India’s preparedness for large-scale EV adoption: An assessment of future challenges and opportunities

India's flagship scheme Faster Adoption and Manufacturing of Electric (and Hybrid) Vehicles (FAME) II was announced in April 2019 with 10 times the budgetary allocation of its predecessor (FAME I). Following its launch, the share of electric vehicles (EVs) in new sales has doubled from 2018, public charging station (PCS) allocations have grown by nine times, and 12 states have announced complementary policies to support the EV ecosystem. These policies address the teething troubles of EVs, but as the volumes grow after the 2020 global downturn, significant new barriers to integration will arise. IHS Markit analyzed the current state of affairs and identified the barriers and techno-economic & policy innovations required for an EV revolution.

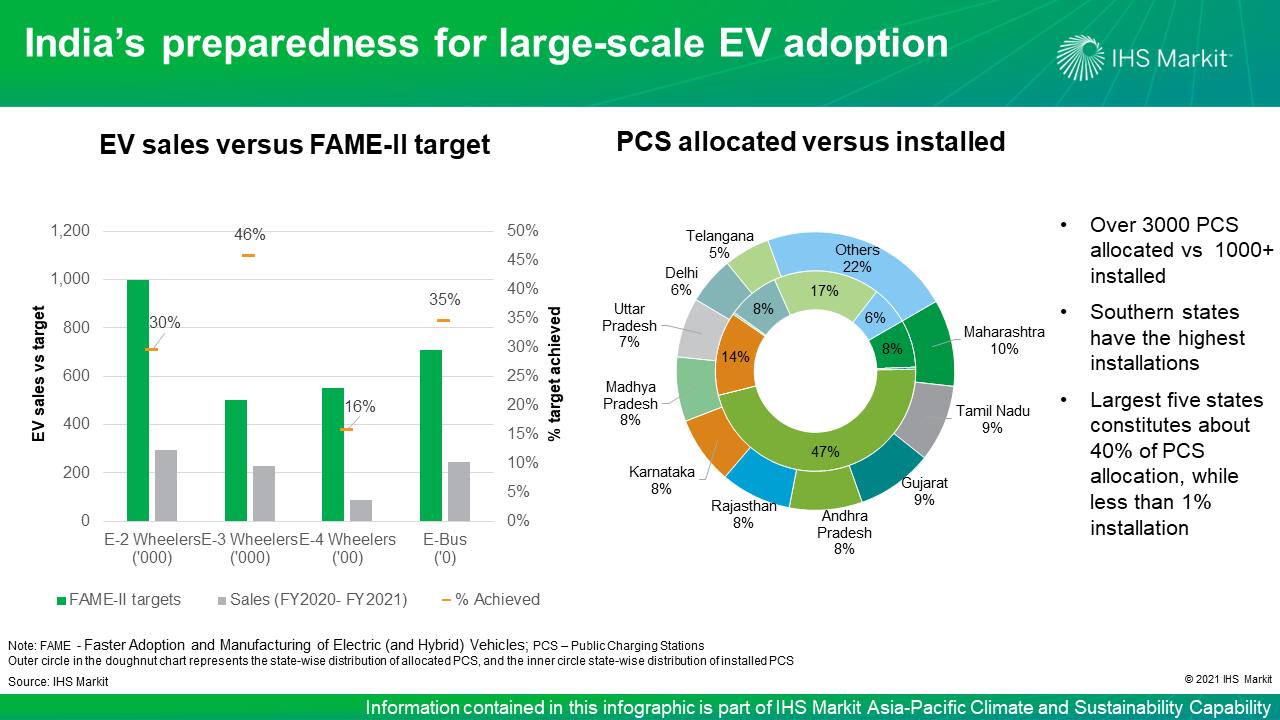

An uneven performance could slacken the push to 30% EV penetration by 2030. Despite the slowdown in the automobiles sector in FY 2021, contraction in EV sales was comparitvely slower, leading to a doubling of its share in the overall sales to 1.5% in 2021 compared to 0.7% in 2018. By March 2021, more than 3,000 PCS had been allocated across states but overall installation remains low. Andhra Pradesh is the exception when it comes to PCS installation, being the only state to install more PCS than allocated.

