India is banking on emerging green technologies for long-term emission neutrality but requires the groundwork for cost-effective implementation

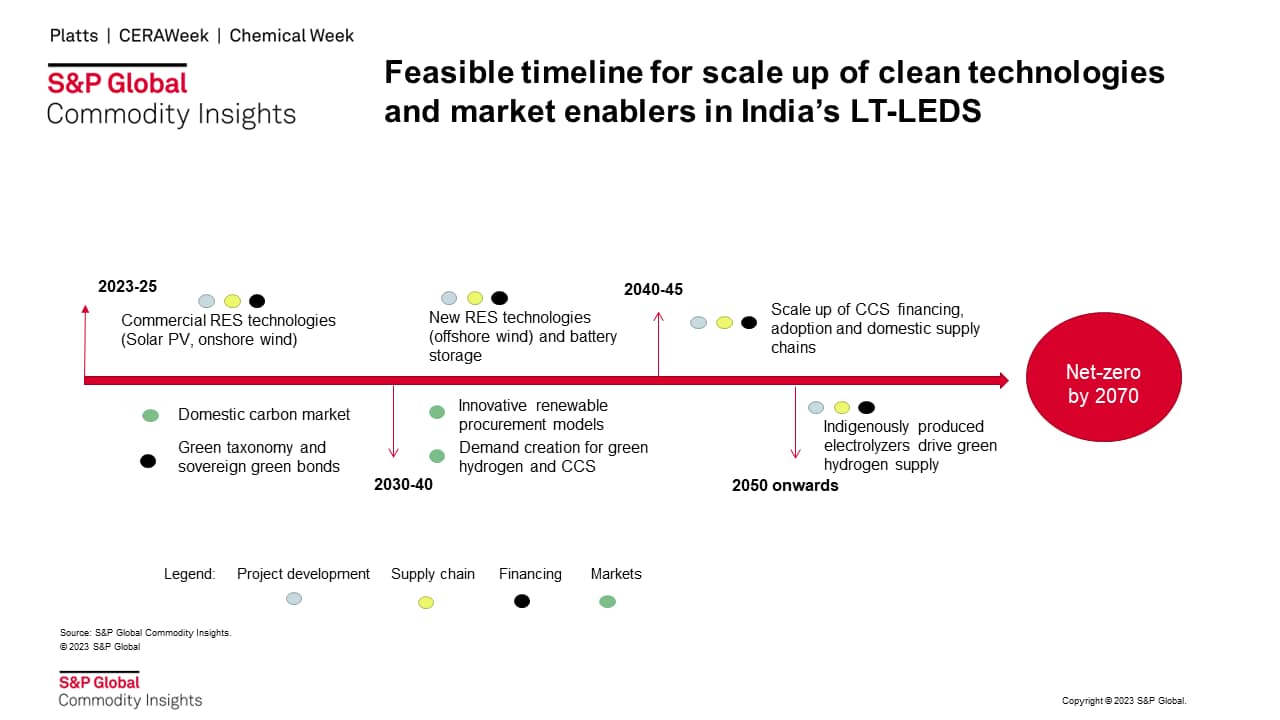

At the 27th Conference of Parties (COP) in Egypt in November 2022, implementation strategies for the updated nationally determined contributions (NDCs) announced by member countries in prior COP were in focus. To this end, India submitted its Long-Term Low Emission Development Strategy (LT-LEDS). It highlighted key priorities and challenges around seven key areas in the power sector, including electrification of end uses in industry and transport, renewable energy, battery storage, and green hydrogen. Given India's reluctance to commit to ending coal use, the question of carbon capture and storage (CCS) is also addressed in the LT-LEDS. Given the high capital intensity of new technologies, India has reemphasized the role of technology transfer, capacity building, and financial support from the developed world to stay on course for net zero by 2070.

The LT-LEDS makes renewable energy the pillar of India's energy transition story, but the sector is not without its share of challenges. S&P Global Commodity Insights finds that notwithstanding an impressive capacity pipeline, regulatory and execution challenges remain in renewable energy deployments. Despite accelerated progress, India may miss its 2030 target of 500 GW renewables by about 150 GW. Technologies such as offshore wind will become scalable in the latter half of the 2020s, and standalone battery storage is still quite expensive. However, India has floated hybrid renewables cum storage tenders, which have been competitive. Despite policy support, it will take India about 8-10 years to reach parity between battery and pumped hydro storage. In line with India's atmanirbharta, or self-sufficiency goals, support for local renewable supply chains is building but requires raw material sourcing, processing capability, and technology investments.

On green hydrogen, the LT-LEDS presents a series of barriers and investment gaps for international technology and finance to fill in—for example, in electrolyzers and end-use technologies. However, the fundamentals affecting the viability of green hydrogen constitute the foremost barrier. Green hydrogen is more than two-thirds more expensive than imported natural gas. Its adoption costs in the power sector remain 8-10 times higher than average grid prices projected by Commodity Insights until 2050. Despite the odds, the government is moving aggressively with its Green Hydrogen Mission to improve fundamentals and build the enabling infrastructure. The LT-LEDS does not communicate a definite plan for scaling up CCS, except for investing in technology development and pilot projects. Under a robust carbon pricing regime, Commodity Insights analysis shows that CCS can become competitive with coal-based power without CCS in 2045-50.

India's financing needs for building out the necessary low-carbon infrastructure are enormous and require global support. The 2023-24 budget estimates a gross allocation of $9.6 billion towards a green growth agenda Commodity Insights estimates about a $30 billion requirement for renewable generation projects alone. In this context, green bonds and carbon market remain valuable instruments for drawing in foreign investment. For this fiscal year, India is expected to issue green bonds to the tune of $2.1 billion. Additionally, India earns out $1.5 billion from its carbon credit sales in the voluntary markets, which is expected to grow 25-50 times its current size by 2050. To attract international capital, India will need to eliminate internal barriers to scaling up and deployment of renewable and storage technologies and continue to demonstrate an appetite for scaling up green hydrogen and CCS as these technologies mature.

Customers can read the full report on Connect here: Priority areas and enablers of net-zero transition in India's Long-Term Low Emission Development Strategy.

For more information on this research and the service it comes from, please visit the Asia Pacific Regional Integrated Service page.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.