Is space heat electrification taking off in the US?

Heat pump adoption in cold climates is driven by demand for improved cooling, not heating

Sales of air-source heat pumps (ASHPs) are rising at a rapid clip and much faster than alternative heating and cooling technologies.

Heat pump sales appear to be rising in step with increased state and local government efforts aimed at reducing building sector carbon emissions. Policies that encourage heat pump adoption are central to nearly all building decarbonization strategies and have gained significant momentum over the past several years.

With heat pump sales on the rise, is electricity starting to chip away at the dominant role played by natural gas in space heating? To answer this question, a lot depends on where heat pumps are being adopted and how they are being used.

Few homes in colder climates are adopting heat pumps as their primary heating system

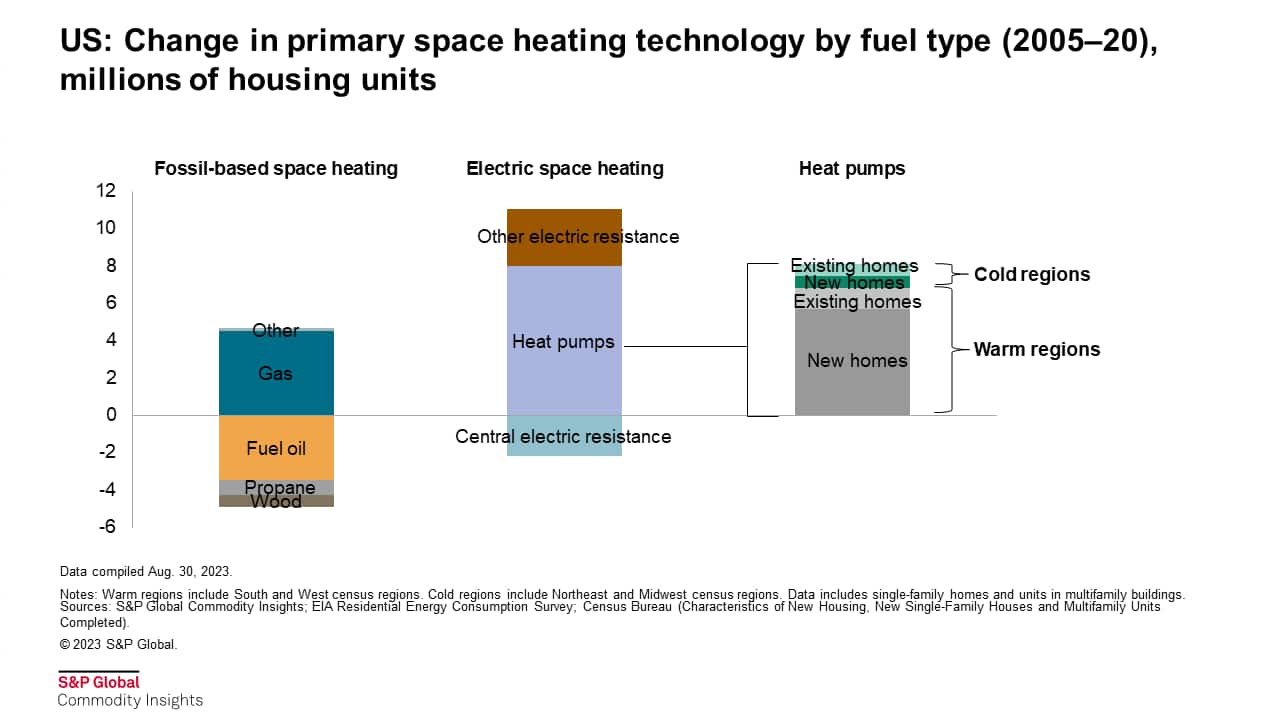

More consumers than ever before are using heat pumps for space heating — around 8 million more housing units have adopted heat pumps as the primary space heating technology between 2005 and 2020.

However, the rise in heat pump adoption has not yet coincided with a noticeable fall in fossil-based space heating. In the past 15 years, the number of housing units relying on any fossil-based heating has changed little (see Figure below).

Of the 8 million more housing units that have adopted heat pumps as the primary space heater, an overwhelming majority are in warmer southern and western states where heating loads are lower, heat pump efficiencies are higher and electric-based heating is already dominant and in new homes.

Heat pumps are playing a larger role in heating in the Northeast but still account for less than 5% of all primary space heaters. Most of this increase has been driven by conversions of systems in housing units that rely on more expensive energy inputs (electric resistance, fuel oil and propane) and new homes.