However, with the two out of three years of FAME II scehme over, the electric car (E4W) sales languish at 16% of the targets, while the electric three-wheeler (E3W) sales have reached nearly 50%. In general, the Southern states have performed relatively well in PCS installation; conversely, five states with more than a third of PCS allocations have achieved less than 1% installation.

Andhra Pradesh has the most ambitious EV plan and Punjab the most balanced. IHS Markit analyzed and ranked states on more than 20 measures across the end-user, manufacturing, and PCS categories and found gaps in the state policies addressing the distribution company (DISCOM) constraints and ease of access concerns relative to city space. Three out of the top five states are from South India, with Punjab and Delhi making the rest. Integrated system planning across urban, energy, and transport departments will help fully realize the benefits from EVs.

DISCOM infrastructure and finances will be strained as the market grows. Charging tariffs for PCS typically lie within the residential and commercial ranges, despite the fact that EVs have a high instantaneous load with unpredictable charging cycles. This provides a conducive signal for PCS ecosystem, which is very much in its incipient stages. As the EV volumes and PCS loads grow, DISCOMs will need managed charging and the right signaling mechanisms to ensure grid stability while servicing EVs. Even with relatively low tariffs, PCS are not presently viable without a 50-100% capital subsidy, with 85-90% EV charging presently being done at homes. Higher EVs on the road, diversified service models and cheaper alternatives to grid supply will improve future prospects.

Innovations and system upgrades will become inevitable to sustain the EV boom:

- Smart batteries and networks for bidirectional electricity and real-time information flows: Managed charging of grid services by EVs (including standalone EV batteries) can significantly reduce costly infrastructure addition for DISCOMs and accelerate the push towards smart grids.

- Captive solar for PCS will reduce reliance on the grid (especially during peaks): Improving business prospects and higher DISCOM tariffs for PCS will incentivize a move towards captive solar which potentially opens up an additional revenue stream via sale to DISCOMs in idle periods.

- Battery leasing and swapping cut EV front costs by 35-50% and aid solar-EV grid integration: The Department of Heavy Industries recently notified battery-swapping for electric two-wheelers and E3Ws. Separating the battery from the vehicle overcomes front cost and operational (charging time) barriers for end-users, helps anciallary services and renewable integration, crowds in asset financiers, and aids manufacturers in enhancing sales and building an income stream from the leasing business.

- EV system aggregators (EVSAs) interface with DISCOMs and multiple EVs/PCS to optimize resources: With a large volume of EV loads, specialized intermediaries in the form of EVSAs could govern interactions of DISCOMs with multiple EVs and PCS. These will inform the demand-supply fundamentals on the when, where, and how much of electricity, thereby optimizing resources. This requires EV regulators to draft guidelines on the pricing and accuracy/ reliability of information.

IHS Markit recommends focusing on indigenization, nimble frameworks, regulatory foresight, and policy continuity to create an enabling environment for EVs. Focus on domestic manufacturing and research in battery and EV components will bring investments, jobs, and opportunities to serve international demand. The frameworks on electricity tariffs should appropriately value power at the right place and time. Energy departments and regulators should anticipate and alleviate barriers to clean energy supply to PCS and manage competing interests effectively. FAME II needs to be extended by at least five years, since the EV ecosystem is still in its incipient stage.

Learn more about our coverage of the Asia Pacific energy market through our Asia Pacific Regional Integrated Energy Service.

Mohd. Sahil Ali is a senior sustainability analyst with the Climate and Sustainability group at HIS Markit, covering cross-cutting issues in power and renewables for South Asian markets.

Posted on 11 June 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.