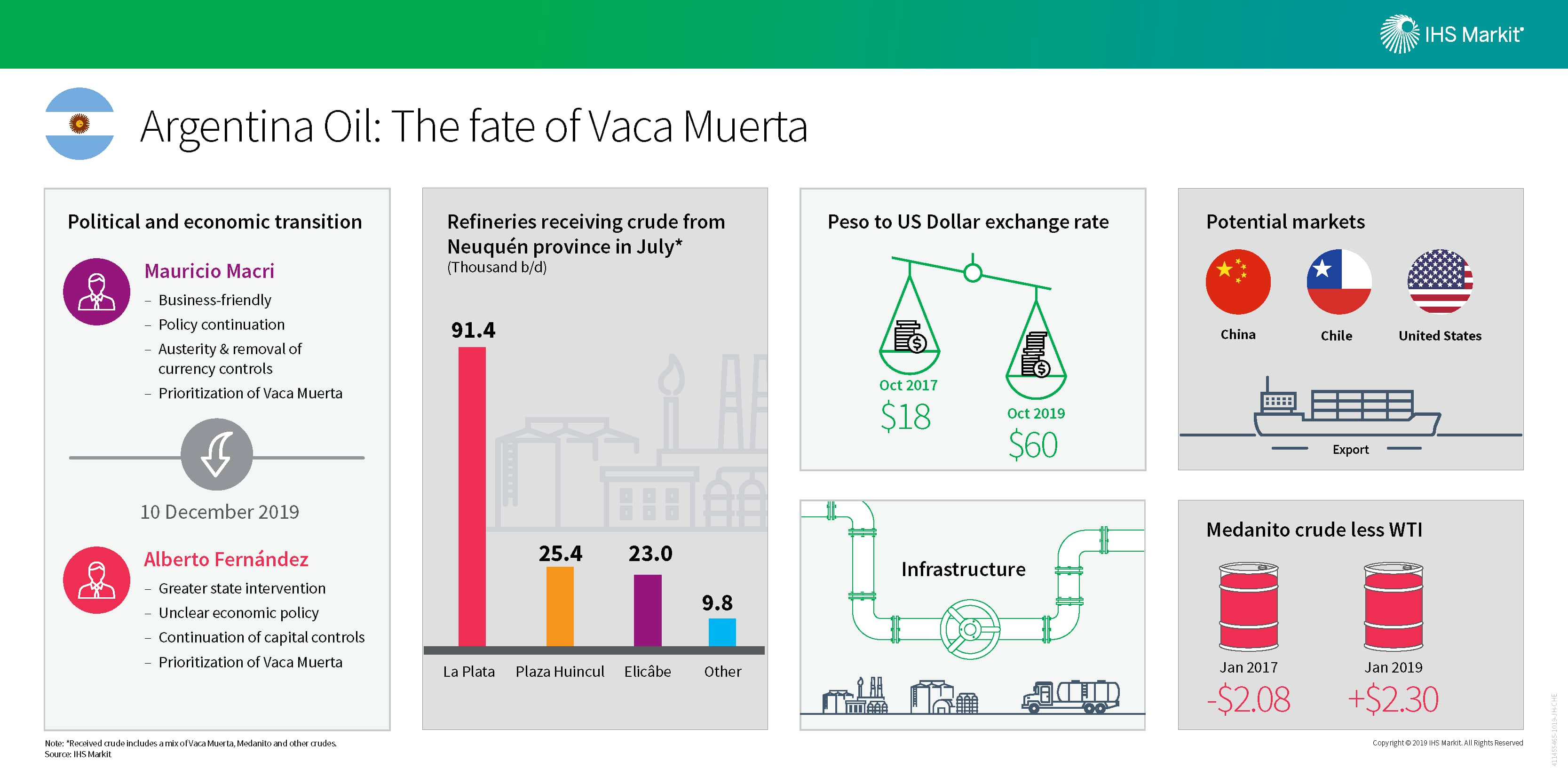

Infographic: Argentina oil- The fate of Vaca Muerta

Following the resounding victory by Alberto Fernández over

President Mauricio Macri in Argentina's August primaries, it was no

surprise that Peronist candidate Fernández won the presidency on 27

October in the first round, with 48% of the votes. Argentina's

economy has been in a deep recession, with a current inflation rate

of 55% and a depreciated currency at 60 pesos per US dollar.

Although Fernández has been unclear in his policies, it is likely

that the economic and political environment in Argentina will

transition into one of greater state intervention and increased

capital controls. Lack of clarity also surrounds the impact that

running mate, former president Cristina Fernández de Kirchner, will

have on policies. During her presidency, Fernández de Kirchner

limited access to foreign investment by implementing protectionist

policies. With the transition to a populist regime as the backdrop,

Argentina's current environment begs the question: how will the

development of Vaca Muerta be affected?

Argentina's crude production was 504,000 b/d in August, one-fifth

of which came from the Neuquén Basin where Vaca Muerta is located.

With an estimated recoverable resource at 16.2 billion bbl of crude

oil, access to capital is key to successfully exploiting Vaca

Muerta's full potential. The temporary oil price freeze, enacted by

President Macri in mid-August to prevent runaway inflation, has cut

into operators' profit margins. It is likely that development will

be kept at a minimum until the price freeze is removed.

Furthermore, without a clear picture of energy policies from newly

elected president Alberto Fernández, investment in new projects

will be delayed. Currently, only about 4% of the play has been

developed. Energy Minister Gustavo Lopetegui has indicated that

Vaca Muerta will require about $5-10 billion in investment per

year. Investment includes the expansion of oil pipelines and new

refinery configurations. There are currently three main refineries

receiving crude from the Neuquén province, including Plaza Huincul,

which will only run Vaca Muerta's lighter Medanito crude in 2021,

after new installations and configurations have been made. With an

average API of 40, interest for the lighter Medanito crude will

likely come from the United States, Chile, and China, three markets

that have received Argentine crude on a regular basis within the

past year. Argentina's lighter Medanito crude properties allow it

to compete with WTI, giving it a premium in price for the majority

of 2019.

You may also be interested in...

Continue to gain valuable insight into IHS

Markit Latin America Energy coverage

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.