India’s power sector prepares for another hot summer in 2023

The spot market is one of the key indicators of the state of India's power sector. During the months of January and February 2023, the prices of electricity in the spot market remained high with an average price of 6.18 rupees per kilowatt-hour. This marks a 58% increase compared to the same period last year.

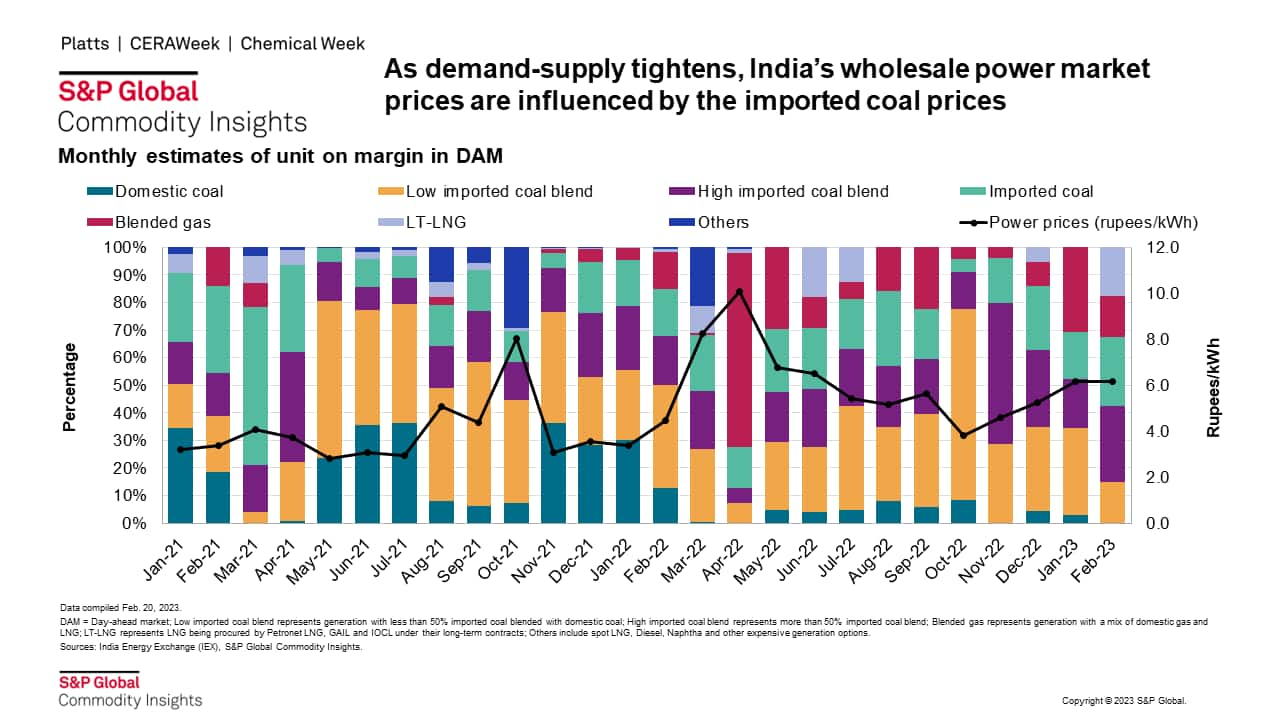

This rise in prices is attributed to tightening of demand-supply in the country, along with high prices of coal in international market. The historical trend indicates that there is a strong correlation between price spikes and the difference between buy and sell volumes on the power exchange. Whenever there is a supply constraint in the spot market, the power prices are pushed up as marginal fuel changes from domestic coal to imported coal (or LNG).

As seen in graph below, prices in February 2023 were higher as imported coal and LNG were on the margin about 40% of the time. Compared with February 2022, these fuels were on margin for only 15% of the time.

