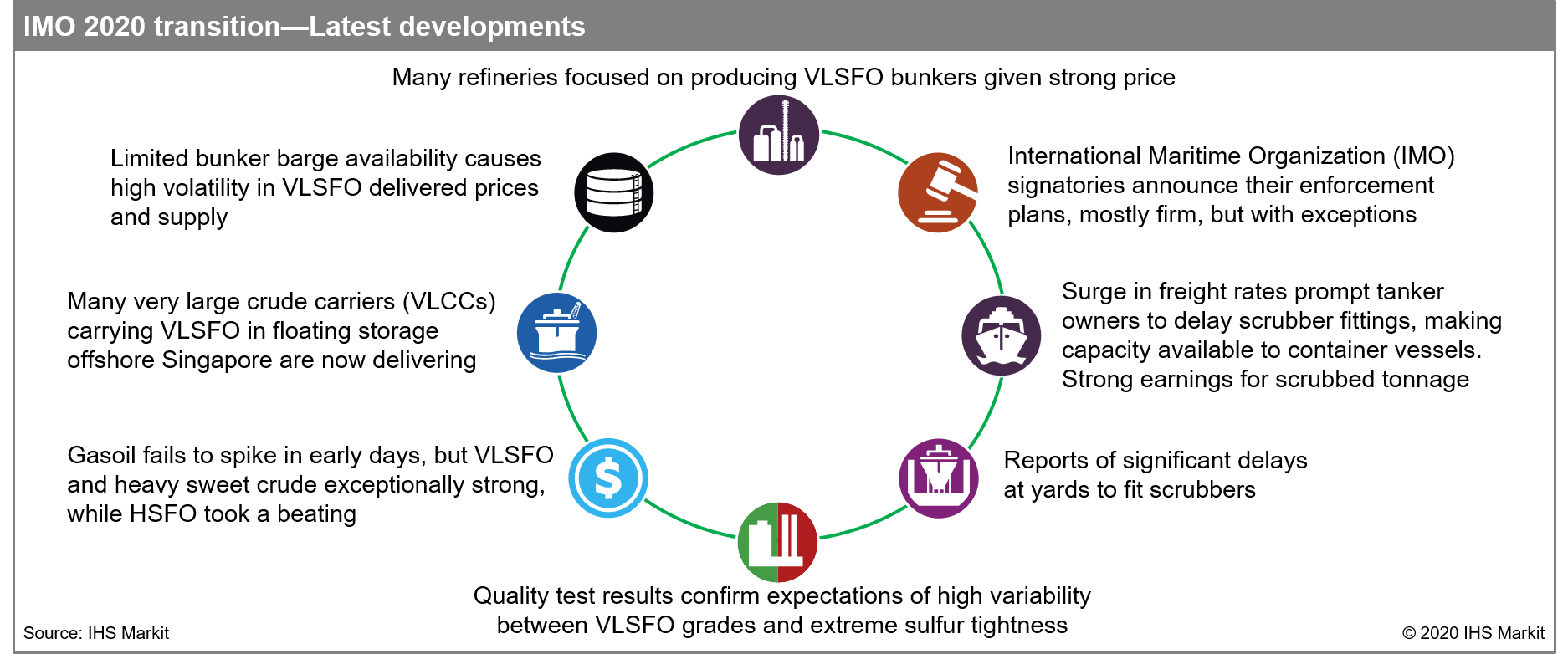

Infographic: IMO 2020 transition

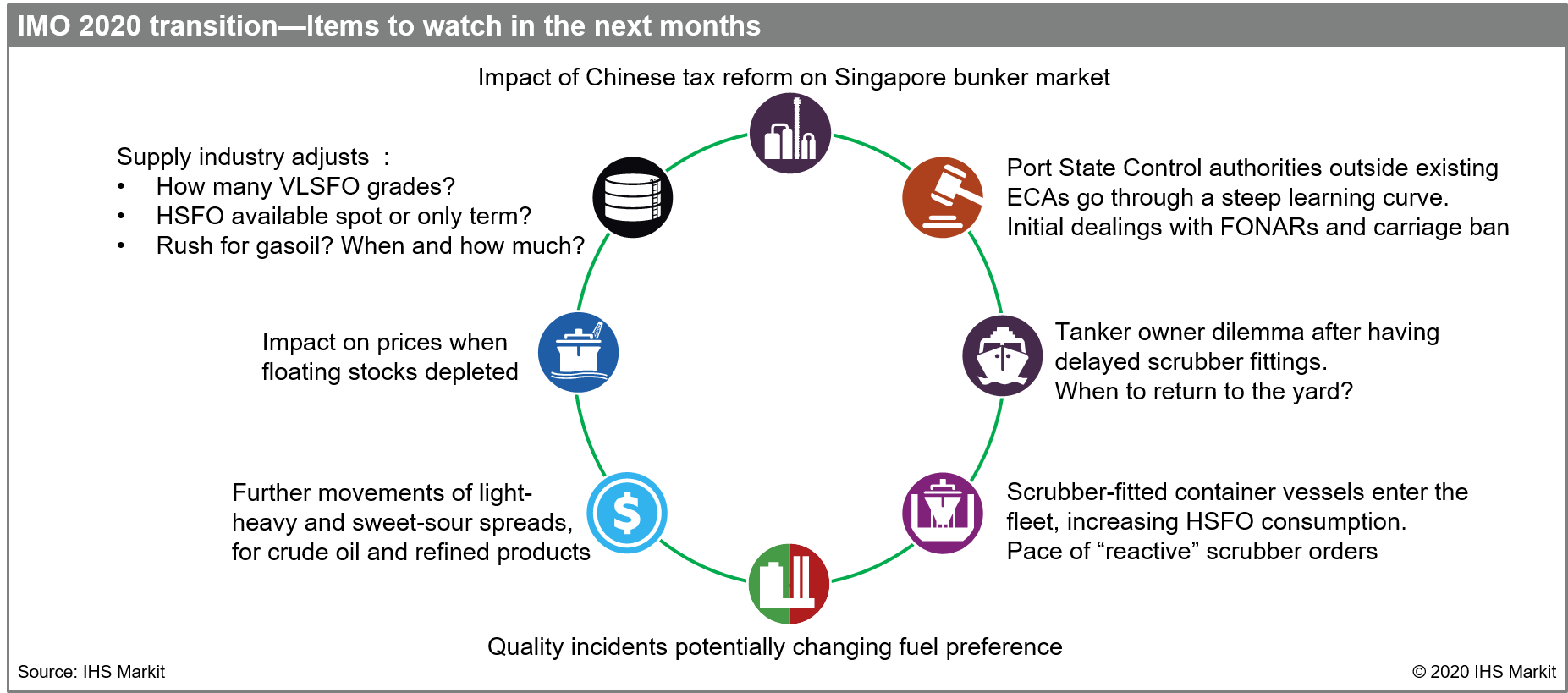

As we have now entered 2020, a new era has commenced for shipping. As expected, high sulfur fuel oil took an initial hit over falling demand, while the new kid on the block, very-low sulfur fuel oil emerged as the star of the oil barrel. Performance of the distillate complex however has been underwhelming so far, with crack spreads failing to increase and marine gasoil demand not taking off … yet … as IHS Markit still expects gasoil consumption to pick up when VLSFO inventories get depleted, enforcement is tightened and product quality issues may tarnish VLSFO's strong appeal

The below IHS Markit infographics provide an overview of current developments in key areas such as refinery preparation, shipping response and policy, and lists the main items to watch as the transition unfolds over the next weeks and months.

IHS Markit continues to monitor the International Maritime Organization's (IMO) global sulfur cap for bunker fuels in 2020 ('IMO 2020'), which is likely to cause significant disruption in global oil markets, but remains a key topic shrouded in uncertainty.

Related Services available to Refining & Marketing suite clients:

- IHS Markit IMO 2020 Quarterly Update:

This quarterly client deliverable provides the latest news and events related to the sulfur cap, as well as our latest outlook on the potential effects of the regulation on global oil markets with relation to prices, margins, futures markets and product inventories. - IHS Markit IMO 2020 Transition Data Viewer

This robust tool allows users to view over 100 weekly prices of key products at the primary international hubs and quickly understand price movements and differentials across the key products likely to be affected by the global sulfur cap on bunker fuel

Learn more

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.