remunerating nonenergy services will increase. Governments are shifting to capacity payments, wholesale top-ups, or ancillary service revenues. For example, India introduced real-time and green term ahead markets in 2020 and is preparing to launch an electricity forward and derivatives market in 2021.

Grid reinforcement will also be important in the years to come. Grid availability could become a key factor for renewable projects in some markets, including in Mexico for example.

For more on our power and renewables research, visit our Global Power and Renewables service page.

Etienne Gabel, a senior director at IHS Markit with the Latin America gas, power, and renewables team, specializes in the analysis of regulatory and market developments in the natural gas and power sectors.

Posted 4 March 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.