High demand growth expected for March to June period

In January and February 2023, increased commercial and industrial activity in northern and western regions led to high growth in electricity demand. Against an all-India average of 10% growth in demand, the northern region grew by 12.5% and western region grew by about 15%.

An unusual rise in temperature in the month of February 2023 is raising the alarm for an upcoming heat wave. Based on projections from the World Meteorological Organization (WMO), 2023 will be a "triple-dip La Niña" year, with the potential for widespread warmer-than-average sea surface temperatures during spring and summer. For March to June period, all-India electricity demand is expected to grow between 8.5-11.5% driven by signs of improved economic activity and unusual rise in temperature.

Peak demand is also expected to grow at 9-12% during the first half of 2023, reaching 235-240 GW and surpass the coincidental peak demand of216 GW in April 2022 (registering a year-on-year growth of 6.3%).

Expecting high demand in the upcoming months of March to May, the government has initiated various steps

In anticipation of high demand, the government has initiated various actions:

- Introduction of a new market segment - High price DAM

(HP-DAM): In April 2022, the central electricity regulator

lowered the ceiling on market prices from 20 rupees/kWh to 12

rupees/kWh. The cap forced expensive generators (e.g., based on

spot LNG, naphtha, battery storage etc.) out of the market. These

expensive generators could potentially sell via bilateral markets,

but paucity of peak-time based contracts led to stranded capacity.

Introduction of high price DAM (with a higher ceiling price of 50

rupees/kWh) will allow these expensive generators to sell in the

spot market and optimize their generation schedule. The new market

structure will insulate DAM participants from high prices

discovered in HP-DAM.

- Coal stocks under close watch: The coal stock

situation at power plants remains healthy, with domestic coal

stocks reaching the highest level since March 2021. On 20 February

2023, domestic coal stocks at power plants reached 30 million

metric tons (MMt), representing 50% of the normative stock

requirement. However, imported coal stocks have declined since the

easing of import guidelines in October 2022.

- Invoking Section 11 of Electricity Act forcing imported

coal plants to run at full capacity: The power ministry

has invoked emergency powers under Section 11 of the Electricity

Act. It has mandated imported coal-based power plants to run at

full capacity for three months starting 16 March 2023. The move

will ensure higher availability of coal plants despite high coal

prices in international market. The high cost of generation will be

pass-through to final consumers and not affect the

generators.

- Blending of imported coal by plants running on domestic

coal: All power plants using domestic coal have been

directed to import at least 10% of their requirement of coal for

blending. The high cost of generation will be pass-through to final

consumers and not affect the generators.

- Deferring scheduled maintenance: All coal

power plants have been advised to defer their maintenance schedule

beyond June 2023.

- No coal retirements: The ministry has issued

an advisory to all power utilities not to retire any thermal plants

(till 2030) if it can be made available for dispatch after

renovation and modernization.

- Boost domestic coal supply by providing priority clearance for evacuation of coal from domestic mines: Similar to last year, various priority railway routes have been identified to assist with the evacuation of coal from key mining regions. Furthermore, power plants in coastal states have been advised to utilize rail-sea-route for delivery of domestic coal.

During H1 2023, power prices are expected to remain high, and consumption of imported coal expected to increase

The projected increase of 70-84 TWh in electricity demand (in H1 2023, compared to H1 of 2022), is expected to be met primarily by increase in coal generation (of 48 to 60 TWh). Key factors contributing to demand supply situation during March to June period include:

- Tepid growth in domestic coal supply to power sector

- High domestic coal stock levels at the end of February 2023

- High hydro reservoir levels at the end of February 2023

- Renewable capacity addition of 15-16 GW between Jan 2022 to Jan 2023

- Dwindling domestic gas supplies to power sector

- Reduction in LNG prices

- Reduction in imported coal prices

Customers of our Asia-Pacific Regional Integrated service can click here to read about our detailed analysis on demand-supply balance and power price projections for H1 2023 on our Connect platform. For non-clients, for more information on the service, pleasse click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.