Demand for cooling is the major driver of heat pump adoption in cold climates

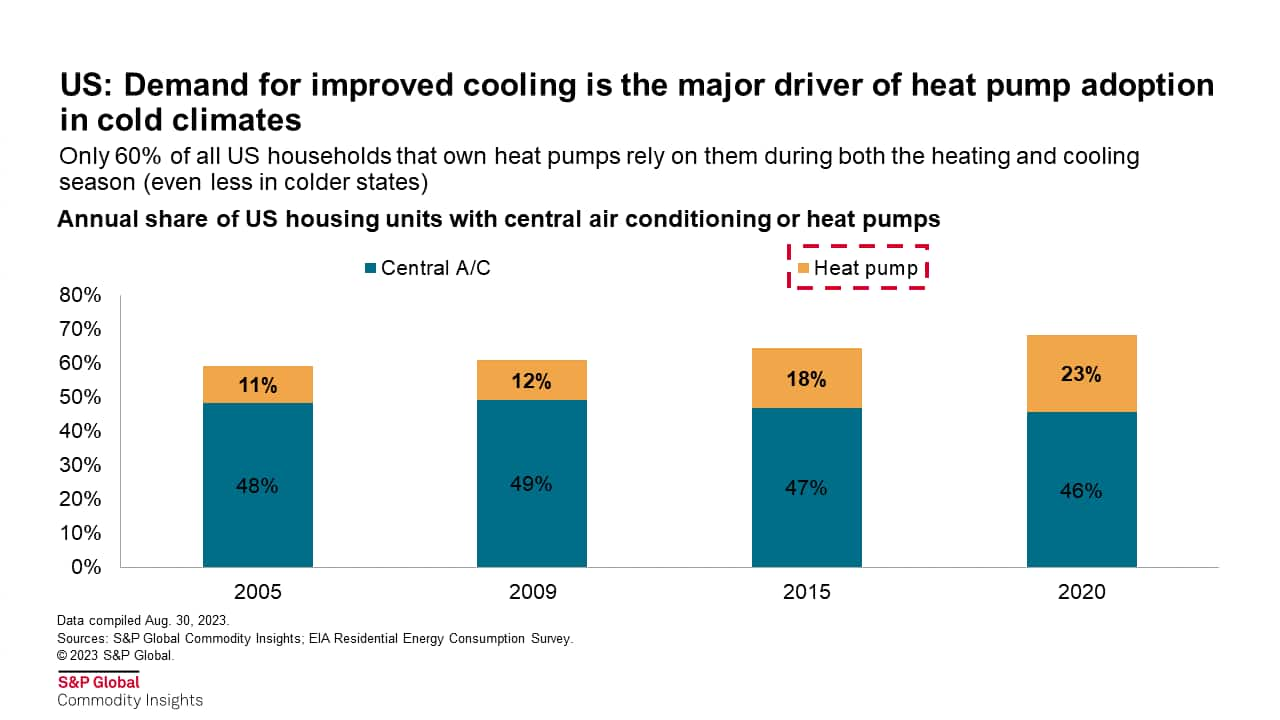

US consumers are upgrading their home cooling configuration and using heat pumps to do it. Between 2005 and 2020, the share of US households with a central air conditioner or heat pump rose from 59% to 68%. This increase has been driven primarily by heat pump adoption (see Figure below).

Households in regions with low rates of air conditioning, such as the Northeast and Pacific Northwest, are driving these trends. Generous subsidies and steadily rising average annual cooling degree days contribute to demand for new and improved cooling. For example, in Maine, where rates of air conditioning use are among the lowest in the country, heat pump adoption has rocketed past state policy targets.

Only 60% of all US households that own heat pumps rely on them during both the heating and cooling season (even less in colder states) — and many of those still have a supplemental fossil fuel heating system. The remaining 40%, or 11 million households, rely on heat pumps for cooling and, in some cases, as a secondary heater.

<span/>Many heat pumps adopted for cooling will only be capable of partial heating

In colder regions, heat pumps installed and sized to meet cooling loads will typically not be large enough to carry the full heating load. For example, in the moderately cold mid-Atlantic region, a home's peak cooling load might be half of its peak heating load. Consequently, a heat pump sized for cooling would require supplemental heating source, such as an existing fossil-based system or electric resistance, to support the full heating load.

In cold climates, partial heating configurations dominate because consumers are buying heat pumps primarily for the cooling mode functionality. In these cases, consumers typically forgo the significant, added expense associated with purchasing a larger and/or "cold climate" model capable of supporting the full heating load.

Successful space heat electrification strategies will exploit rising demand for improved cooling

In cold climates, one of the most significant barriers to residential space heat electrification is simply getting heat pumps into existing homes. The easiest way to get heat pumps into existing homes is to give consumers what they want — improved cooling systems. Strategies that focus on substituting heat pumps for existing, inexpensive, and reliable gas-fired heating systems are likely to be losing propositions.

Most consumers, especially existing gas customers, will forgo the extra expense of buying an ASHP better equipped for cold weather. Why pay extra for a better heating capability if that is not what they want? Effective rebate and incentive programs will cover the incremental expense associated with improved heating capability for an ASHP or even tie ASHP incentives to cold climate systems.

Heat pump adoption in cold climates will likely continue to be heavily motivated by improved cooling. Utilities are also likely to devise new tariffs that incentivize the shift of more heating load from fossil-based heating systems to ASHPs. In many cases, this will take the form of partial heating which aligns with an outlook that reflects electrification as part of a portfolio of options to decarbonize buildings.

Learn more about our Americas power and renewables research.

Benjamin Levitt is an associate director for the Gas, Power, and Climates Solutions, North American Power and Renewables research team at S&P Global Commodity Insights.

Posted on 10 October 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.